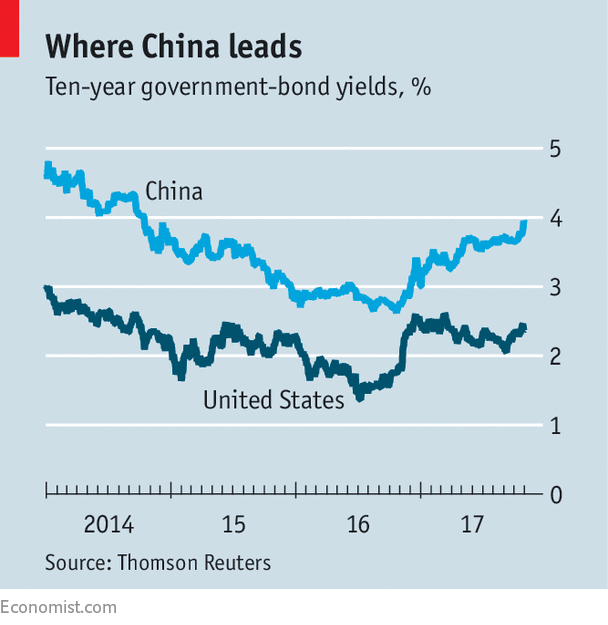

FOR the umpteenth time in the past decade, a great turning-point has been declared in the government-bond market. Bond yields have risen across the world, including in China, where the yield on the ten-year bond has come close to 4% for the first time since 2014. The ten-year Treasury-bond yield, the most important benchmark, has risen from 2.05% in early September to 2.37%, though that is still below its level of early March (see chart).

Investors have been expecting bond yields to rise for a while. A survey by JPMorgan Chase found that a record 70% of its clients with speculative accounts had “short” positions in Treasury bonds—ie, betting that prices would fall and that yields would rise. Meanwhile a poll of global fund managers by Bank of America Merrill Lynch (BAML) in October found that a net 85% thought bonds overvalued. In addition, 82% of the managers expected short-term interest rates to rise over the next 12 months—something that tends to push bond yields higher.

-

The making of the “Psycho” shower scene

-

Donald Trump dominates Virginia’s tight governor race

-

Interest rates rise in Britain for the first time in a decade

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why QR codes are on the rise

In part, this reflects greater optimism about the global economy. For the first time since 2014, America has managed two consecutive quarters of annualised growth of 3% or more. Forecasts for European growth have also been revised higher. Commodity prices, including oil, have been rising since June, which may be a sign of improving demand.

The BAML survey found that, for the first time in six years, more managers believe in a “Goldilocks” economy (in which growth is strong and inflation is low) than in a “secular stagnation” outlook (in which both growth and inflation are below trend). If those views turn out to be correct, then it might be expected that bond yields would move a bit closer to more “normal” levels. Until the crisis of 2008, the ten-year Treasury-bond yield had been above 5% for most of the previous four decades.

Investors also expect that, eventually, some kind of fiscal stimulus will be passed in Washington, DC. Of the fund managers polled by BAML, 61% expect tax cuts in the first quarter of next year. Such a package may increase the deficit and induce more economic growth; both factors would push bond yields higher.

Another factor behind the upturn in yields is a shift in central-bank policy. The Federal Reserve has started to wind down its balance-sheet, by not reinvesting the proceeds when bonds mature. The European Central Bank will soon cut the amount of bonds it buys every month by half, to €30bn ($35bn). The private sector will have to absorb the bonds that central banks are no longer purchasing.

Whether this will trigger the long-prophesied collapse of the bull market in bonds is another matter. Globally, there are no signs of a sustained surge in inflation (see previous article). PIMCO, a fund-management group, thinks that global economic conditions may now be “as good as it gets”. The momentum of growth may already have reached its peak.

Central banks also know that higher bond yields can act as a brake on economic growth. In G20 advanced economies, the combined debt of households, governments and the non-financial corporate sector has been rising steadily and stands at 260% of GDP. Every debt is also a creditor’s asset, but higher borrowing costs can create awkward adjustments; in America, for example, 30-year mortgage rates are around half a percentage point higher than they were a year ago. So the pace of tightening will be very slow. And if the economy shows any sign of wobbling, central banks will probably relent.

Perhaps the real area of worry should be the corporate-bond market. Low government-bond yields have pushed investors in search of a higher income into taking more risk. American mutual funds now own 30% of the high-yield bond market, up from less than 20% in 2008. The spread (extra interest rate over government bonds) on these riskier securities is close to its lowest level since before the financial crisis. BlackRock, another fund-management group, says there is “a more favourable environment for issuers at the expense of lenders”, especially as the quality of the covenants protecting lenders has been deteriorating.

With the rate of bond defaults falling, and the global economy doing well, investors probably feel there is little to worry about. But there is a problem: the corporate-bond market is less liquid than it was before 2007, as banks have pulled back from their market-making roles. Investors have found it easy to get into the market in search of higher yields. When the time comes, they will find it much more difficult to get out.

Source: economist

Investors call the end of the government-bond bull market (again)