High volatility isn’t going away for bitcoin, raising questions about whether the digital currency can be a sustainable investment asset.

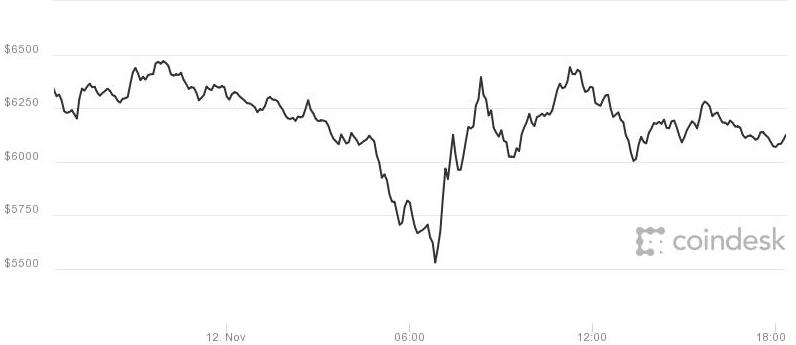

Late Saturday, the crypto-currency plunged 15 percent from nearly $6,500 to a low of $5,507, before intermittently shooting back up to near $6,400, according to CoinDesk. Bitcoin last traded near $6,060, down about 4 percent on the day.

Trading in a U.S. stock index is typically halted after such an extreme drop, not to mention repeated swings higher or lower. However, more than 120 “cryptofunds” have emerged to invest in bitcoin, other digital currencies and related business projects, according to financial research firm Autonomous Next.

Analysts say a major factor behind bitcoin’s seven-fold surge to record highs this year is increased interest from institutional developers.

Bitcoin in the last 24 hours

Source: CoinDesk

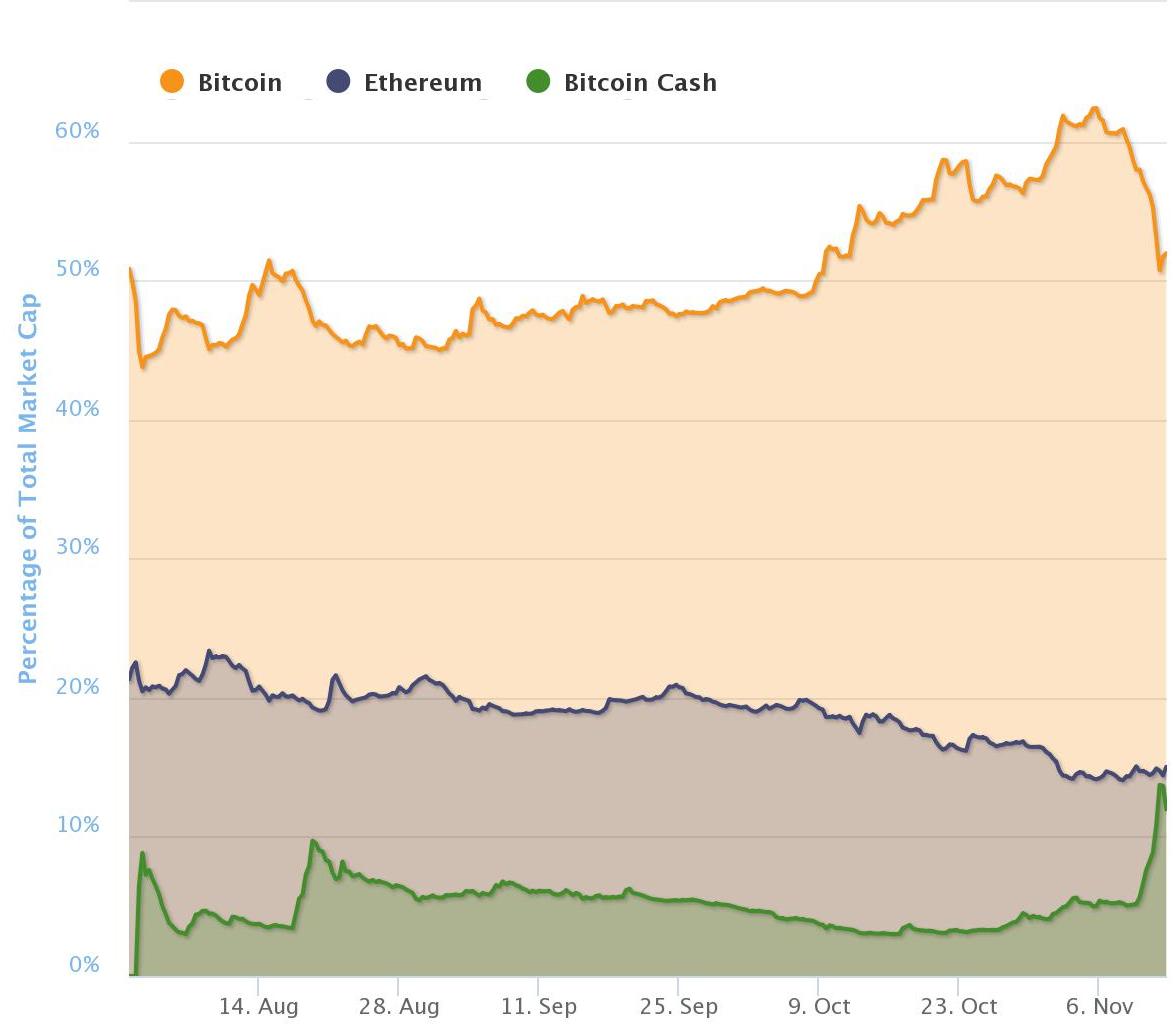

Critically, the latest swings in bitcoin also reflect disagreement among digital currency developers about the future of bitcoin. As the original bitcoin tumbled, supporters of offshoot bitcoin cash, took to promoting it over the weekend on Twitter.

Bitcoin has retraced in the last few days, despite initially rising to a record high of $7,879. Last week, developers called off an upgrade called SegWit2x, initially planned for around Nov. 16.

The proposal was an attempt to improve bitcoin’s transaction speed and cost. But support for SegWit2x waned in the last few months.

Meanwhile, bitcoin cash soared to a record high of around $2,477 overnight, before crashing about 50 percent to a low near $1,224 Sunday afternoon, according to CoinMarketCap. Trading volume in bitcoin cash over the last 24 hours was around $7.9 billion, versus $8.6 billion for the original bitcoin, according to CoinMarketCap.

Bitcoin cash split off from bitcoin on August 1 after a minority of developers decided to implement an upgrade that increased the block size to eight megabytes from one megabyte. Block size limits transaction speeds, and the SegWit2x upgrade would have raised the block size to two megabytes.

The high cost and slowness of transaction speeds have limited bitcoin’s usability as a digital currency. A Bernstein report last week found it cheaper and faster to use more traditional means of sending payments overseas than using bitcoin.

Bitcoin vs. bitcoin cash share of total cryptocurrency market capitalization

Source: CoinMarketCap

Adding to the debate over bitcoin’s future, another offshoot called “bitcoin gold” was set to launch Sunday. Bitcoin gold seeks to make the process of “mining,” or generating bitcoins, less dependent on the few who have access to specialized technology.

The offshoot was not exempt from the latest volatility. Futures for bitcoin gold plunged more than 40 percent from just over $500 Saturday to below $300 Sunday, according to CoinMarketCap.

That said, CME’s planned launch of bitcoin futures by the end of the year is a step towards limiting bitcoin’s volatility. CME, the world’s largest futures exchange, says on its website the bitcoin futures will have specialized trading limits at 7, 13 and 20 percent.

Digital currency enthusiasts also point out the launch of futures will allow traders to protect themselves from major losses during bitcoin price swings, thereby encouraging more institutional investors to try and profit from the volatility.

“Cryptocurrency volatility is unspectacular relative to other asset classes, as long as you use the right comparisons,” said Ari Paul, CIO and managing partner at cryptocurrency investment firm BlockTower Capital. He pointed out that investment assets such as small-cap stocks in emerging markets and agricultural commodities have also experienced similar volatility.

“Many crypto currencies are best through of as Seed or Series A stage equity investments,” Paul said. “If VC [venture capital] investments were publicly listed, they would likely see similar swings in valuation.”

Source: Tech CNBC

Bitcoin briefly drops 15% in rocky weekend on controversy over the digital currency's future