It doesn’t sound like much: General Electric is cutting its dividend from 96 cents a year to 48 cents. But GE has a lot of shares outstanding: 8.67 billion.

Reducing the dividend by 48 cents with 8.67 billion shares outstanding means shareholders are getting $4.1 billion less in dividends each year.

On an historic basis, that’s a lot.

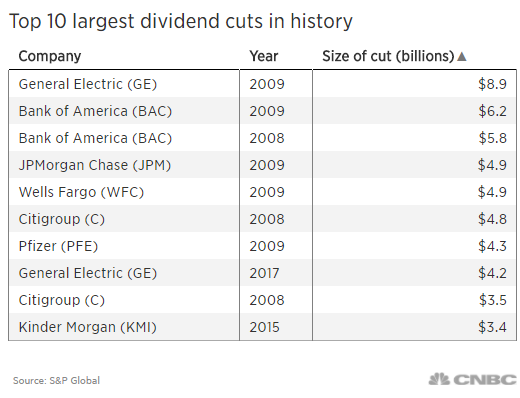

It’s the eighth-largest dividend cut in the history of the S&P 500 by dollar value:

Two points to make:

- GE had the largest dividend cut of all time, in 2009.

- All the largest dividend cuts made prior to Monday were made during the 2008-2009 financial crisis.

That means GE’s most recent cut would be the biggest cut of all time on a dollar basis outside the financial crisis, according to S&P Global data.

You have to go to Kinder Morgan, which cut its dividend by $3.4 billion in December 2015, and ConocoPhillips, which cut the dividend $2.5 billion in February 2016, to find dividend cuts around this size outside the financial crisis. Both, of course, are energy stocks.

Dividend cuts are fairly rare, and with good reason: Investors have been willing to pay a lot for higher yields.

Through Friday, 310 companies in the S&P 500 have increased their dividend this year, only nine have decreased them. GE makes it 10.

The other dividend cutters this year include DowDuPont, Mosaic (twice), Mattel (twice), Xerox, and Progressive.

What’s all this mean? For the moment, it appears that GE is a bit of a one-off.

Howard Silverblatt, who watches dividends for S&P, noted that the “overall dividend picture is very positive, as companies have record earnings, with cash also at a record, and cash-flow good; additionally the bleeding in energy related issues appears to have stopped.”

Indeed, Silverblatt notes that dividend payments for the S&P 500 are at a record in Q3,’17: $105.4 billion, same for Q4. This would be a sixth-consecutive annual record.

Source: Investment Cnbc

GE's dividend cut is the largest ever by a US company outside of the financial crisis