IN THE first quarter of 2018 thousands of banks will look a little less profitable. A new international accounting standard, IFRS 9, will oblige lenders in more than 120 countries, including the European Union’s members, to increase provisions for credit losses. In America, which has its own standard-setter, IFRS 9 will not be applied—but by 2019 banks there will also have to follow a slightly different regime.

The new rule has its roots in the financial crisis of 2007-08, in the wake of which the leaders of the G20 countries declared that accounting standards needed an overhaul. Among their other shortcomings, banks had done too little, too late, to recognise losses on wobbly assets. Under existing standards they make provisions only when losses are incurred, even if they see trouble coming. IFRS 9, which comes into force on January 1st, obliges them to provide for expected losses instead.

-

The Trump tax cuts fall far short of Ronald Reagan’s reforms

-

Wine-making existed at least 500 years earlier than previously known

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why big-wave surfers are heading to Portugal

-

Hybrid models are changing the piano market, too

Under IFRS 9 bank loans are classified in one of three “stages”. When a loan is made—stage one—banks must make a provision equivalent to the expected loss on it over the next 12 months, however small. There it stays unless things change: if credit risk increases but the loan is still good (suppose, when a bank has lent money to a house-builder, that the property market takes a tumble), it shifts to stage two. The bank must increase the provision, to the expected loss over the life of the loan; its profits take a one-off hit. If the loan goes bad, it passes to stage three. The provision is the same as in stage two, but from then on the bank books less interest revenue, in proportion to the expected loss on the loan. (In the American rule, banks must recognise lifetime expected losses from the off.)

In theory, the change makes sense. The old rule flattered performing loans. On the one hand, interest rates reflected a borrower’s credit risk; on the other, provisions did not. So loans to riskier borrowers meant higher revenues but no corresponding provisions; and no provision was made when creditworthiness declined, as long as borrowers kept servicing their loans. Banks’ profits and capital positions were thus, in effect, overstated until loans went awry. Timelier provisions might not have prevented the crisis, but troubles might have been admitted to sooner.

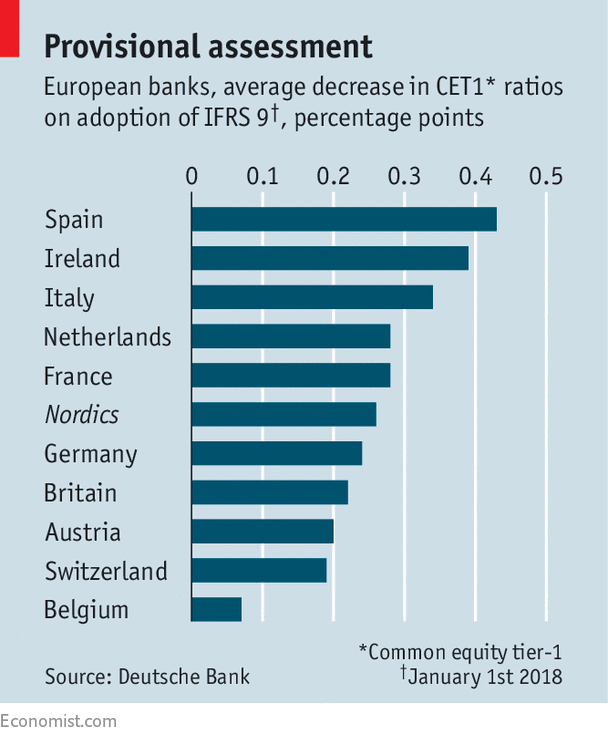

In practice, banks will increase their loan-loss provisions—in the EU, by 13% on average, according to a report published in July by the European Banking Authority (EBA), a supervisor. The EBA estimates that their average ratio of common equity to risk-weighted assets, a key measure of capital strength, will drop by 0.45 percentage points (ratios are typically in low double figures). Banks with bigger stocks of duff loans than average will take bigger hits.

For regulatory purposes, the impact will be softer. In calculating common-equity ratios and other gauges, the standard will be phased in over five years, in much the same way as post-crisis capital standards known as Basel 3. However, reckons Manus Costello of Autonomous Research, markets are likely to look at the full impact from the off, as they have with Basel 3.

Not everyone is convinced that IFRS 9 is an improvement. Quarterly calculations of the 12-month expected losses on a wide variety of sound assets worth trillions of euros will involve a lot of informed guesswork. That will give big banks a fair amount of discretion in modelling. Natasha Landell-Mills of Sarasin & Partners, an asset manager, worries that rather than making provisions that are too little, too late, banks will instead do “too much, too late”. For long-term investors, she says, “ups and downs are not helpful.”

The EBA reported that 72% of banks indeed expect the new standard to make profits more volatile. When recessions bite and a lot of loans are moved from stage one to stage two, provisions may rise sharply, in a “cliff effect”. That could in turn cause banks to curb lending and worsen the economic downturn. That said, the cliff may not be vertiginous. Mr Costello notes that according to the EBA, under IFRS 9 stage-three loans will account for 78% of provisions and stage 2 for just 14%. So most provisions will be more or less as they are now. Will banks provide any more prudently? For the answer, wait for the next crisis.

Source: economist

Timelier provisions may make banks’ profits and lending choppier