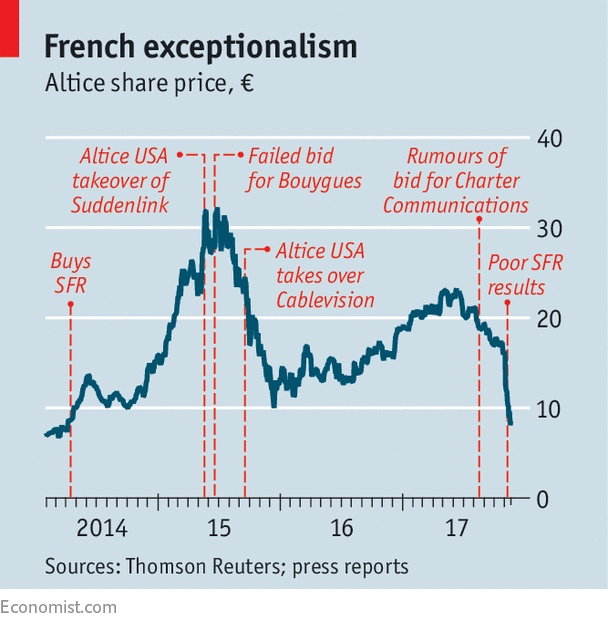

WHAT does France’s corporate establishment make of the change in fortunes of Patrick Drahi, a telecoms billionaire who achieved brief greatness before crashing to earth? In August he was reported to be planning a $185bn bid for Charter Communications, America’s second-largest cable operator, which is part-owned by John Malone, a famous cable investor. This month the market value of his indebted firm, Altice, collapsed by half, removing much of his personal wealth.

Mr Drahi’s empire is centred on his control, since 2014, of SFR, France’s second-largest telecoms operator and a big cable firm. It was not his only acquisition; in recent years the Franco-Israeli dealmaker went on a shopping spree, buying dozens of firms and building a transatlantic telecom-and-media empire. He typically sacked 30% of the acquired firms’ employees and squeezed salaries and other costs. Customer service often tended to worsen. In doing so Altice amassed a debt burden of over €50bn ($59bn), far bigger than the value of the firm itself. That made it vulnerable: investors dumped its shares after poor third-quarter figures at SFR.

-

The Supreme Court takes up a major digital privacy case

-

Germans get little in reward for booking their flights early

-

Parents now spend twice as much time with their children as 50 years ago

-

The strange geopolitics of rising oil prices

-

Is Honduras’s ruling party planning to rig an election?

-

Doctors judge female surgeons more harshly when patients die

Mr Drahi is not entirely untypical in France, even if the extent of his activity is. Other swashbuckling dealmakers exist: Vincent Bolloré, a media investor with wide interests, for example, or Xavier Niel, owner of Iliad, another mobile-phone operator. Just as Mr Niel won political influence as an owner of Le Monde newspaper, Mr Drahi bought Libération, a daily, and other titles. Both men bid for telecom operators in America, though only Mr Drahi succeeded, buying two cable firms for a total of $26.8bn, in 2015 (see timeline).

One prominent businessman who is close to Mr Drahi notes that his difficulties elicit mixed views. Suppliers, partners and rivals to SFR relish them. Some conservative figures are happy to see a foreign-born upstart get his comeuppance. But others grudgingly admire his boldness. A decade ago regulators and investors would have stopped him by now, “but now they watch and wait,” says the businessman.

Mr Drahi’s mistake was not knowing when to stop. Whereas Mr Niel showed social acumen by investing in education and tech startups, Mr Drahi chased the next big deal. What comes next for him? Altice’s debts were raised on generous terms and need not be repaid for years. SFR, though badly run, will generate cash. That, and perhaps sales of assets, such as its mobile-phone towers, should satisfy creditors.

“I imagine two or three years of his struggling, but surviving,” says François Godard of Enders Analysis, a research firm. He might bounce back. A politician draws a broader lesson. Referring to prejudice in France against financiers, he asks whether now, “doesn’t he incarnate the new kind of financial and cosmopolitan capitalism that France wants?”

Source: economist

The tumultuous career of Patrick Drahi