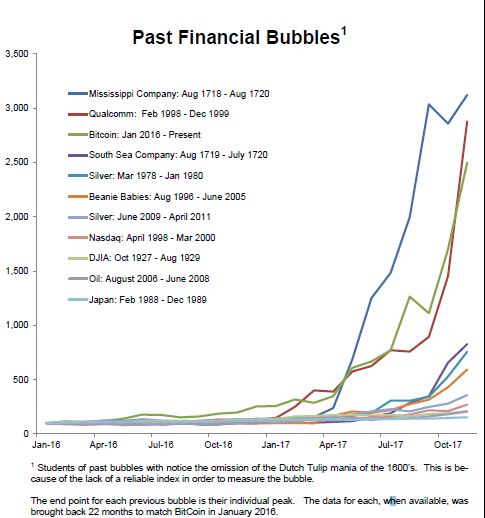

Bitcoin already has the look of one of the biggest financial market bubbles of all time.

Source: Birinyi Associates

If bitcoin is indeed a cryptocurrency bubble, it’s already much larger than the Nasdaq in the late 1990s, the Dow in the roaring 1920s, and silver in the late 1970s.

Birinyi Associates studied bitcoin versus 10 large financial bubbles. Bitcoin showed particular bubble-like qualities this week, surging past $11,000 before trading back at about $9,600 Thursday afternoon. It started November at about $6,500.

Of the 10 events Birinyi studied, bitcoin was third largest, behind an 18th-century French financing scheme around the development of the Mississippi Valley, known as the Mississippi bubble, and the one-day 31 percent surge in Qualcomm in December, 1999. According to Birinyi Associates, it was a Wall Street analysts call for a $1,000 target that set Qualcomm shares on fire.

“I’ve got to think it is,” said stock market guru Laszlo Birinyi of bitcoin’s bubble potential. “Quite frankly, we’ve traded it a little bit. I don’t mind trading it, but I wouldn’t invest in it on a dare…I would not want to go home with a lot of bitcoin.”

But Birinyi, best known for his stock market calls, says the stock market is not in a bubble, as the Dow surged more than 300 points Thursday. “Look at the stock market. I see measured consistent gains, most of which are rational and some are not but most of which you understand,” he said.

Bitcoin is already dwarfing some of the largest financial market bubbles of all time