It’s been a wild ride for bitcoin traders.

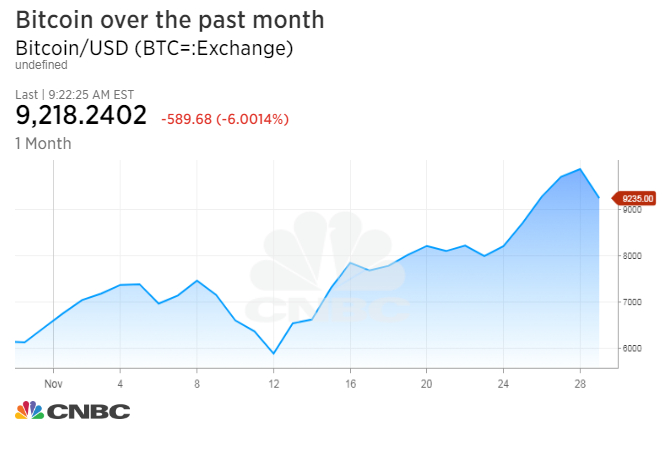

From Wednesday’s high of $11,363.99, bitcoin has fallen to a low of $9,021.85, a 20.6 percent drop. The crypotocurrency is in a period of extreme volatility after a strong showing over the Thanksgiving holiday weekend, when it set multiple all-time records.

Bitcoin last traded at $9,206.13, down 6.2 percent on Thursday, according to CoinDesk.

But despite the cryptocurrency’s sharp decline after hitting an all-time high, it could fall to near $7,000 without doing much damage on a technical basis, said Mark Newton of Newton Advisors.

“I would say that you’ve seen several important, pretty severe corrections to bitcoin over time and it’s managed to come back,” Newton told CNBC on Thursday. “From a percentage standpoint, the volatility isn’t that different then what you’ve seen in August.”

“Temporarily, you’ve seen a potential peak. It’s gotten a bit overdone sentiment wise,” he added.

Volatility is nothing new for the digital currency. One of the major grievances leveled at bitcoin has been regular swings in value, a trend unbecoming of a global means of monetary exchange. Bitcoin’s more than 1,000 percent appreciation over the past year has also drawn bubble concerns.

Former Fortress hedge fund manager Michael Novogratz said Tuesday that cryptocurrency pricing may be a historic phenomenon.

“I think this [crypto] is going to be the biggest bubble of our lifetimes by a longshot,” he said at the CoinDesk Consensus: Invest conference in New York. “To be fair, this is a bubble and there’s a lot of fraud mixed in. We look at tons of projects. And some get funded, and they literally look like Ponzi’s. There’s a lot of froth and fraud in something that’s exciting as this.”

But bitcoin is growing in acceptance across Wall Street. Nasdaq official told CNBC that it plans to launch bitcoin futures as early as the second quarter of next year.

—CNBC’s Evelyn Cheng contributed to this report.

Source: Tech CNBC

Bitcoin plunges 20% from its high