Buying Home Depot, General Electric, Nike and Goldman Sachs in December has been a good trade, history shows.

Home Depot‘s stock averages a return of 4.89 percent in the final month of the year — the best out of any Dow Jones industrial average component — and trades positive 67 percent of the time in December, according to CNBC analysis using Kensho.

The company’s stock is up sharply this year, rising more than 38 percent. Home Depot shares have benefited from swelling momentum in the housing market and e-commerce initiatives that have largely paid off.

Home Depot will “disproportionately capitalise” on an attractive housing backdrop, said Atlantic Equities analyst Sam Hudson in a note to clients Tuesday.

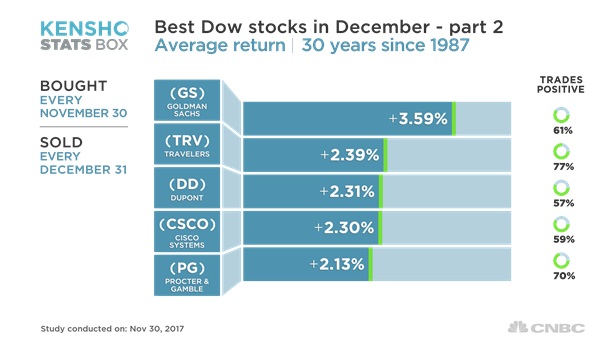

Shares of GE, Nike and Goldman have also been strong trades in December, averaging returns of 4.18 percent, 3.92 percent and 3.59 percent, respectively.

Below are two charts showcasing the 10 best Dow stocks in December, on average, the last 30 years.

But GE’s stock has had a dismal 2017. The industrial giant’s stock has fallen more than 43 percent this year and is the biggest decliner on the Dow. Last month, CEO John Flannery unveiled a restructuring plan that would renew focus on the company’s health care, aviation and energy businesses. A run in December would be a bet on Flannery’s ability to turn the bellaugered bellwether around.

Nike and Goldman Sachs, on the other hand, are up 18.9 percent and 5.4 percent for 2017, respectively.

To be sure, past performance doesn’t equal future results and historical pattern alone is not typically reason enough to buy a stock.

Disclosure: NBCUniversal, parent of CNBC, is a minority investor in Kensho.

Source: Investment Cnbc

Home Depot and these other Dow stocks are the best bets for December, history shows