ON NOVEMBER 30th, as oil tsars from the Organisation of the Petroleum Exporting Countries (OPEC) and Russia met in Vienna, Venezuela’s former oil minister, Eulogio del Pino, once one of their number, was seized by armed guards at dawn in Caracas, and taken to jail. His arrest was not publicly acknowledged in Vienna. His replacement, Manuel Quevedo, a general in the national guard, attended OPEC and was received with the usual deference.

Also unmentioned was how Venezuela, embroiled in a massive, messy debt default, is doing plenty of OPEC’s dirty work. Since November 2016, when OPEC first agreed with Russia to cut output to push up oil prices, Venezuela’s has fallen by 203,000 barrels a day (b/d), to 1.86m b/d in October. That is more than twice the cut it agreed with OPEC of 95,000 b/d.

-

Supervisors declare global bank-capital standards completed

-

Donald Trump’s Jerusalem move sparks Christian disputes

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

What the Yugoslav war-crimes tribunal achieved

-

Democrats take a strong line on sexual misconduct in Congress

If its production continues to fall—some analysts say it could be down to 1.6m b/d in 2018—it could either drive up oil prices further or absolve some countries from the cuts they agreed to last month. “Venezuela gives OPEC and Russia wiggle room,” says Helima Croft of RBC Capital Markets.

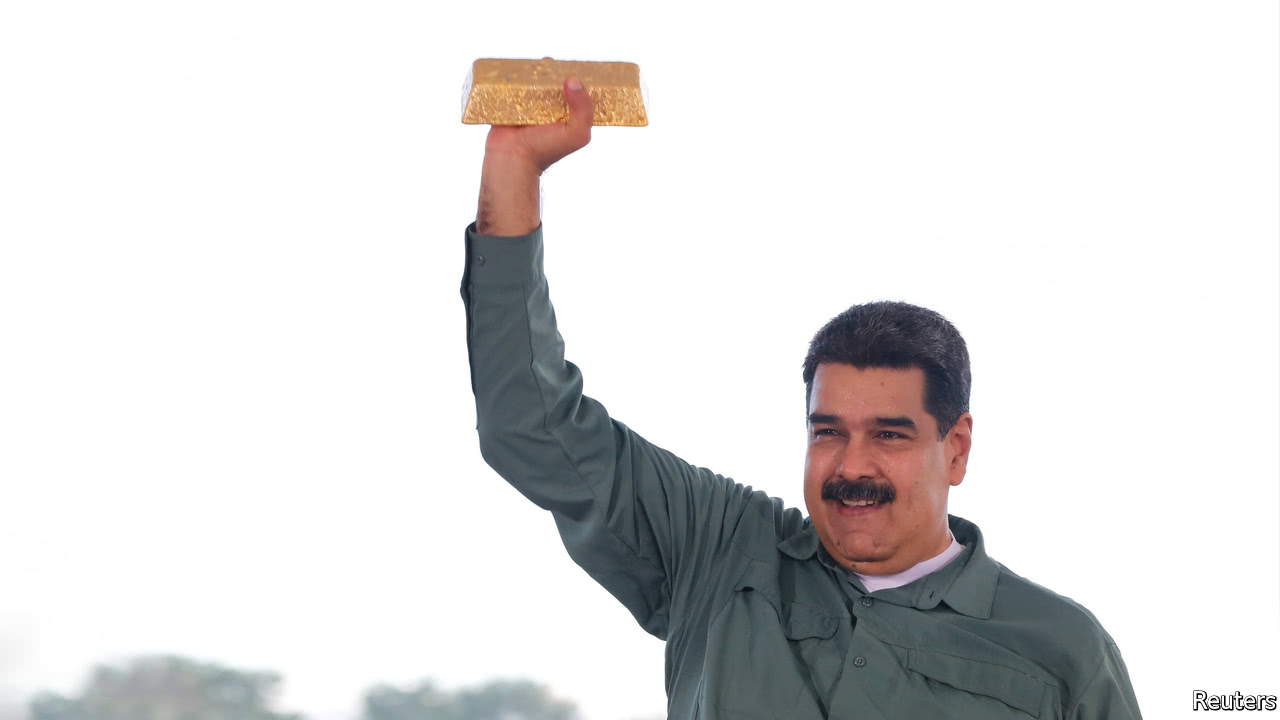

Venezuela’s output has lurched lower since 2016 amid economic mismanagement by the government of President Nicolás Maduro. A cash crunch hit payments to the oil-service companies that work on the world’s most abundant oil reserves. Making matters worse has been the partial default on debts of the government and PDVSA, the state oil company that provides 95% of the country’s exports. PDVSA has made $9bn of payments this year, and owes $5bn in 2018.

In recent weeks the disarray has become farcical. The Maduro administration arrested more than 60 oil executives, accusing them of corruption, and replacing them with soldiers such as Mr Quevedo, who have no clue how to produce oil. In a Christmas message on December 3rd, Mr Maduro compounded the absurdity by announcing a planned cryptocurrency called the “petro”, backed by Venezuela’s oil reserves, to evade American financial sanctions. He might as well have asked people to believe in Santa Claus.

The threat to Venezuelan oil production is real enough, though. Vortexa, a firm that tracks flows of crude in real time, says shipments to America, where Venezuela provides heavy crude feedstock for its own and other refineries, plunged in the three months to November 30th. On Vortexa’s data, China has replaced America as Venezuela’s biggest export market. But it is losing patience. This week Sinopec, a state oil company, sued PDVSA over unpaid debts.

Output could plummet if the country or PDVSA fall into full-scale default. So far, the company is considered to be in default on some interest payments, though it continues to repay principal, according to rating agencies. Lee Buchheit, a debt-restructuring expert at Cleary Gottlieb, a law firm, says that so long as some cash continues to flow to bondholders, they are reluctant to use legal means to seize Venezuelan assets, as they did in Argentina. If that calculation changes, oil firms could be loth to buy Venezuelan oil.

American sanctions make things harder. Francisco Monaldi, an economist at Rice University in Texas, says Venezuela’s exclusion from American credit markets has worsened PDVSA’s difficulty in paying partners and suppliers. As a result, production from fields it operates directly has fallen sharply. He says fields where it is in partnership with international oil companies have provided almost two-thirds of recent production, but are also starting to suffer.

Mr Quevedo blames PDVSA’s falling output on American “sabotage”, as a prelude to a coup. Adding to the ferment, Russia has backed Venezuela by refinancing some of its debts, thanks largely to Igor Sechin, boss of Rosneft, an oil giant, which has lent $5bn to PDVSA. The upside for him is that even if Venezuela’s plight worsens, its oil assets will become cheaper.

Source: economist

A full-scale Venezuelan default could push up oil prices