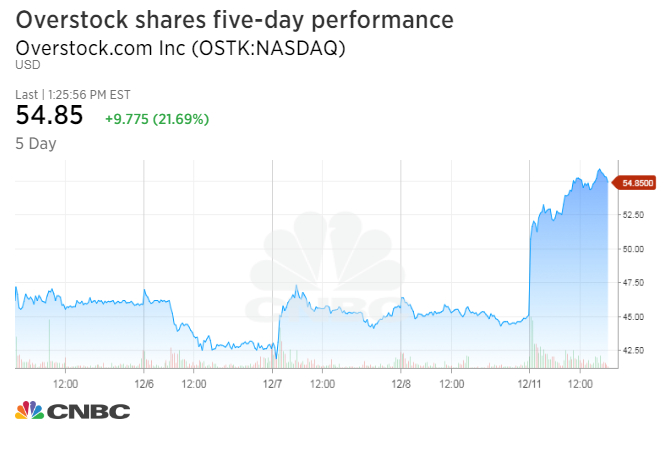

Shares of Overstock.com briefly surged more than 23 percent Monday after Morgan Stanley Investment Management disclosed an 11.4 percent stake in the company.

The investment management division has $447 billion in assets under management and its products include mutual funds and hedge funds. The department said in a 13G filing Friday with the U.S. Securities and Exchange Commission that it owned nearly 2.87 million shares of Overstock.com as of Nov. 30.

The 13G filing is typically used for passive stakes of between 5 to 20 percent of a company. Representatives for Morgan Stanley Investment Management and Overstock.com did not immediately respond to a request for comment.

With Monday’s gains, Overstock.com shares were on pace for its best day since Nov. 9. The stock leaped 30.7 percent that day, after D.A. Davidson analyst Tom Forte predicted more than 60 percent in gains for the stock. Forte pointed to indications on Overstock’s third quarter earnings call that the company could sell its home goods e-commerce business to focus on bitcoin‘s blockchain technology through its Medici Ventures division.

Forte maintained his $85 price target on Monday, still nearly 52 percent above Monday’s session high of $56.05 a share.

Overstock’s gains accelerated in the last few months after news the company is planning to launch a licensed digital coin trading platform through its subsidiary tZero and raise funds through an initial coin offering. Shares are up more than 200 percent this year.

Bitcoin leaped more than 9.5 percent to above $16,500 Monday, according to CoinDesk’s bitcoin price index, after the launch of bitcoin futures on the Cboe Futures Exchange Sunday night.

Source: Tech CNBC

Shares of retailer-turned-bitcoin-play Overstock.com rocket higher after Morgan Stanley reveals stake

These uromexil cena adverse effects are generally mild and also short-lived.