We don’t know if we’ve just seen the moment of maximum upside energy for this bull market. But even if we have, history says there’s likely a fair slug of further gains left in this run before it finally ends.

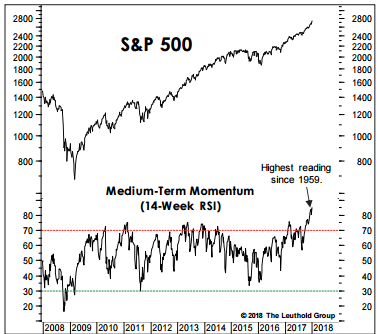

A market’s “momentum peak” is measured by various tools that capture the angle and persistence of a rally. The S&P 500‘s surge into the new year — which followed an upturn in August and an earlier steepening of the ascent after Thanksgiving — registered some of the highest momentum readings on record.

Doug Ramsey of the Leuthold Group noted last week that on Jan. 5 his preferred gauge, the 14-week Relative Strength Index, reached its highest level since 1959 — and then the market pushed higher still into last Friday and Tuesday’s morning peak, before stocks reversed by the close.

Source: The Leuthold Group

The only way to tell whether momentum has peaked for a bull market is in retrospect, once momentum wanes and ultimately the bull’s run ends. Yet even if the recent push higher does turn out to be that peak, odds are the ultimate market highs are not already in.

“It’s historically been very rare that the cyclical peak in stock prices coincides with the peak in momentum,” Ramsey said.

Source: Investment Cnbc

Bull market may find it hard to keep this momentum, but that doesn't mean it's over