FOR a phenomenon with such predictably bad outcomes, a financial boom is strangely seductive. Not a decade after the most serious financial crisis since the Depression, the world watches soaring markets with a mixture of serenity and glee. Natural impulses make finance a neck-snappingly volatile affair. Governments, though, deserve heaps of blame for policies that amplify both boom and bust. As regulators begin picking apart reforms only just enacted, it is worth asking why that is so.

Finance is hopelessly prone to wild cycles. When an economy is purring, profits go up, as do asset values. Rising asset prices flatter borrowers’ creditworthiness. When credit is easier to obtain, spending goes up and the boom intensifies. Eventually perceptions of risk shift, and tales of a “new normal” gain credence: new technologies mean profits can grow for ever, or financial innovation makes credit risk a thing of the past. But when the mood turns, the feedback loop reverses direction. As asset prices fall, banks grow stingier with their loans. Firms feel the pinch from falling sales, get behind on their debts and sack workers, who get behind on theirs. The desperate sell what they can, so asset prices tumble, worsening the crash. Mania turns to panic.

-

Why tennis players grunt

-

Why Donald Trump has become a pro-life crusader

-

Some hotels charge visitors for bad reviews

-

Paul Romer quits after an embarrassing row

-

Music will miss irascible, unpredictable and prolific Mark E. Smith

-

Five English teams are among the ten highest-earning football clubs

The pattern is an ancient one. In their book “This Time is Different”, Carmen Reinhart and Kenneth Rogoff, two economists, point out that eight centuries of financial pratfalls have not persuaded investors to treat financial booms with the requisite caution. You might expect Joe Daytrader to succumb to the lure of financial excess, but the chronically poor response of governments is more perplexing. Regulators could dampen frenzies by asking banks to raise their equity-to-assets ratios or to tighten lending standards. Regulation could be “countercyclical”, in other words, leaning against the natural financial cycle in order to limit excess, prepare financial institutions for bad times, and leave more room for leniency when the economy is on the ropes. Governments have got better at leaning against turns in the business cycle, so that recessions are less common and less severe than they once were. It seems strange that finance should be different.

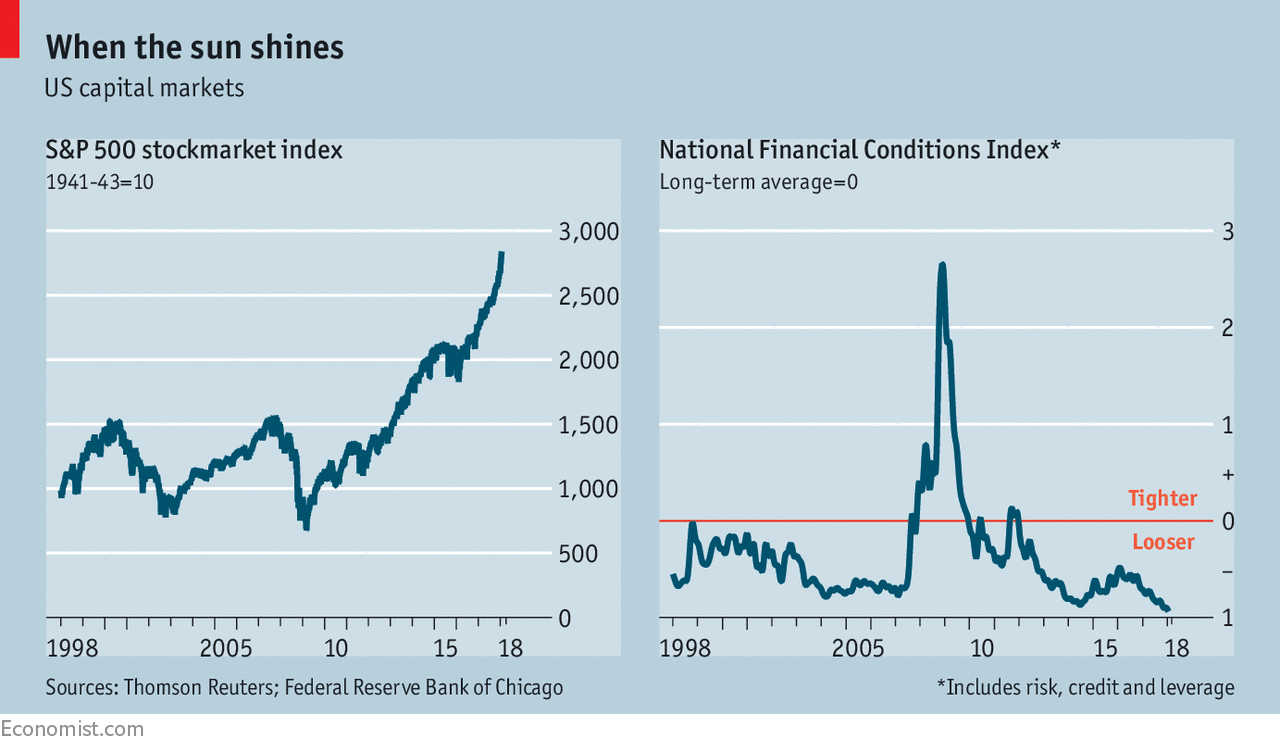

Indeed, regulation is often “procyclical”: it adds fuel to the fire. In the decade up to the global financial crisis America rolled back Depression-era bank regulations, protected liberal trading rules for derivatives, presided over a wave of banking-industry consolidation and tolerated a dangerous drop in mortgage-lending standards. The ensuing crisis prompted a wave of new financial regulation, but these rules are now being weakened, even as exuberance returns. America’s Congress is expected to tweak the Dodd-Frank Act in coming months to limit the application of some rules to the largest banks. Republicans seem to lack the votes to eliminate the new Consumer Financial Protection Bureau, but President Donald Trump’s choice to run it, Mick Mulvaney, has long expressed a desire to neuter it. The Federal Reserve is drafting plans to reduce bank-capital requirements. (Post-crisis revisions to the Basel bank-capital standards for global banks encouraged regulators to set a countercyclical capital buffer, which should rise with financial excess; the Fed’s is currently set at zero.) Not every element of the deregulatory push is reckless, and America is tougher on some aspects of capital than others, but the timing is poor—coming amid historically easy financial conditions and soaring asset prices (see chart).

Technical defaults

One reason is that regulators are, like everyone else, too eager to conclude that this time is different. Many proposed post-crisis reforms offered technical solutions to the industry’s problems, such as better measures of financial instability or reforms to CEO pay to improve bank behaviour (and reduce the need for robust regulation). Yet in finance, as in much of economic policy, problems that look technical are in fact political. As Charles Calomiris and Stephen Haber describe in their book “Fragile by Design”, governments are not neutral observers of the financial system; they also depend on it, for their own financing needs, among other things. This co-dependency means that the evolution of banking regulation is shaped by bargaining between bankers and politicians, not all of which aims to maximise social welfare.

In a new IMF working paper, Jihad Dagher examines the political-economy elements of ten financial crises, beginning with the South Sea Bubble in Britain, and finds they had much in common. They were often preceded by periods in which light-touch regulatory thinking was in the ascendant. Such an approach becomes less tarnished as memories of past crises recede, and opening credit taps often brings short-run political rewards. As deregulation proceeds, politicians’ electoral hopes—and, sometimes, their own financial interests—rely on the burgeoning booms. So they become more sympathetic to financial interests. When Britain’s Parliament voted to protect the value of shares in the South Sea Company, for example, many of its members owned some. Crises are usually followed by a political backlash, which sweeps in new leadership with a mandate to regulate. Warren Buffett’s famous financial axiom—that only when the tide recedes can you see who has been swimming naked—also applies to politics. At times of financial excess, voters cannot easily tell responsible leaders from reckless ones. Negligence becomes obvious only later. That makes recklessness an attractive political strategy.

Is there any hope of escaping such cycles? Central-bank independence helped depoliticise business-cycle management. Giving central banks more regulatory responsibility, as many countries did after the crisis, might therefore help (though it might also encourage politicians to meddle more with central banks). Curbing the power of the financial industry might prove more effective, but for now there is little political appetite for bold strategies such as breaking up large banks. If this time is different, it is only because the lessons of history have been discarded so quickly.

Source: economist

Financial regulators too often think “this time is different”