MORGAN STANLEY emerged in 1935 out of a global financial disaster, as one of Wall Street’s leading firms. In a rare shred of consistency in America’s turbulent markets, history has repeated itself. But it was a close call. An ill-timed infatuation with debt ahead of the 2007-08 financial crisis threatened to add it to the industry’s towering funeral pyre, which consumed all its big competitors with the exception of Goldman Sachs.

Of the two, Morgan Stanley came out of the crisis the more tarnished, less for what it did than for what it was: less profitable; less connected, through its former employees, to political power; and less respected for having evaded disaster. But after the release of financial results from the fourth quarter of 2017, Morgan Stanley’s valuation has surpassed Goldman Sachs’s. This reflects not only the improvement in its profitability but also investors’ greater confidence in how it is managed.

-

Donald Trump tells leaders in Davos that America is open for business

-

Why drones could pose a greater risk to aircraft than birds

-

Being religious does not make you greener

-

Why tennis players grunt

-

Why Donald Trump has become a pro-life crusader

-

Some hotels charge visitors for bad reviews

Goldman, with some justice, finds the comparison unfair. The two firms make roughly equivalent returns and each is top dog in global league tables for segments of the capital markets. Goldman might easily reclaim its edge in the next quarter. But its approach has a growing legion of doubters. Fixed-income, currencies and commodities, the mysterious profit centre from which its chief executive, Lloyd Blankfein, graduated, has had a rough stretch that reflects more than bad luck. Its newest growth initiative—to profit from small clients it ignored in the past—has yet to prove itself more than an interesting idea.

The rising esteem for Morgan Stanley came grudgingly at first, and then fast. The firm and its chief executive, James Gorman, are seen as having attributes common in many businesses but oddly rare on Wall Street: a long-term vision; a plan to execute it; and a record of bringing it to life. All the more unusual, these attributes omit the defining trait of the historically successful investment bank—wild, euphoric, glorious years of profit (often then paid out to staff and lost in subsequent busts).

Since the financial crisis, Morgan Stanley’s results have improved steadily, albeit only to their current level of barely adequate. Its return on equity in the recently completed year (adjusting for the oddities of America’s recent tax reform) is 9.4%, not quite up to that of a run-of-the-mill utility. Mr Gorman’s new targets are for 10-13%, somewhat closer to the overall market average. On a recent conference call a financial analyst asked him why the target was not higher. After all, Morgan Stanley will enjoy a big boost from the tax overhaul, which will cut its tax rate from over 30% to the mid-20s. Mr Gorman demurred, stressing that the firm would only project returns it felt were feasible even if conditions become rough. To aim higher—and in particular to replicate the pre-crisis returns on equity of more than 20%—would mean “doing something you don’t want us to do”.

Some of this coyness stems from Wall Street’s new arithmetic. Since 2006, Morgan Stanley’s capital has grown from $35bn to $77bn and it has slashed its debt: that has eaten into returns on equity. Capital requirements may fall a bit as regulatory models are tweaked (see Free exchange)—Morgan Stanley has been especially affected by some of their quirks—but the permissive mood of the past is unlikely soon to return. Often, when a chief executive explains barriers to profitability, a company’s share price sinks. Mr Gorman’s comments had the opposite effect. Sobriety is in vogue.

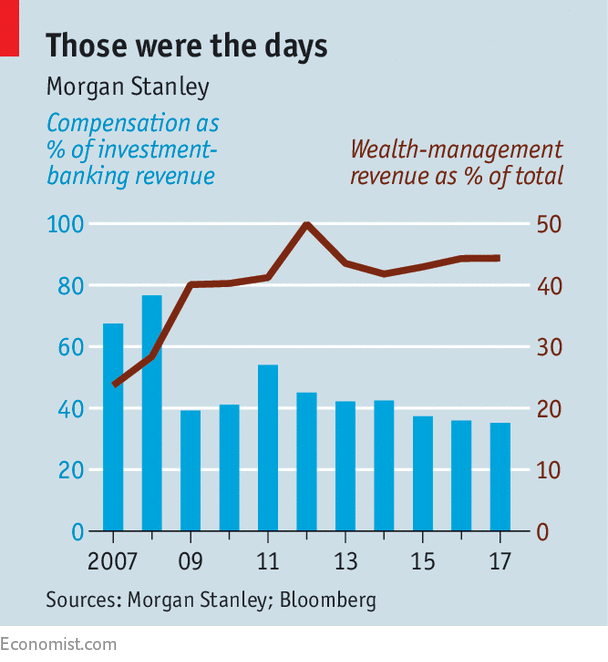

Underlying the results are large changes to the firm. Its hallways still buzz with slim, well-dressed, intense people of indeterminate age. But they are not quite the self-anointed masters of the universe of the pre-crisis era. Pay as a share of investment-banking revenues has dropped from a peak of 78% in 2008 to 35% (see chart). Investment banking itself is less important these days, accounting for about half the overall business. In contrast the firm’s wealth-management income has grown sharply since the crisis, and has become even more central to its operations since it bought into Citigroup’s wealth-management business in 2009. Controversial then, the move appeared foolish a year later when the process of integration faltered.

It is now cited as an obvious and unrepeatable opportunity. Revenues and profits have grown quickly. Margins, Mr Gorman said, had reached levels only ever achieved by a broker in 1999 during the dotcom bubble (by Smith Barney, whose remnants were picked up in the Citi acquisition). That, he suggested, might mean they were peaking. In response, Steven Chubak, an analyst at Instinet, a broker, created side-by-side comparisons of the two businesses to illustrate how much their approaches differed. Three-quarters of Smith Barney’s revenues, compared with a fifth of Morgan Stanley’s, came from transactions, ie, from commissions on stock and bond sales, and so were highly volatile. The emphasis since has shifted.

Fees charged as a percentage of assets are the most important source of income. But mortgages and other loans to clients, financed by deposits, are a second, fast-growing one. The loans are backed by the borrowers’ securities holdings, helping explain why credit losses to date have been almost non-existent. Attracting deposits is not as hard as might be expected from the affluent customers Morgan Stanley pursues. Of course they already have bank accounts, but many conventional retail banks pay almost no interest, are starting to charge for current accounts and, in effect, are encouraging clients to look elsewhere.

As this trove of information grows, giving Morgan Stanley data on clients’ income, holdings and spending, it will create new sources of value. The firm employs 16,000 financial advisers (formerly known as brokers) who, over time, may form teams made up of people with very different skills, such as in taxes or inheritance law. A linked online offering that the firm hopes will appeal to millennials was recently launched, enabling investment decisions to take into account preferences such as environmental concerns.

The firm sees its best opportunities in cosseting its clients so well that they bring in some of the vast investments they hold elsewhere. The rub is that others doubtless feel the same. Wells Fargo and Bank of America Merrill Lynch have somewhat similar approaches and are doing well, as are many independent financial advisers. Electronic start-ups such as Wealthfront and Betterment claim to do most of what the older firms do, but at a fraction of the cost. They are attracting younger customers. Betterment says its clients are, on average, 37; Morgan Stanley’s are in their late 50s or early 60s. A harder-to-track cohort of investors ignore advisers altogether and instead invest directly in cheap, passively managed funds.

In short, with so many ways to fail, even Mr Gorman’s decade-long record cannot quell all doubts. But scepticism is countered by the fact that it all seems to be working. And enough consistent progress has been made to suggest Morgan Stanley’s returns may one day climb beyond the “barely adequate”.

Source: economist

Morgan Stanley’s unexciting model takes the prize on Wall Street