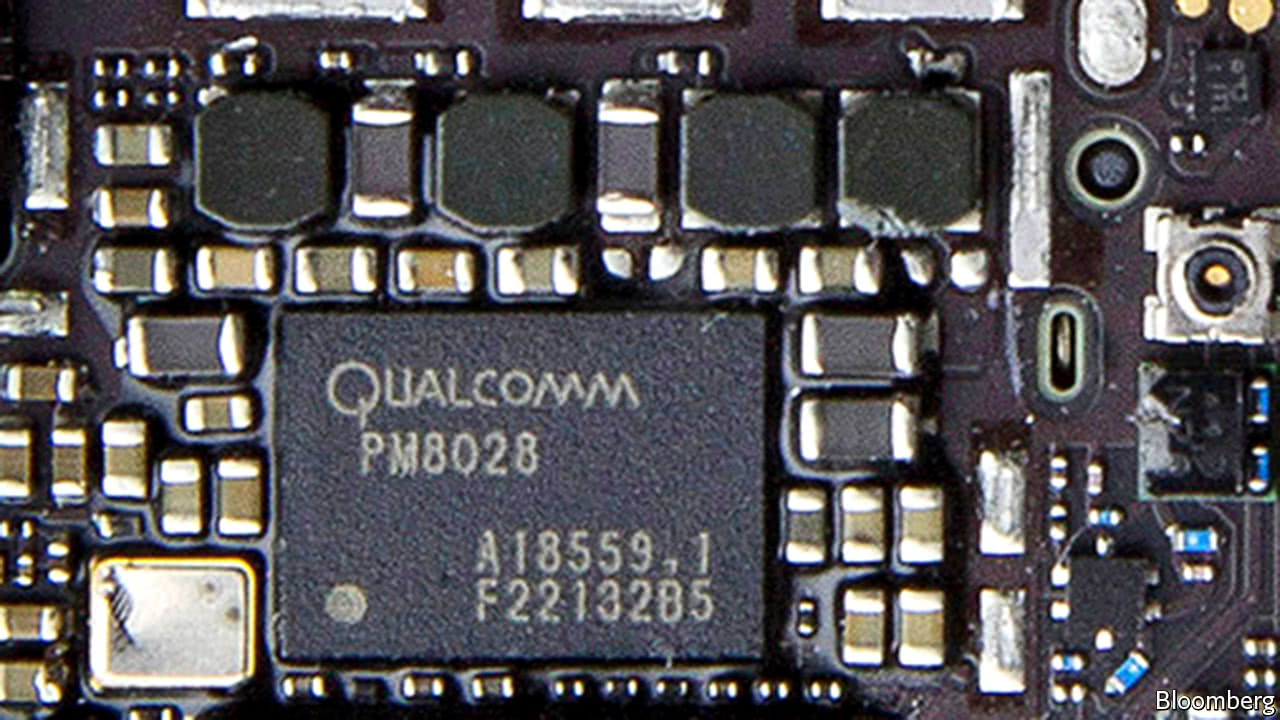

THE tech industry hardly needs another reminder that trustbusters are on its case. But the European Commission is always happy to oblige. On January 24th Europe’s executive body slapped a penalty of €1bn ($1.2bn) on Qualcomm, one of the world’s largest chip-designers, for abusing its dominance in baseband processors, a critical component in mobile phones.

Large fines are becoming something of a habit for Qualcomm, which will have paid out nearly $1bn a year, on average, to trustbusters the world over since 2015. This week’s penalty, which amounts to nearly 5% of the company’s global annual revenue, is a reflection of what Margrethe Vestager, the European competition commissioner, described as its “very illegal behaviour” between 2011 and 2016. During that time, according to Ms Vestager, the company attempted to shore up its dominant position—it is estimated to supply up to four-fifths of essential types of baseband chips—by paying Apple, its biggest customer, billions of dollars in return for being its exclusive supplier.

-

Five English teams are among the ten highest-earning football clubs

-

Remembering Ursula Le Guin, the true wizard of Earthsea

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

A severe case of “truth decay”

-

Britain’s statisticians are at war like never before

The commission ruled that the strings attached to these payments—which included a clawback of part of the money, should Apple use other suppliers—acted to shut rivals out of the market. According to internal documents from the time, Apple had long considered sourcing its chips from Intel, but it did not actually do so until 2016, after its deal with Qualcomm had expired. (The chipmaker insists that its practices did not violate European Union rules, and plans to appeal against the commission’s decision.)

Qualcomm’s pricing strategy, too, has won it few friends in recent years. Most contentious is the way in which it licenses its intellectual property to device-makers, charging them a percentage of the total selling price of their devices. Apple alleges that such royalties act as a tax on any innovative features it adds to its products, and is yet another way in which the chipmaker is abusing its market power. Apple is seeking damages of over $1bn from the chipmaker in lawsuits filed both in China and California. Regulators in Taiwan, South Korea and China have already extracted penalties for the licensing model; an investigation by America’s Federal Trade Commission, launched last year, is under way.

In a rare bit of good news for the chipmaker, regulators in Europe and South Korea last week gave their blessing to Qualcomm’s $47bn acquisition of NXP, another chip-design firm. Qualcomm hopes the purchase will help it to boost its business in 5G chips and the “internet of things”, as connected devices are collectively called. But Ms Vestager is not quite finished with the firm. The commission is yet to rule on whether it also engaged in predatory pricing between 2009 and 2011 by setting the prices of certain chips below cost, allegedly to force a competitor out of the market.

The continued uncertainty, and Qualcomm’s hefty penalties so far, may give the company’s own predator, Broadcom, a rival chipmaker, more ammunition. Its $130bn offer for Qualcomm was rebuffed last year; a heated proxy fight at Qualcomm’s annual investor meeting in March seems likely. Qualcomm argues that regulators will never bless the union, which would be the largest-ever tech deal. But Broadcom reportedly plans to end the licensing model if it is allowed to make the purchase, which would probably draw the battle with Apple to a close. That is something for trustbusters to chew on.

Source: economist

Qualcomm is fined for anti-competitive practices—again