AT THE start of 2017, just before Donald Trump was inaugurated as president, a survey of fund managers by Bank of America Merrill Lynch (BAML) found they believed that being positive on the dollar was “the most crowded trade”. It turned out they were right to be cautious. On a trade-weighted basis, the currency has fallen by 9% against other major currencies in the past year.

It is not clear what the Trump administration thinks about this. At the recent World Economic Forum in Davos, Steven Mnuchin, the treasury secretary, said: “Obviously a weak dollar is good for us as it relates to trade and opportunities.” Although the rest of his statement was more nuanced, it is unusual for anyone in his position to depart from a “strong dollar” line. The greenback duly fell in price.

-

Muhammadu Buhari starts to jockey for a second presidential term

-

Theresa May’s awkward Chinese visit shows Britain’s weakened clout

-

The dollar keeps weakening. Is that good news for the world?

-

Democracy continues its disturbing retreat

-

Some of Nature’s strangest mammals are also some of the most threatened

-

In the 1960s, Californian artists became masters of light and space

Mr Trump then followed up with a statement in favour of a strong dollar in the long term, which caused a rebound. Since it was only last April that he referred to the dollar as being “too strong”, the markets can be forgiven for being confused. Never mind singing from the same hymn-sheet, the American authorities are using different tonal systems.

Adding to the puzzle is the administration’s focus on eliminating the trade deficit. The recent package of tax cuts, by boosting demand, is likely to suck in imports and make the deficit worse. The trade deficit tends to fall during a recession, but that is not a desirable outcome. So it may need a big decline in the dollar to effect a cut in the deficit, while keeping the economy buoyant.

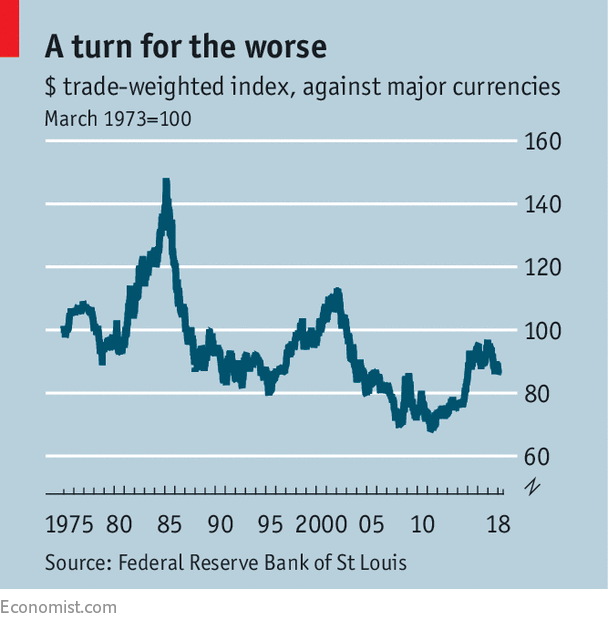

If the dollar is poised to experience one of its long periods of weakness, as in the late 1980s or the early 2000s (see chart), what would that mean for the financial markets? Much may depend on why the dollar is weak. If the weakness relates to bad news about the American economy, then that is usually bad for equities and good for government bonds. The reverse applies if the weakness reflects a boom in emerging markets; that would be a sign of investors taking advantage of exciting opportunities elsewhere.

Current dollar weakness seems to be linked to a rebound in the global economy. That also helps explain why stockmarkets have started 2018 in a buoyant mood. A weaker dollar helps American multinationals, as Mr Mnuchin suggested. Not only does it make their exports more competitive, but their overseas earnings are also worth more in dollar terms. BAML says that, in the fourth quarter, 68% of companies with high foreign sales beat analysts’ forecasts of profits and sales. Only 39% of companies with no foreign exposure managed to do so.

Although equities have been performing strongly, Treasury-bond prices have been falling (in other words, yields have been rising). This may suggest that foreign investors require a higher return to persuade them to put their money in a depreciating currency. Another explanation is that American bond investors think stronger economic growth will eventually lead to higher inflation and are demanding higher yields to compensate.

What about the rest of the world? A weak dollar means a strong euro and thus, all else being equal, tighter financial conditions in Europe. Mario Draghi, the president of the European Central Bank, made some pointed remarks on January 25th about disorderly movements in exchange rates, and their adverse implications for financial and economic stability. He took a more doveish tone on monetary policy than investors expected; the ECB will not want the euro to rise too far. Government-bond yields in Europe have also been rising, so financial conditions are already tightening.

Life tends to be easier for developing countries when the dollar is falling than when it is rising. The Asian financial crisis, for example, occurred during the dollar surge of the late 1990s. Many countries peg their currencies, formally or informally, to the greenback; if the dollar is rising, they may be forced to tighten monetary policy in order to maintain the link. A weaker dollar gives countries scope to cut interest rates, boosting growth.

Of course, all these trends may reverse if they go too far. If a lot of money flows into emerging markets, their economies can become overheated and their exporters uncompetitive in the face of overvalued currencies, leading to an eventual crisis. If Treasury-bond yields rise far enough, that will prompt capital to flow back into the dollar. Furthermore, a sharp rise in bond yields will put the squeeze on economic growth. Investors do not mind a bit of dollar weakness; they just don’t want too much of it.

Source: economist

The dollar keeps weakening. Is that good news for the world?