IN THE mining world the bout has the drama of a heavyweight title fight. In one corner is Ivan Glasenberg, billionaire boss of Glencore, the world’s biggest commodities-trading firm. In the other is Dan Gertler, an Israeli billionaire accused by America of corruption related to his dealings with Joseph Kabila’s government in the Democratic Republic of Congo (DRC).

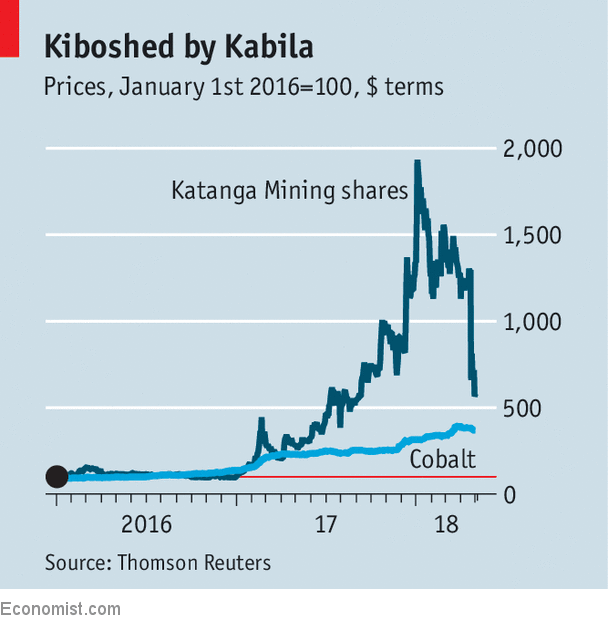

The prize is a battery mineral, cobalt, which Glencore produces in the DRC and whose value has almost tripled since the electric-vehicle revolution accelerated at the start of 2017. It will be a tough fight. In the DRC Glencore is currently facing the potential loss of one of its biggest mines and sharply higher mining levies, as well as a costly lawsuit. “It’s a shakedown of Glencore,” says an analyst in London.

-

Why has Qatar Airways just launched flights to Wales?

-

Young Americans believe in a vengeful God

-

Gay and women’s rights are remarkably a part of Lebanon’s elections

-

The art of doing something with nothing

-

Under the surface of Eisenhower’s era

-

Retail sales, producer prices, wages and exchange rates

The clash between Messrs Glasenberg and Gertler, two former business partners, dates back to December, when the American government slapped sanctions on Mr Gertler, accusing him of amassing hundreds of millions of dollars through “opaque and corrupt” mining deals in the DRC, which he denies. Glencore’s two mining companies in the country, Kamoto Copper Company (KCC) and Mutanda Mining, had been paying royalties to firms owned by Mr Gertler in recent years, as required by Gécamines, the country’s state mining company. In order to avoid violating the sanctions, Glencore says it has stopped those payments.

On April 27th a company affiliated to Mr Gertler filed a suit in the DRC to freeze some assets of KCC and Mutanda, and to seek damages of almost $3bn for future unpaid royalties. The sum is staggering. Glencore says it “entirely rejects” the calculation. According to audited accounts, KCC’s last payments to a Gertler-related company were $54.7m in 2015. On May 1st Glencore won a temporary injunction in a London court against Mr Gertler taking further legal action against KCC. But the court did not rule on the legality of the Congo proceedings, and Glencore’s assets there remain frozen—at least until another hearing on May 11th.

Mr Gertler’s move puts serious strain on Glencore’s operations in Congo, where it is the biggest producer of both copper and cobalt. It is under attack there on other fronts, too. Last month Gécamines started legal proceedings in the DRC to dissolve KCC, in which it is a joint-venture partner with Glencore’s Toronto-listed subsidiary, Katanga Mining, arguing that KCC’s $9bn debt is draining the firm for Glencore’s benefit. Katanga’s shares, which soared last year on the strength of rising cobalt prices (see chart), have plunged on fears that Gécamines may nationalise the mine and sell it to a Chinese rival.

Glencore says it hopes to recapitalise KCC to save it from the possibility of nationalisation. NGOs pressing for greater transparency in Congo, such as Belgium-based Resource Matters, say that would be long overdue. They say the debts (mostly borrowed from Glencore-related companies) have helped KCC cut its tax bill in a poverty-stricken country in dire need of roads, schools and hospitals.

Yet even if that matter is settled, Glencore faces another round of pain—a new mining code that could sharply raise royalty rates on mineral production. Glencore and other global mining firms in the DRC have so far failed to persuade the authorities in Kinshasa to relax some of the terms of the code, though negotiations are said to be continuing.

Mr Glasenberg may be partially reaping what he sowed, analysts say. His firm long did business with Mr Gertler, despite reports about the latter’s relationship with Mr Kabila. Other Western mining firms say they steer clear of the DRC because of reputational and legal risks. Glencore’s travails may be the result of Mr Kabila—who has overstayed his second, and supposedly final, term in office—squeezing mining firms for cash to stay in power.

Glencore may survive the slugfest. Some analysts say it may be encouraged to make a big tax prepayment to Gécamines to preserve its assets (it would probably have to verify where that money goes). Others say it may attempt to convince America’s Treasury to relax sanctions against Mr Gertler (companies may have similarly intervened in the case of Rusal, a Russian aluminium producer that has been sanctioned by America—see Schumpeter). But that is unlikely. Meanwhile, the gloves are off.

Source: economist

Glencore, a hard-slugging mining giant, meets its match in Congo