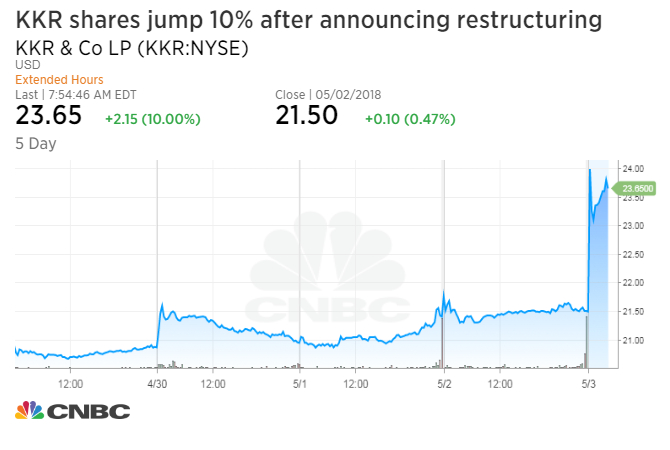

Shares of private equity firm KKR jumped 10 percent in premarket trading after announcing a plan to convert to a corporation from a partnership.

The change will become effective July 1, the company said in an earnings release Thursday.

As a corporation, KKR plans to pay an annualized dividend of 50 cents per common share and increase its authorized share repurchase amount to $500 million.

“KKR’s conversion from a partnership to a corporation is designed to broaden our investor base, simplify our structure and make it easier to invest in our shares,” Henry R. Kravis and George R. Roberts, co-chairmen and co-CEOs of KKR, said in a statement.

“We believe this change, together with continued strong performance, will increase our ability to generate significant long-term equity value for all of our shareholders,” they said.

The private equity firm also reported quarterly earnings that beat expectations on both the top and bottom line, according to FactSet.

Shares of Blackstone rose 1 percent in premarket trading. Shares of Apollo Global Management and Carlyle were unchanged.

Source: Investment Cnbc

KKR shares jumps 10% after private equity firm announces structuring change