A cryptocurrency project backed by billionaire Stanley Druckenmiller and Federal Reserve chair runner-up Kevin Warsh is looking to rid the market of one massive problem: volatility.

Bitcoin has a fixed supply, so, when demand for it rises, bitcoin’s price goes up, and the opposite is true when demand drops. The cryptocurrency project, called Basis, aims to keep a stable value around $1 by increasing and shrinking supply, the company’s founder told CNBC Friday.

“It does it in a way that’s actually analogous to how central banks grow and shrink the money supply to also maintain price stability,” Nader Al-Naji, Basis co-founder and CEO told CNBC’s Power Lunch. “What we’re trying to do is make cryptocurrency useful.”

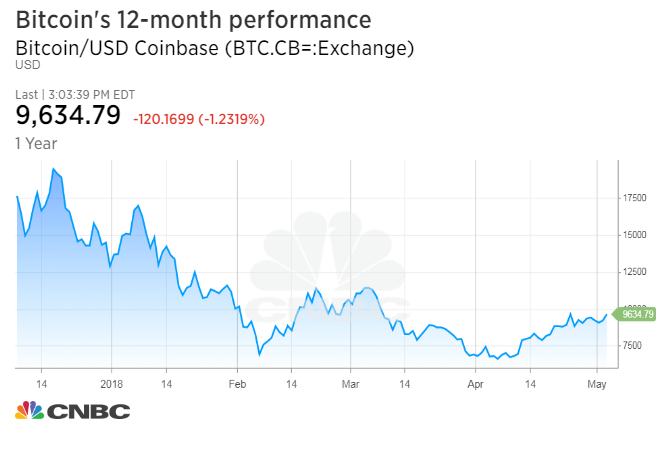

Bitcoin prices fluctuated dramatically in the past 12 months, and have fallen by roughly 50 percent since their high near $20,000 in December, according to CoinDesk. That volatility has made it impossible to do things like pay salaries in bitcoin, said Al-Naji.

“If the price goes down, you’re going to miss rent because that one bitcoin isn’t worth very much,” he said. “If it goes up your employer is also going to be upset because he feels you’re being paid too much.”

Al-Naji quit his job as an engineer at Google last year to found Basis with fellow Princeton graduates Lawrence Dio and Josh Chen.

Bain Capital Ventures led the $133 million private placement, which was the firm’s first purchase of cryptocurrency tokens. Other investors in Basis included Alphabet’s GV venture capital arm and Andreessen Horowitz.

Druckenmiller and Warsh have both bashed bitcoin for recent volatility.

Druckenmiller told CNBC in December that bitcoin cannot be a medium of exchange “because you can’t do transactions, particularly retail transactions, with this kind of volatility,” adding that he didn’t own any of the cryptocurrency.

Warsh said in a March Wall Street Journal opinion piece that cryptocurrency “price volatility significantly diminishes its usefulness as a reliable unit of account or an effective means of payment.”

“But a new generation of cryptocurrencies is on the horizon, some of which might possess more of the attributes of money, better satisfying bitcoin’s founding purpose,” Warsh wrote.

In countries like the U.S., where citizens have access to a relatively stable currency, Basis might not have as much of an appeal versus the dollar. Al-Naj saw more potential disruption in emerging markets.

“In developing countries, the most stable currency they have access to is actually devaluing at a rate of 5 percent or more,” Al-Naj said. “We’re targeting emerging markets, I think that’s really going to be the killer.”

Source: Tech CNBC

Druckenmiller-backed crypto start-up looks to solve bitcoin's volatility problem