Warren Buffett‘s longtime investing partner Charlie Munger thinks Americans should look for opportunities in China, where Berkshire Hathaway has invested in electric automaker BYD.

“American investors are missing China,” Munger said Saturday in response to a question at Berkshire’s annual shareholder meeting. “It just looks too hard, sitting in Omaha, to outsmart the Chinese market. But I think you’re absolutely right. It’s where they should be looking.”

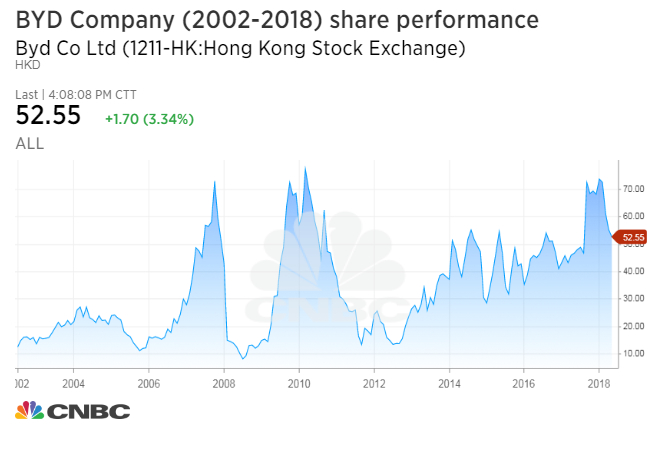

The optimism on China comes as BYD’s Hong Kong-traded shares have tumbled 22.8 percent this year, after the company forecast a nearly 82.6 percent to 71 percent drop in net profit attributable to shareholders for the first half of this year. BYD attributed the decline to reduced subsidies for electric vehicle purchases.

In September 2008, Berkshire bought 225 million shares of BYD for an 8.25 percent stake. Since then, shares have climbed about 480 percent even with the decline of the last few months. A first quarter report from BYD showed Berkshire still held its 8.25 percent stake, now worth about $1.5 billion.

Munger, vice chairman of Berkshire, “deserves 100 percent of the credit for BYD,” Buffett said in 2010, according to the CNBC Warren Buffett archive.

One of Munger’s close friends, Li Lu, introduced the investor to BYD. Li’s Himalaya Capital Investors controls LL Group, which had a 2.76 percent stake in BYD, according to the automaker’s 2017 annual report.

BYD is based in southern China and opened its North American headquarters in Los Angeles in 2011. Several regional transportation authorities in the U.S. use BYD vehicles. The company did not immediately respond to a CNBC request for comment.

“I think we’ll see tremendous growth over the next 12 years,” Macy Neshati, senior vice president for BYD’s coach, bus, truck and material handling unit, told CNBC in November. The trend of electric vehicles “I think that’s going to spread out to the world quickly. China has done a tremendous job of setting the bar very high.”

In September, Xin Guobin, China’s vice minister of industry and information technology, said Beijing is considering a ban on production and sales of fossil fuel cars. The country is already the world’s largest market for electric vehicles.

Here’s why Munger liked BYD, according to his comments in 2009:

BYD is one of the main manufacturers to the world of the rechargeable lithium battery. And it achieved that position from a standing start at zero under the leadership of the founder, Wang Chuanfu.

And — they went on into cell phone components and developed a huge position.

And then, finally, not satisfied with having worked a couple of miracles, Wang Chuanfu decided he would go into the automobile business.

As nearly as I can tell, it was zero experience in automobiles. And from a standing start at zero and with very little capital, he rapidly was able to create the best-selling single model in China.

And that’s against competition that was Chinese joint ventures with all the major auto companies of the world, technological marvels with way more capital and so on.

This is not some unproven, highly speculative activity. What it is, is a damn miracle.

…

I don’t want to bet against 17,000 Chinese engineers led by Wang Chuanfu, plus 100,000 more talented Chinese in a brand-new area — constructed the way they want it. I will be amazed, if great things don’t happen here.

I don’t think, given the size, it can be all that important to Berkshire, financially. But I have never, in my life, been more — felt more privileged to be associated with something than I feel about BYD.

Munger still liked BYD three years later in 2012. “It’s a very interesting start-up company,” he said, although the noted investors didn’t expect many cars in 2030 would be electric.

One of the challenges for Berkshire to invest more in China is restrictions on foreign investment.

“It’s very hard to imagine that we won’t find more things to do in China over time. I mean, it’s a huge market,” Buffett said in 2009. “And there will also, perhaps, be opportunities to buy more businesses there.”

“We would’ve bought more than 10 percent of BYD, if we could’ve. But, that’s all that they wished to sell us. So we hope that comes about.”

BYD didn’t come up specifically in Saturday’s annual meeting. In fact, the investing duo hasn’t mentioned the company by name during an annual meeting since 2013, according to a search using the CNBC Warren Buffett archive. But Munger said Monday on CNBC’s “Squawk Box” that he still thinks China has better investment opportunities than the U.S.

“Charlie, Charlie actually keeps pushing me to do more in China,” Buffett said during Saturday’s meeting.

Back in 2009, Buffett said it was generally a good idea to heed his investment partner’s advice.

“And Charlie, when he gets to the point where he really wants me to do something, like buy the BYD interest or something, he always says to me, ‘Well,’ he says, ‘in the end, you’ll see it my way. Because you’re smart, and I’m right.'”

Source: Tech CNBC

Charlie Munger plays Berkshire's hand in China bet and seeks more opportunities