The biggest hedge funds have been loading up on tech and media names, mostly to good results for an industry that has struggled otherwise to beat the market.

The list of most-owned stocks contains many of the market’s favorites, with 15 of the top 20 with the highest hedge fund ownership being in the technology, media and internet sectors, according to a study that RBC Capital Markets conducted of major funds.

Of the top 20, 16 have posted higher returns than the S&P 500. That comes amid a rare year when the$3.2 trillion hedge fund industry has narrowly outperformed the broad market index. The HFRI Fund Weighted Composite Index rose 0.39 percent through April, compared to a loss of 0.39 percent for the S&P 500 on a total return basis.

It’s the first time since the financial crisis in 2008 that hedge funds have had the edge, however slight.

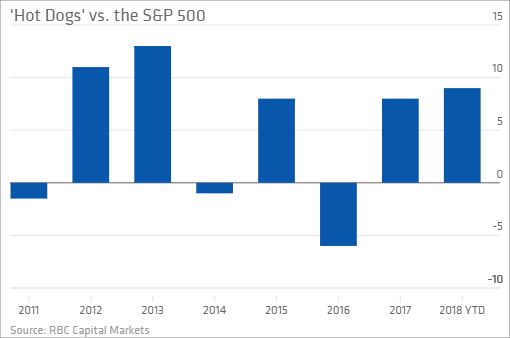

The most-owned stocks comprise what RBC calls its “Hedge Fund Hot Dogs,” or those stocks that have the most hedge fund dollars invested in them. When isolating that group, it has beaten the S&P 500 five of the past eight years.

The screen has seen some changes in 2018 as manager appetite has shifted.

New to the list are Booking Holdings ($6.1 billion in hedge fund dollars, 16th most popular), Electronic Arts ($5.5 billion, 17th), MasterCard ($5.2 billion, 20th) and UnitedHealth Group ($5.2 billion, 19th).

Those no longer in the top 20 are CNBC-parent Comcast, DowDuPont, Charter Communications and PayPal.

One big surprise: Apple remains in the top 20 but tumbled well down the list, from eighth to 18th, with $5.2 billion in hedge fund assets.

The screen focused on 340 of the industry’s more than 9,700 funds.

Here’s the top 10 of the “hot dogs”:

Hedge funds have been using these 'hot dogs' to beat the market this year