SHOULD Europeans worry that China Three Gorges (CTG), a state-owned firm, wants to buy EDP, a utility that is Portugal’s biggest company? It is three years since one local banker, Fernando Ulrich, called Portugal “a Chinese aircraft-carrier in Europe”—back then, Chinese buyers were already snapping up stakes in “strategic” local companies as quickly as the government could privatise them. CTG’s offer of €9.1bn ($10.8bn) for EDP, which was made on May 11th, will further unsettle those suspicious of China’s desire to snap up European assets.

The country is unusually welcoming to investors from the east. Its national airline, TAP Air Portugal, and Redes Energéticas Nacionais, the monopoly power transmitter, both have Chinese investors. CTG is already EDP’s largest owner, with a stake of 23%, after a €2.7bn investment in 2012. Now the Chinese want outright control.

-

Surging numbers of Chinese people going abroad should be welcomed

-

Step inside a gay bar for a “RuPaul’s Drag Race” viewing party

-

Why liberals need to be vulgar

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

The effect on European companies of American sanctions on Iran

To get that, CTG will probably have to raise its offer; EDP’s board rejected the price offered by the Chinese on May 15th. Crucially, however, CTG won Chinese approval in advance, necessary these days given official restrictions on capital flowing abroad. Portugal’s government is also relaxed, calling the Chinese “good investors”. It helps that EDP’s headquarters would remain in Lisbon.

Officials elsewhere may yet object. EDP has electricity or gas operations in 14 countries, including America, where it bought Horizon, a Texan wind-farm company, in 2007. Joint ventures with CTG elsewhere are sizeable. In Brazil the firms together run hydropower stations, and constitute one of the largest private energy producers. EDP makes and distributes electricity in Spain; it operates wind farms in France, Italy and Poland.

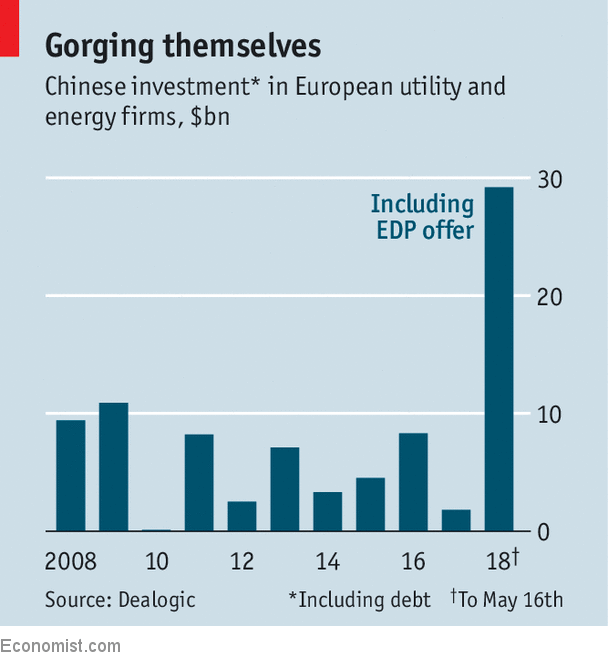

Chinese firms have been investing heavily in energy in Europe (see chart). But governments are getting twitchier about this. France and Germany have started to push for stricter screening of foreign investment, especially in sectors involving sensitive technology. Proposed deals have caused trouble in the past: two years ago another Chinese energy firm, State Grid, failed in a bid for 14% of Eandis, a public distributor of gas and electricity in Flanders, Belgium, after an intelligence service warned of threats of theft and corporate espionage from China. A counter-bid for EDP from a European buyer is possible. But that would be tricky to engineer, given the existing links between the Chinese investor and its Portuguese partner.

CTG also faces hurdles across the Atlantic. In view of EDP’s American operations, the Chinese firm needs approval from America’s powerful Committee on Foreign Investment in the United States. Hoping to pre-empt objections that Chinese ownership of power generation in America threatens national security, CTG has hinted it would consider selling some assets (though it also indicated it would drop its EDP bid rather than give up too much).

Exactly what the Chinese firm hopes to gain with its takeover offer remains to be seen. Getting more access to European technology is one possible benefit. Being able to sell Chinese technology, such as the ultra-high voltage networks in which China specialises, to European buyers might eventually be another goal.

Probably more important for Chinese companies, however, is learning how Europe’s liberalised energy markets work. John Seaman, who studies Chinese investors in Europe’s energy sector for IFRI, a think-tank in Paris, points out that China is reforming its own energy markets, letting its firms compete more in an effort to reduce costs. “In Portugal China is looking for know-how, to drive its own energy transition [and] to learn how to integrate renewables,” he says. That interpretation of events sounds benign. But it may not drown out talk of aircraft-carriers.

Source: economist

Portugal’s energy giant may sell to a Chinese state-owned utility