HOW much should company bosses be paid relative to their employees? It depends who you ask. Plato argued that the richest members of society should earn no more than four times the pay of the poorest. John Pierpont Morgan, a banker from America’s gilded age, reckoned that bosses should earn at most 20 times the pay of their underlings. Investors today hold chief executives in vastly higher esteem. According to new filings submitted to the Securities and Exchange Commission (SEC), America’s largest publicly listed firms (those worth at least $1bn) on average paid their chief executives 130 times more than their typical workers in 2017. The figures are being disclosed by firms in their financial filings for the first time this year.

-

Trade creates losers. Here’s how to help them

-

Who owns an idea?

-

Rafael Nadal is the biggest men’s grand-slam favourite in years

-

Italy’s new government collapses before even getting started

-

Why airliners in Cuba and Iran crash so much

-

How Armenia’s revolution has been different

The SEC’s new requirement to quantify the gap has its origins in the financial crisis. Facing populist outrage over the pay packages of Wall Street executives held responsible for triggering the crash, Congress added a provision to the Dodd-Frank act, a financial-reform law, that required listed firms to report the annual compensation of their chief executives, that of their median employees, and the ratio of the two.

In the five years of rulemaking that followed, corporate behemoths like General Electric, an industrial conglomerate, Johnson & Johnson, a pharma firm, and AT&T, a wireless and pay-TV giant, lobbied hard against the new disclosure rule, arguing that it would be costly for firms to implement and would provide little new information to their investors. Supporters of the reform countered that the disclosures would help shareholders to evaluate CEO compensation. Debate over the rule grew so fierce that the SEC, which was charged with implementing it, received over 287,000 comment letters.

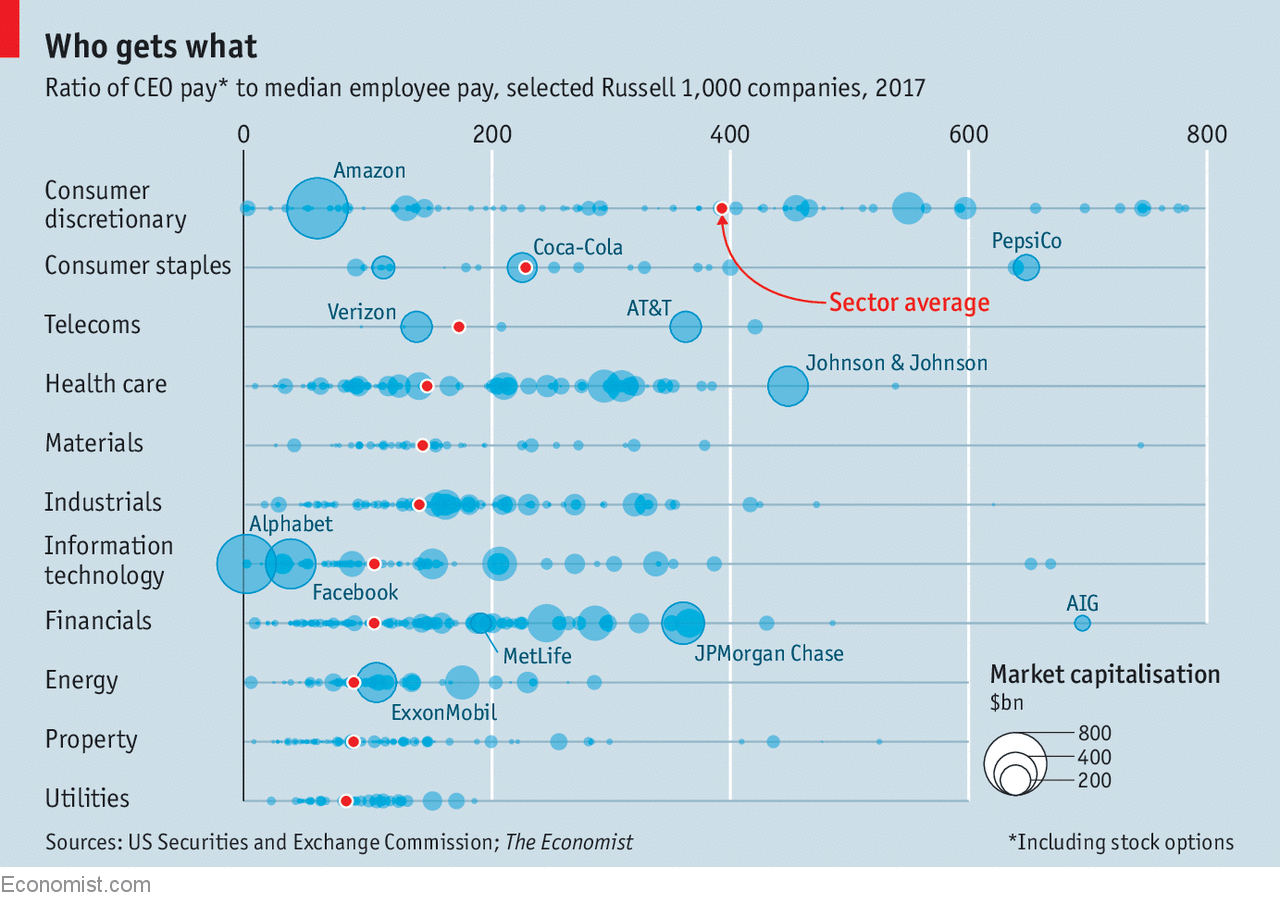

An analysis by The Economist of filings submitted by over 700 large public companies shows that the pay ratios should not be taken at face value. Across the companies in our sample, which paid their chief executives a median salary of $9m and their rank-and-file employees a median of $69,000, ratios are heavily influenced by factors such as company size and industry. Whether a company relies on foreign, part-time or temporary labour can also skew the results. Marathon Petroleum, for example, reported an industry-topping pay ratio of 935:1. As the company pointed out, however, after excluding its retail outlets (which other oil refiners do not have), the figure drops to 156:1. If you control for such factors, much of the remaining variation in pay ratios is driven by levels of chief executive pay alone, a metric which has been disclosed to investors for years.

Interest in the pay ratios among investors has been fairly limited. “We haven’t really seen institutional shareholders take note of this disclosure,” says Steve Seelig of Willis Towers Watson, a consultancy. Yet shareholders can glean some insights from the disclosures, such as comparing ratios for similarly-sized firms in the same industry. The pay ratio of American International Group (AIG), for example, is more than three-and-a-half times as large as that of MetLife, a rival insurance provider. That of PepsiCo, a drinks giant, is nearly three times bigger than that of Coca-Cola (see chart).

And research suggests the information can be valuable to investors. A paper by Ethan Rouen of Harvard Business School finds that large, unexplained disparities in pay tend to be associated with poorer company performance. According to Mr Rouen, pay differences within firms may lead to feelings of resentment among lower-level employees, which may in turn cause some to shirk or to leave. Another paper, by researchers at Rice University, Texas Christian University and the University of Houston, finds that banks with massive ratios of boss-to-worker pay tend to receive fewer votes of support from shareholders on executive-pay packages.

Politicians will certainly find ways to make use of the data. In 2016, in anticipation of this year’s disclosures, lawmakers in Portland, Oregon introduced a 10% business-tax surcharge on firms with pay ratios greater than 100:1 and a 25% surcharge on those with ratios above 250:1. Lawmakers in at least six states, including California, Illinois and Massachusetts have considered policies of this sort, too.

Such laws would, however, be impossible to implement if the pay-ratio rule is scrapped. In October, in response to an executive order from President Donald Trump to review America’s financial regulation, the Treasury called on Congress to do just that, writing that the information is “not material to the reasonable investor for making investment decisions”.

Source: economist

American firms reveal the gulf between bosses’ and workers’ pay