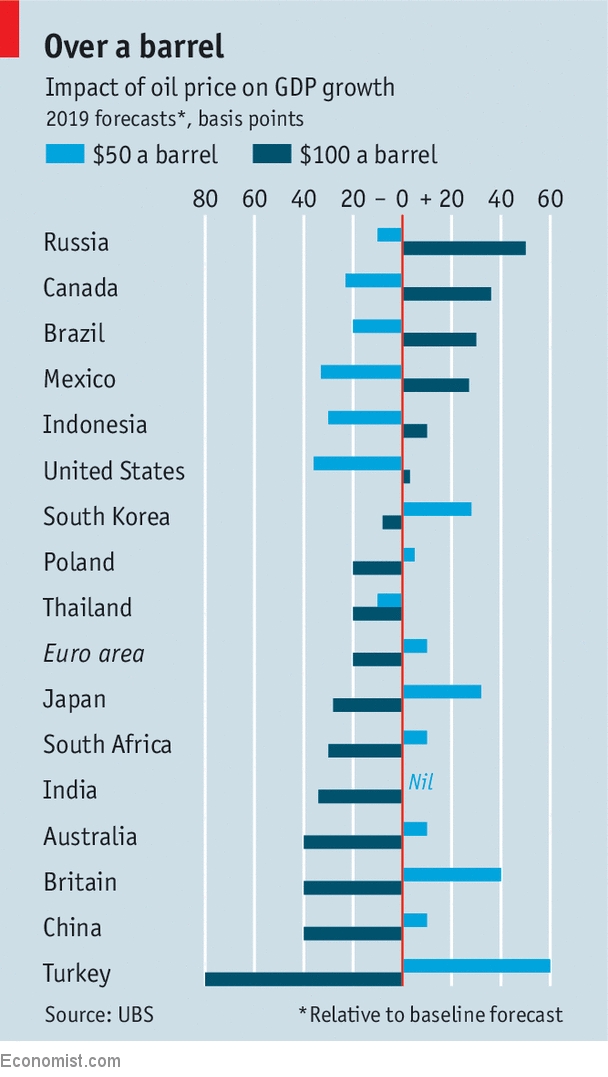

When they are not fretting about the American dollar or Chinese debt, policymakers in emerging economies keep a close eye on the oil market. The price of Brent crude has risen by nearly 50% in the past year to around $80 a barrel. It ranks as the 11th-biggest spike in the past 70 years (adjusted for inflation), according to UBS, a bank. So should emerging markets now worry that oil prices will carry on rising above $100, or that they will tumble below $50? The answer is yes.

-

Donald Trump cancels his meeting with Kim Jong Un

-

Barbados’s mucky election

-

Freedom of speech and religion is not a licence to discriminate

-

Introducing our prediction model for America’s mid-term elections

-

Billions of women are denied the same choice of employment as men

-

Who’s ahead in the mid-term race

Many emerging economies import oil; others export it. As a rule, higher prices hurt the first group and lower ones hurt the second. But it can be more complicated than that. Indonesia, for example, is a net importer of oil, but a net exporter of “energy”, more broadly defined, including coal and palm oil. Since coal, palm and oil prices tend to rise roughly in tandem, Indonesia would benefit overall from $100 oil, according to UBS. Mexico, like America, is also a net importer of crude. But in both countries a higher oil price will help investment and employment in the oil industry by more than it hurts household spending.

The impact of a price change also depends on the price level. A jump from cheap to dear oil works differently than a jump from dear to even dearer. In America, many rigs that are not profitable at $40 become viable at $60 or more. Conversely, most rigs that would be lucrative at $120 are already viable at $100. So an increase in price from $40 to $60 might inspire a lot of additional investment and employment, whereas an increase from $100 to $120 might induce less. Meanwhile, the damage to household wallets increases relentlessly.

As a consequence, the relationship between oil and growth is not straight but curvy. Prices below $50 and above $75 seem to hurt global prospects, according to calculations by Arend Kapteyn of UBS. In between, they appear to help.

Thus if the oil price remains within its recent range, the global economy should suffer few ill effects. But that is a big if. It is perilous to predict whether the oil price will lurch up or down, safer to predict that it will do one of the two.

Source: economist

Dear oil helps some emerging economies and harms others