J.P. Morgan’s chart expert is telling clients to ignore recent market worries, predicting the S&P 500 will rise to new highs.

“Technicals continue to suggest consolidation within a late-cycle rally. Look for new highs in the months ahead,” Jason Hunter, head of global fixed income and US equity technical strategy said in a note to clients Wednesday. “Even if the market folds back into the Apr-May holding pattern and spends more time ranging above critical support in the 2,500s, the 2018 price action still looks like a consolidation within an intact late-cycle bull market.”

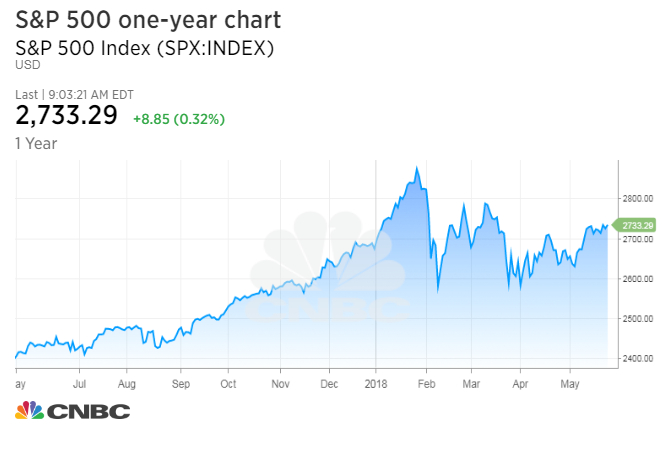

Hunter predicts if the S&P 500 can break through resistance around the 2,800 level, it will then soar to new highs. The market hit its current all-time high on Jan. 26, reaching 2872.87.

The strategist also believes bank stocks will be a key driver for the market’s coming rally.

“We continue to think Financials can lead the S&P 500 Index break to new highs this summer and the relative performance of that sector versus the broad market can recouple with rates over that period,” he said.

The S&P 500 is up 2.2 percent this year through Wednesday, while the Financial Select Sector SPDR Fund, a widely-followed bank stock ETF, is up 0.9 percent.

JP Morgan: Charts show new market highs are coming soon, led by bank stocks