JOHN KENNETH GALBRAITH, a quotable economist, observed that one of the deeper mysteries is why, in a falling market, there is still a buyer for every seller. It is a conundrum that bond investors must now contemplate. Since January the yield on a ten-year Treasury bond has risen (and thus bond prices have fallen) with scarcely a backward step. It is above 3% for the first time in years.

-

Freedom of speech and religion is not a licence to discriminate

-

Billions of women are denied the same choice of employment as men

-

Who’s ahead in the mid-term race

-

“Heavenly Bodies” mixes metaphors at the Met

-

Olga Tokarczuk has finally found major recognition in English

-

Jordan Peterson on modern liberalism

In part, the fall in bond prices reflects a growing acceptance that the Federal Reserve will raise short-term interest rates to 2.75-3% by the end of 2019, as its median rate-setter expects. In part it reflects worries that tax cuts and rising oil prices will fuel higher inflation. And there is anxiety that the supply of Treasuries is about to increase (in order to pay for tax cuts) just as buyers may become scarcer. The Fed itself is running down its holdings. The higher cost of hedging currency risk in dollars is putting off some foreign buyers.

If sellers outgun buyers, prices will continue to fall. Who then will buy? Actually, there is a large class of investors for whom long-dated Treasuries have an almost unique virtue. It may even include people who believe that 3% is far too low for a sensible long-term interest rate. It consists of holders of other, riskier assets, such as stocks, houses or high-yield corporate bonds, who wish to hedge against falling prices in the event of a recession.

There are other ways to insure against a crash than buying bonds. You might buy Japanese utilities—“the most boring stocks in the most defensive currency”, says Robert Buckland, a strategist at Citigroup. For investors willing or able to take a short position (ie, to sell borrowed assets in the hope of falling prices), Andrew Sheets of Morgan Stanley suggests an index of junk-rated property bonds, the price of which may not rise much further in a growing economy but would fall fast in a shrinking one. Still, buying Treasuries is less fiddly for no-nonsense investors. And this insurance policy pays 3% a year.

Yields on government bonds now compare favourably with the paltry dividend yields on stocks or with rental yields on prime city property. But why buy a volatile ten-year (or nine-year) bond with a mere 3% yield? Why not instead buy a two-year Treasury, yielding 2.6%? That is a slightly lower return, but a surer bet. After all, securing good returns with the lowest risk is supposed to be the art of investing.

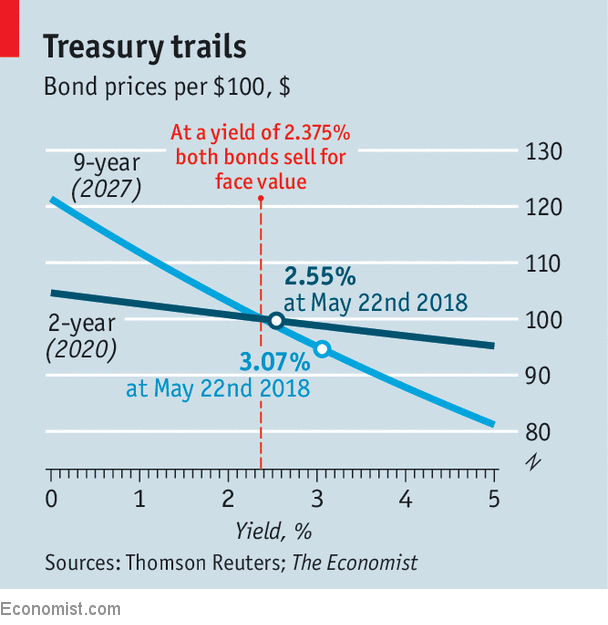

The answer is that long-dated bonds offer the prospect of a bigger capital gain should recession strike. The chart explains why. It shows the relationship between price and yield for a two-year bond and a nine-year bond. The slope of the line—how much price changes as interest rates rise or fall—is much steeper for the nine-year bond. That is because a change in interest rates must be discounted over a longer period than for the two-year bond. The gradients of the two lines are determined by each bond’s “duration”. This is a measure of the bond’s lifespan, which takes into account that some of what is due to bondholders (the annual interest) is paid before the principal is paid back on maturity. The duration for the 2027 bond is 8. So for every one percentage-point change in interest rates, its price changes by 8%.

The two-year bond offers a narrow sort of diversification. A true diversifier pays off when you really need it—when trouble strikes. In bad times the scope for fiscal stimulus in America would be limited by an already large budget deficit. The Fed would cut short-term rates, perhaps to zero. It might start buying bonds again. Investors would rush to the safety of Treasuries. Ten-year yields could plausibly fall to 1% or so. Those who had bought at yields of 3% would secure a 17% capital gain. Not only would that cushion a fall in the price of stocks, it would provide the means to buy them while they are cheap.

In a world without mystery, buyers of bond insurance would wait until prices stopped falling. A few investors may be able to sense the bottom of a market, but it would not be wise to assume you are one of them. If ten-year yields rise by half a percentage-point, it would mean a capital loss of around 4% but the 3% interest would almost offset it. A net loss of 1% is not a terrible price to pay for insurance.

If yields go a lot higher, the losses would be greater, of course. A surge above 4% might well prompt a brutal repricing of stocks, property and other long-duration assets. Bond losses might be tolerable by comparison. Yet there is also good reason to think that a further rise in bond yields will be self-limiting. A debt-ridden world cannot sustain high interest rates for long. Perhaps long-term interest rates will move a lot higher over time. But they will probably fall again first.

Source: economist

Why it makes sense to invest in Treasury bonds