A new research note warns that too many investors are stuck in a losing trade reminiscent of the dot-com era.

The Leuthold Group’s Jim Paulsen is behind the ominous call.

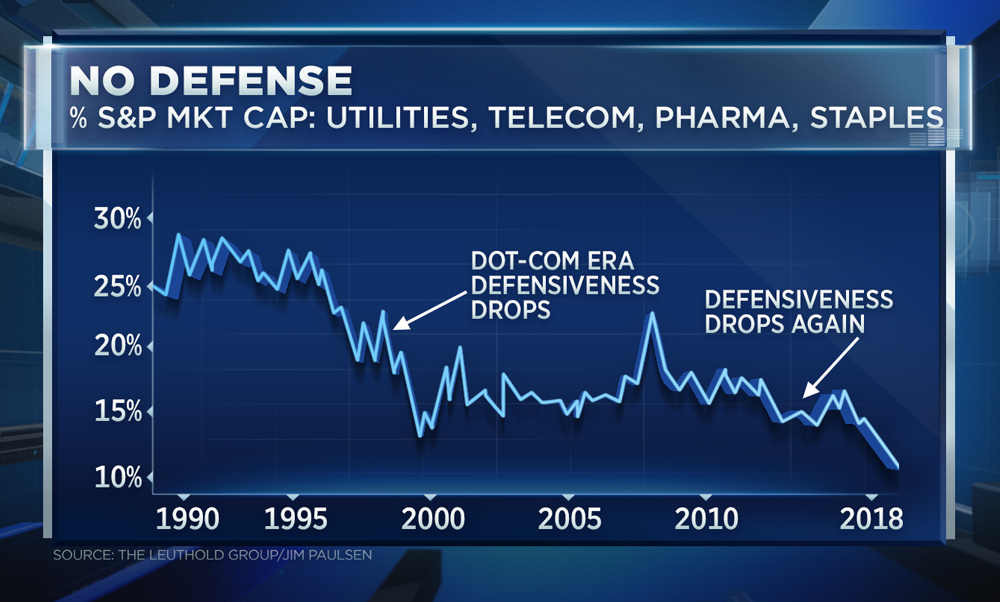

“More and more of the leadership stocks have been the more aggressive, high beta stocks and a lot of the defensive names have been left for dead. They’ve diminished as far as their size of the overall [S&P 500] index,” the firm’s chief investment strategist said Monday on CNBC’s “Trading Nation.”

Paulsen hasn’t seen that phenomenon since the late 1999s when excitement surrounding dot-com stocks hit a fever pitch.

“I don’t think it is nearly as severe as it was back then, but the culture is the same. The character is the same where everyone is going into the same, very narrow number of popular names,” he said. “Really nobody is investing new moneys into the rest of the S&P.”

He included a chart that shows a sharp decline in the number of people investing in S&P 500 defensive names since the bull market began in 2009 — noting that defensiveness is at a record low.

According to Paulsen, many investors are too exposed to trendy areas of the market such as big tech FANG, otherwise known as Facebook, Amazon, Netflix and Google parent Alphabet.

“You wonder if we do hit an air pocket, if we would break below those February lows sometime this year, who do you think is going to sell? It’s probably going to be those popular names because that’s all anyone has recently bought,” he said.

Paulsen, who estimates there’s a 50-50 chance see a 15 percent sell-off this year, is urging investors who are overweight big tech to take some profits.

“Maybe to pat yourself on the back, congratulate yourself for a great investment,” Paulsen said. “Maybe buy a beat-up consumer staple or utility here or pharma stock today that no one is taking a look at, but sells at a much better value.”

A dangerous dot-com era phenomenon is back and it's going to inflict pain, Jim Paulsen warns