THE shipping industry has encountered rough seas over the past decade. Between 1985 and 2007 trade volumes shot up at around twice the rate of global GDP but since 2012 their rate of growth has barely kept pace, leaving the industry with overcapacity. Freight rates for containers have plunged by a third since 2008. Worse may be to come. The industry does not regard as good news President Donald Trump’s announcement on June 15th of tariffs of 25% on up to $50bn of Chinese goods, which will slow trade growth further. Now a veritable hurricane of new environmental laws is about to hit.

-

What does it mean to be Métis?

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why tipping in America is up for debate

-

America’s trade spats are rattling markets

-

Donald Trump signs an executive order to stop family separations

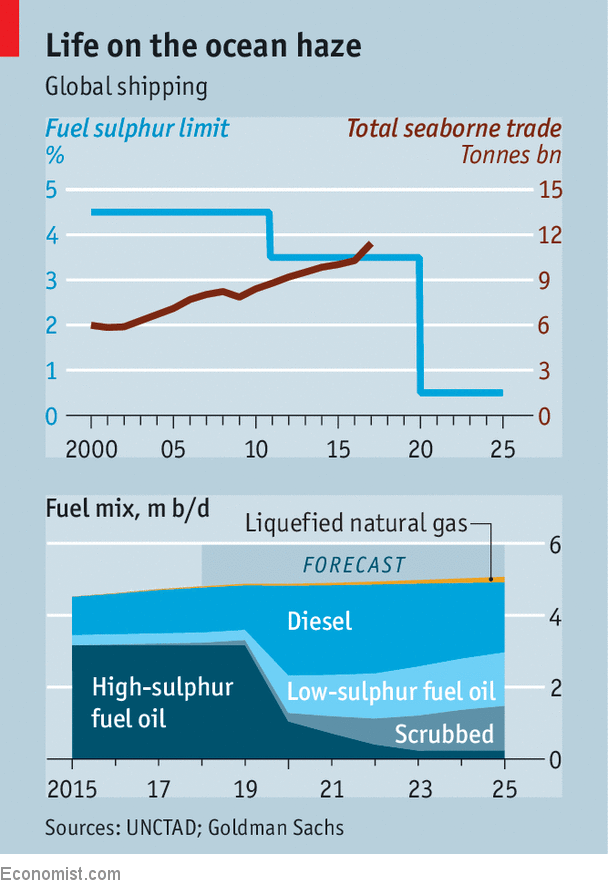

Shipping accounts for only around 2% of global carbon emissions, but is quite dirty. Burning heavy fuel oil, the industry produces 13% of the world’s sulphur emissions and 15% of its nitrogen oxides. And by 2050 ships will be producing 17% of all carbon emissions if left unregulated, according to research by the European Union.

The International Maritime Organisation (IMO), the United Nations agency for shipping, last September brought in rules forcing owners to install equipment by 2024 to clean the dirty ballast water their ships suck in and discharge. That may cost the industry as much as $50bn. In April the IMO agreed to halve the industry’s carbon emissions from 2008 levels by 2050. The biggest worries are new rules that cut the global limit on sulphur content of marine fuel from 3.5% to 0.5% from January 1st 2020 to slash emissions from sulphur, which cause air pollution and acid rain. If everyone complies by buying dearer low-sulphur fuels, the bill could hit $60bn, says Suresh Sivanandam of Wood Mackenzie, a research firm—roughly equivalent to the entire industry’s fuel bill in 2016.

Given that either 2020 or 2025 had been agreed as possible dates for bringing in the sulphur cap, firms have had time to prepare, but have gone into panic mode in recent months. In part this is because 2020 was only recently chosen after a study by Finland found that without it there could be 570,000 more deaths from air pollution worldwide in the five years after 2020. Many firms have belatedly realised the huge sums involved. If they cannot pass them on in higher freight rates, “we’re all going to go bust,” Junichiro Ikeda, boss of Mitsui OSK Lines of Japan, has warned.

Neither are the technological choices in adjusting to the new rules easy, says Stephen Gordon of Clarksons, a shipbroker. Shipowners will have to switch to pricier low-sulphur fuels, invest in “scrubbers” which remove it from the smoke of dirtier fuels, or use greener alternatives such as liquefied natural gas (LNG). Although there are suggestions for how the 50% cut in carbon emissions can be achieved by 2050, such as batteries and hydrogen fuel cells, none has been tried on big ships yet.

For neither goal is it clear which option makes most sense financially. On meeting the sulphur cap, there is no consensus. Maersk, the largest container line, thinks low-sulphur fuel is the best choice, but France’s CMA-CGM has opted for LNG and Mediterranean Shipping Company (MSC) for scrubbers. Shipowners worry that the rules will not be uniformly enforced, says David Vernon of Bernstein, a research firm. They fear being the only buyers of scrubbers and the like in an industry with tight margins, or losing money by picking a bad solution. So the industry is holding fire. Demand for low-sulphur fuel oil and marine diesel is expected to double overnight in 2020, sending prices soaring (see chart).

Eventually more shipowners will invest in scrubbers and LNG. Bigger lines such as Maersk and CMA-CGM, will not find this a problem. But smaller, more indebted shipowners will not be able to raise finance to pay for the conversions, says Basil Karatzas, a shipping consultant in New York. They may have to scrap their ships, which could help address the overcapacity that has crippled industry profits since the financial crisis. “Even this dark cloud has a silver lining,” he says—if only for some.

Source: economist

A wave of new environmental laws is scaring shipowners