MOST startups proudly announce their presence on buildings, billboards and any surface offering visibility. Not Coinbase, a crypto-currency startup. Visitors to its headquarters on a high floor of an office tower in San Francisco find themselves before an unmarked door and doorbell. They are asked to confirm by intercom which firm they intend to see. An online search for Coinbase shows its offices at a different location, a diversion tactic to keep away disgruntled crypto-currency investors, thieves who are trying to get access to crypto-assets, and other malefactors.

Such inconspicuousness contrasts with the company’s high profile. Coinbase is one of Silicon Valley’s fastest-growing young firms and by far the most prominent business to emerge from the mania around crypto-currencies. The six-year-old startup, an online brokerage for buying and selling bitcoin and other crypto-currencies, claimed a valuation of $1.6bn when it raised $100m from venture capitalists last year. It reportedly now has a valuation of around $8bn. It claims to have around 20m user accounts, perhaps half of all crypto-currency exchange accounts held globally, and stores assets worth $20bn. As well as catering to retail investors, it manages an exchange for professional ones trading large volumes of crypto-currency. Rumours swirl that Facebook, a social-networking giant, is interested in buying it.

-

Bullshit jobs and the yoke of managerial feudalism

-

Madeleine Albright on fascism

-

The Trump administration wants to expand immigrant family detention

-

How smog affects spending in China

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

As the price of crypto-currencies rocketed last year, with bitcoin notching up a sixteen-fold increase, Coinbase achieved revenues in 2017 of around $1bn. “We’re selling picks and shovels in a gold rush,” says Brian Armstrong, its boss. Coinbase charges a fee on every transaction, much like Charles Schwab does when people purchase stocks. The question now is whether Coinbase can be a star performer if, as has been the case recently, crypto-currencies perform poorly. (Bitcoin, for example, had fallen by 55% between the start of the year and June 27th.)

Crypto-currencies are “everything you don’t understand about money combined with everything you don’t understand about computers”, in the words of John Oliver, a comedian. Such opacity has presented an opportunity for Coinbase, which has both an easy-to-use mobile app and a law-abiding reputation. In contrast to other startups such as Airbnb, a room-sharing app, and Uber, a ride-hailing firm, both of which launched in new markets without first seeking government approval, Coinbase was careful to first secure licences in American states where it planned to operate. This has probably hampered its growth but helped it to avoid controversy.

Mr Armstrong became an advocate for crypto-currencies after seeing the difficulties of moving conventional money around the world. While studying at Rice University in Houston, he co-founded an online marketplace for tutoring, called UniversityTutor.com, which grappled with how to pay tutors worldwide in various currencies. He later worked at Airbnb and then attended Y Combinator, a startup school, before setting up Coinbase with Fred Ehrsam, once of Goldman Sachs.

Both founders contradict the stereotype of crypto-enthusiasts as wild, lawless iconoclasts. On June 27th Mr Armstrong launched GiveCrypto.org, a philanthropic effort to encourage people who have made fortunes in crypto-currency to give some away; he pledged $1m of his own money. Yet Coinbase’s digital fortunes are not immune to volatility. Mr Armstrong declines to comment on how recent falls in the value of crypto-currencies have affected Coinbase’s sales, but acknowledges that “in up markets people tend to trade more”.

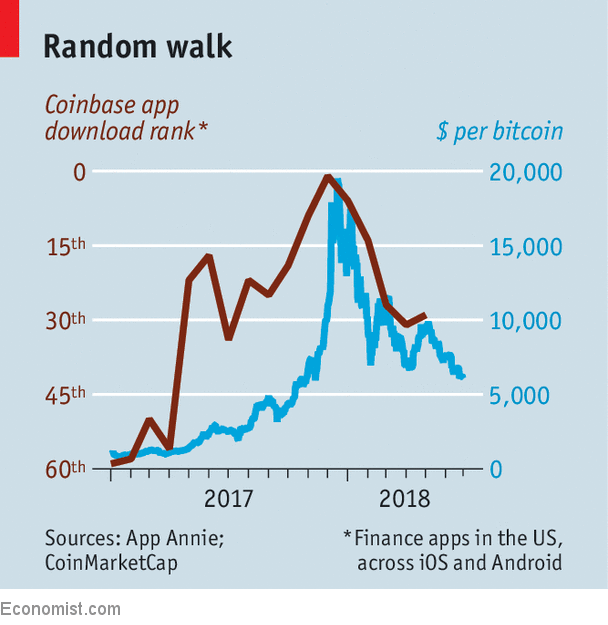

Since bitcoin’s peak in December Coinbase has fallen from America’s most-downloaded finance app to the 29th-most popular, according to AppAnnie, a research firm (see chart). To insulate itself from price swings, Coinbase is diversifying beyond the brokerage business. It has added an asset-management division, custody and other business lines, and is buying other crypto-startups. Trying to expand quickly is never easy, however. Last year Coinbase struggled to accommodate a spike in demand for new accounts.

According to people close to the firm, Coinbase wants to go public as soon as next year. But, in addition to crypto-currency volatility, three potential threats to its plans loom. The first is regulation. America has adopted a hands-off attitude towards crypto-currencies; it is the largest market not to have big restrictions on trading them. China, India, Japan and South Korea have all imposed rules that make trading crypto-currencies difficult, costly or illegal. Any change could be disastrous for Coinbase. A change to America’s currently generous tax treatment could also reduce crypto’s allure as an investment.

A second threat is competition. Coinbase has shown that there is lots of appetite for investing in crypto-currencies, and banks are now eyeing the market. Robinhood, an online brokerage that has won customers by selling shares without charging a commission, now offers crypto-currencies. Just as stock-trading fees have collapsed over time, transaction fees in crypto-currencies are likely to tumble, putting pressure on Coinbase’s margins.

Security is the third and most acute risk. In January armed robbers targeted a crypto-currency exchange in Canada; there have been many instances of individual investors’ bitcoin being stolen by hackers and thieves. A similar incident could devastate Coinbase’s business, since most of the $20bn of crypto-assets it stores are uninsured. Executives and the board are aware of the risks. “As a bank chief executive you can authorise a big wire transfer in a robbery, and then undo it the next day. Digital currencies are like handing over a suitcase of cash. You can’t get it back,” says Balaji Srinivasan, Coinbase’s chief technology officer. The doors of the office remain unmarked for a reason.

Source: economist

A disciplined startup emerges from the Wild West of crypto-currency