ECONOMISTS think prices, like spilt ketchup, are sticky. They move only slowly as firms digest economic conditions. Financial markets are an exception. Computerised trading by thousands of participants means prices, especially of currencies, can move in a McFlurry.

Since The Economist last updated the Big Mac index (BMI), our lighthearted guide to currency valuation, burger prices have remained constant in 19 of 44 countries. But every currency has shifted in value (see chart 1). Our index uses a nugget of economic wisdom called purchasing-power parity: currencies should adjust until goods cost the same everywhere. If, once converted into dollars, Big Mac prices vary, one or other currency looks dear. Big movements in exchange rates, without similarly supersized shifts in burger prices, can send a currency up or down the index.

-

Trans-inclusive feminist voices are being ignored

-

A British traveller’s travelogue

-

There are fundamental differences between gay and trans identities

-

The robots coming for your job

-

Courts slap down the Trump administration’s immigration policies

-

Are today’s young football stars worse than those before them?

That explains why the Argentine peso has been the biggest mover since January. Then, it looked 25% undervalued compared with the dollar; today, that has swelled to 51%. The peso tumbled on fears of a debt crisis and inflation. For similar reasons, two other emerging-market currencies, the Turkish lira and Brazilian real, are also big movers. Only the valuation of Norway’s krone has moved much on account of purchasing power. A 14% fall in the dollar price of a Norwegian Big Mac has taken the krone from looking 18% overvalued in January to 5% undervalued now. This shift should be taken with a pinch of salt, however; burgers may be getting cheaper, but overall Norwegian inflation is a bland 2.6%.

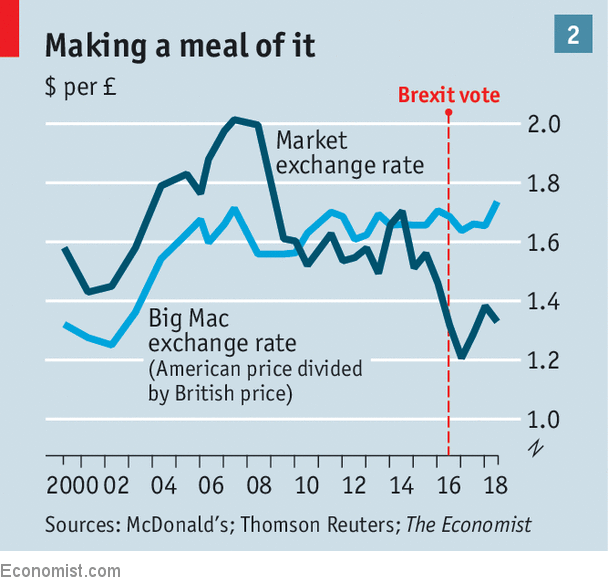

Sometimes, currency traders foresee long-term changes that have yet to move domestic prices. That may be true in Britain, where the pound has been particularly cheap since the Brexit vote in 2016 (see chart 2). It now looks 23% undervalued. At other times, currencies deviate from fundamentals because of temporary disparities in risks and short-term interest rates. America’s economy is sizzling and the Federal Reserve is raising rates, but growth has flattened off elsewhere. That has made the dollar as strong as a bull. Almost every currency in the index has weakened relative to the greenback since January. Only two, the Swiss franc and the Swedish krona, now look overvalued against it.

One beef with the BMI is that burgers cannot easily be traded across borders. Neither can some inputs to production, such as land and labour. To take account of this, we also produce another version of the index, which adjusts Big Mac prices for GDP per person. You can binge on both at economist.com/bigmac.

Source: economist

Investors are gorging on American assets