MERGERS of euro-area banks from different countries, a banker jokes, are “very much like teenage sex. There’s a lot of talk, but little action. And when it does happen, there’s a lot of disappointment.” In recent months gossip has linked each of France’s three biggest banks (BNP Paribas, Crédit Agricole and Société Générale), as well as UniCredit, Italy’s largest, with Commerzbank, Germany’s second-biggest listed bank. Lately chatter has connected UniCredit and Société Générale. But no big, cross-border takeover is imminent.

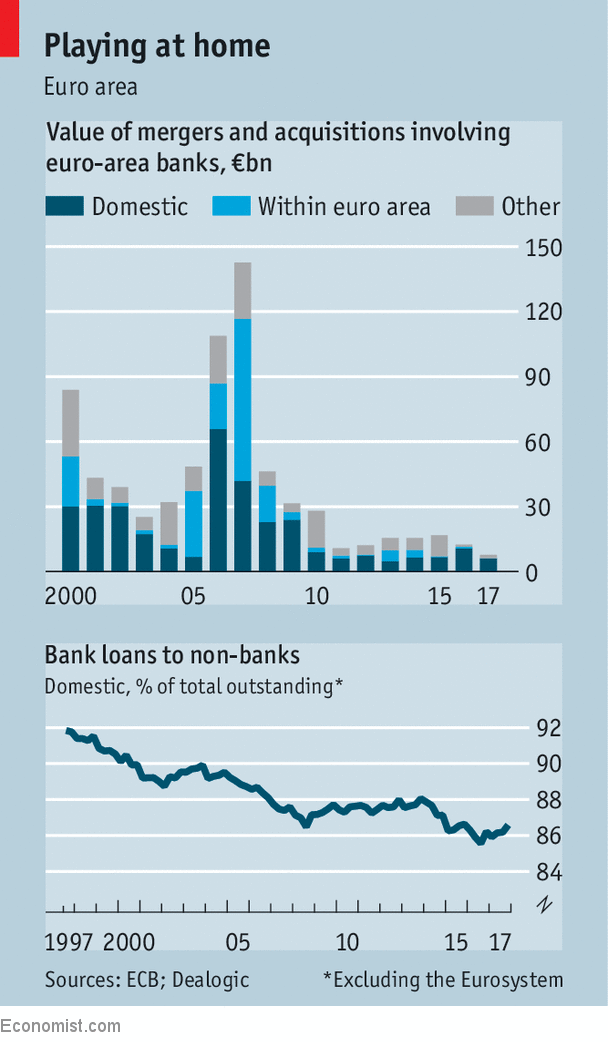

A stream of deals in the 2000s—notably UniCredit’s purchase of HypoVereinsbank, another leading German lender, in 2005—has slowed to a trickle (see chart, top panel). Policymakers at both the European Commission and the European Central Bank (ECB) would like the flow to revive. The euro area’s banking markets are still essentially national ones. “European banking remains as fragmented today as it was in 2012,” notes Magdalena Stoklosa of Morgan Stanley. Domestic lending still accounts for seven-eighths of the total (see lower panel). Three-fifths of banks’ holdings of corporate and government bonds are from their home countries.

-

Imagining the “Trump in Europe” opera

-

Why Binyamin Netanyahu is fudging east European history

-

France’s victorious footballers do Emmanuel Macron a favour

-

Some gender-critical voices are not being heard as they should

-

What sovereignty means for America’s Indian tribes

-

France wins the World Cup, beating Croatia 4-2

Policymakers believe that pan-zonal banks would be more resilient because the fates of lenders and national governments would be less tightly intertwined in a “doom loop”. In Spain’s property and banking crisis in 2008, an official points out, internationally diversified Santander and BBVA fared far better than purely domestic lenders. Cross-border mergers would bring scale without harming competition within national borders. They would deepen the zone’s capital markets. And bigger euro-area banks would be better placed to take on Wall Street’s big five, which have come to dominate European investment-banking league tables. Just one European bank is in the world’s top ten by market capitalisation: Britain’s HSBC, which does half its business in Asia.

To the banks, the chief appeal of a merger is scale, as fixed costs are reduced and spread across greater output. But as Jernej Omahen of Goldman Sachs notes, “banking is fully scalable, as long as it is within a single jurisdiction”. When banks cross borders, “complexity increases quite sharply”, offsetting the benefits of greater scale.

Bankers say regulators need to do more of the groundwork first, by completing Europe’s banking union—a single market, with a single set of rules. It is still only part-built. The euro zone has a single supervisor, the ECB, watching over its most important banks, and a single resolution board, to deal with failing banks. But it still lacks a common scheme for insuring deposits, which would in effect allow, say, German savings to be used to finance Italian loans, and is unlikely to have one soon. “Removing that obstacle would significantly change the equation,” says Nicolas Véron, of the Peterson Institute for International Economics in Washington, DC, and Bruegel, a think-tank in Brussels. Mr Véron says that the “real bottleneck” is banks’ concentrated exposure to their home governments’ bonds. The euro zone lacks a common safe asset to break this doom loop.

In fact, not even supervision and resolution are truly unified. Danièle Nouy, the head of the ECB’s supervisory arm, has complained that European rules allow dozens of national exemptions from common standards. For example, 11 countries (including Germany) have reserved the right to set their own rules for large exposures to single borrowers. Variations in national bankruptcy laws mean that different procedures can apply when winding up stricken banks in different countries.

In addition, “globally significant” banks, of which the euro area has seven (of the world’s 30), face extra capital requirements under international rules. Mergers, by making them bigger, may mean higher surcharges. The same rules treat the euro zone’s 19 members as separate jurisdictions, not as a single one, which raises the minimum requirements for big cross-border banks (though probably not by enough to halt a merger of healthy lenders). European finance ministers would like those rules to be amended.

Yet even if all the regulatory obstacles were magicked away, banks might not hurry to hook up. In domestic mergers, costs can be cut by closing neighbouring branches and slimming down duplicated product lines. In recent retail-banking takeovers in Italy and Spain, Ms Stoklosa says, buyers have identified savings of 20-30% of the target institutions’ costs. It is much harder to find such savings when branch networks do not overlap and differences in products, accounting systems and languages cannot be avoided.

Friends, no benefits

Stuart Graham of Autonomous Research argues that the need to upgrade banks’ old, cumbersome computing systems is another barrier. “The last thing you want to do is to redeploy your scarce tech people from developing whizzy apps for customers to sort out different lots of legacy spaghetti,” he says. And banks in some countries are still weighed down by bad loans of uncertain quality, making them hard to value as acquisition targets.

Domestic consolidation, moreover, is far from finished. Deutsche Bank may be a likelier partner for Commerzbank than any foreigner is for either. Germany has 1,600 banks, most of them small publicly owned or co-operative lenders. Despite a wave of mergers since the crisis, Spain still has some whittling to do. So does Italy.

Meanwhile banks are making inroads into foreign territory without making big purchases. Organic growth, or smaller deals, look more attractive for now. ING, of the Netherlands, has become the third-biggest retail bank in Germany (by number of customers) by building on a digital bank it bought in 1998, and has set up online operations in Spain and elsewhere. BNP Paribas is nabbing corporate clients in Germany without yet seeing a need to buy Commerzbank. Société Générale recently agreed to acquire Commerzbank’s equity-markets and commodities unit for an undisclosed sum.

For all that, one deal could spark another. “Banks are herd animals,” Mr Graham says. If two banks join forces, others may respond (much gossip is rooted in models of such defensive mergers). But the lack of a single market is a big obstacle. Until it is cleared away, Europe’s great banking merger wave will be slow to get going.

Source: economist

Why the euro zone hasn’t seen more cross-border bank mergers