Effective Obligation, Retired & Pros

- Effective Responsibility members of the new Military, Marine Corps, Navy, Air Force, Coast guard, National Protect and Area Force

- Delay Entryway Program (DEP)

- DoD Manager Applicant/ROTC

- DoD Reservists

- Pros, retired people and you may annuitants

Members of the family

The ultimate way to join the credit relationship is to stroll to your a part with a valid style of ID (license, passport, etc). Its not necessary your personal loans with good credit family member’s DD-214 or army ID. You just need their identity and you can department off solution.

Really old-fashioned mortgage loans wanted no less than 5% down (20% to avoid paying personal mortgage insurance rates) and therefore I shall consider just like the PMI throughout this informative article.

What exactly is PMI?

PMI are insurance rates one to protects the borrowed funds lender (or lender) when your consumer (you) defaults. So if you eradicate your work and can’t manage to pay the loan repayments, in addition to home is foreclosed for the, the lending company does not sustain an enormous loss as if you manage.

If you can’t afford to establish at the least 20% towards financial, you are going to need to spend individual financial insurance rates, which will be added to your month-to-month mortgage payment if you do not started to you to 20% guarantee of your house.

PMI rates are derived from multiple facts in addition to credit rating, therefore no a few funds can be compared and there’s no mediocre money fee each financing.

Navy Government Borrowing Union’s Homeowners Solutions home loan even offers that loan having no downpayment without PMI! This is exactly Huge as an FHA loan (and this needs 3.5% down) keeps astronomical PMI.

To deliver a sense of how much money this might help save you, my husband and i purchased the basic family along with her from inside the Georgia getting $160,100. Of our own $1300/month homeloan payment (costs were higher at that time), $180 monthly would PMI.

But there’s a capture! You pay a funding fee (just like charge for USDA and Virtual assistant funds).

Put another way, which payment is similar to PMI, however spend they initial at the time of money the brand new financing. Which fee becomes necessary to possess Va loans and you will USDA fund (which happen to be including zero down mortgage programs).

Closing costs getting Homebuyers Options Mortgage

Navy Government lenders were very easy to speak to over the cell phone. We entitled on 3 some other occasions to inquire about questions relating to the fresh new program, in addition they was basically really educational.

The fresh settlement costs will be reduced of the client, however, what is actually extremely is the fact that merchant is also lead up to 6% for the closing costs with this financial.

It means if you are to buy good $250,100 domestic, the seller you certainly will (in the event the discussed on your part along with your Real estate professional) spend in order to $fifteen,000 to your closing costs and you may not need to emerge from pouch things during the closure table!

Navy Federal Borrowing from the bank Connection Financial Credit history Criteria

There are several things I did not get a definite answer towards. Credit rating criteria try among those. Navy Government yourself underwrites every one of their mortgage loans.

This means it has a faithful party from underwriters to look more multiple compensating items, such work history, settlement, obligations so you’re able to income proportion, credit score, and cash supplies designed for issues.

Considering BankRate, Navy Government demands an excellent 620 credit history so you’re able to qualify for an effective home loan, however, once more…those compensating situations matter.

Navy Government Homeowners Selection DTI Standards

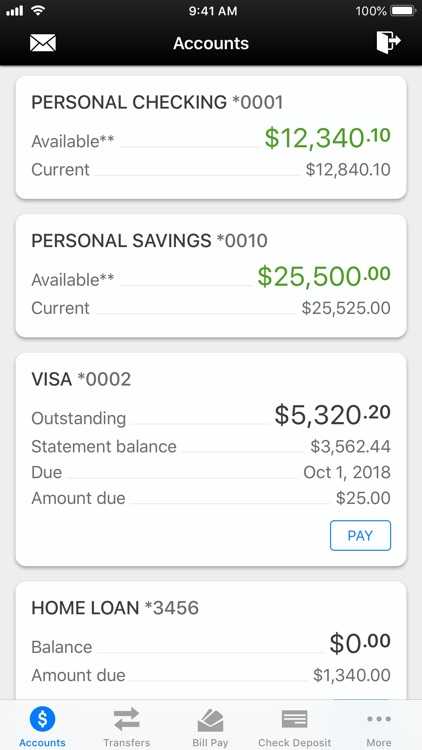

Since the my spouce and i paid back $63,one hundred thousand with debt this past year, the debt to help you earnings ratio is really lowest, but We would not rating a definite address out-of Navy Federal on this.

What is Financial obligation to Income? And ways to Estimate It?

Your debt so you’re able to money is literally personal debt separated from the earnings. So if you provides a car or truck commission away from $450 and a home loan regarding $1200, you might add those two payments together $1200 + $450 = $1650. Then divide you to matter by your gross monthly earnings.

Which have a complete DTI out-of below 46% total is the best, and there was houses DTI requirements as well. Again…I did not get a clear address with this as the for every single financing and you may borrower’s items are different.

Navy Federal Homebuyers Options Ratings

We scoured the web once i very first been aware of which financial to try to select critiques and you can other than a number of Reddit listings, I would not look for much. My spouce and i are currently preapproved having a homeowners Choice financial, and I will improve this information whenever we receive property and you may finalized.

Summation Navy Federal’s No money Down Mortgage was Legitimate

This article is maybe not sponsored in any way because of the Navy Government. I simply moved to the fresh new Fl panhandle, a largely armed forces area, and on browse, I do believe this become one of the best financing applications available.

Because the a former Realtor and you will banker, I comprehend the worth in the saving cash on closure table (especially if you are searching to help keep your crisis loans coupons unchanged and not sink it in order to become a resident).

How to Register Navy Federal Credit Union On line?

We have complete all the stuff! Lady, You will find clean my personal face. I have thrown out exactly what doesn’t ignite delight. We have wandered the infant steps. I have cried. I’ve prayed, but my perfectionism provides very held myself straight back.

Perfection Dangle over would be devastating. Avoid evaluating yourself to other people and begin way of life your very best lives! This is exactly why PH can be acquired! I wish to encourage one manage your money, your website, and your organization.