More traditional money managers are worried about bitcoin than ever before.

The soaring digital currency topped the list of “most crowded trades” — a measure of sentiment on which popular investment could quickly reverse its gains— in Bank of America Merrill Lynch’s December global fund manager survey released Tuesday.

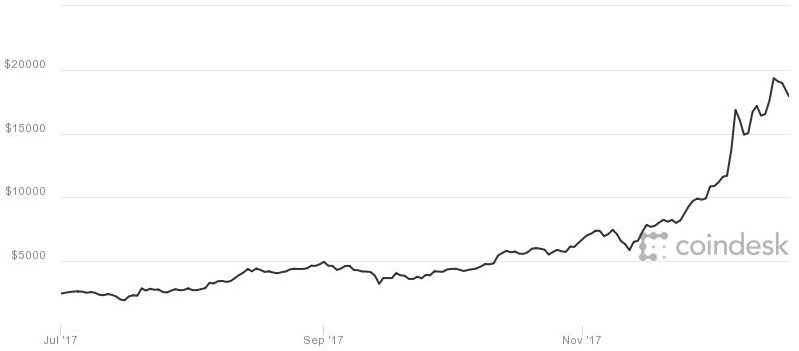

The survey found that 32 percent of respondents named bitcoin as the most crowded trade in the financial world, up from 26 percent in September when the digital currency first led the list. At the time, bitcoin had surged about 375 percent for the year to $4,600.

But clearly that was not the top, despite a rocky September for bitcoin in which the digital currency briefly plunged more than $2,000 as China cracked down on cryptocurrencies and J.P. Morgan Chase CEO Jamie Dimon called bitcoin a “fraud” that “won’t end well.”

December’s “most crowded trades”

Source: BofAML

Bitcoin has roughly quadrupled since September to briefly trade above $19,000 in the last week. Fueling part of the rally was the launch of bitcoin futures on the CME, the world’s largest futures exchange, and its competitor Cboe’s Futures Exchange.

The BofAML survey, conducted from Dec. 8 to 14, covered 172 global fund managers with a total $480 billion in assets under management. It’s widely considered one of the best surveys of investors conducted on Wall Street.

Another crowded trade is betting on the stocks of U.S. and Chinese technology giants, 29 percent of respondents said.

“FAANG,” or Facebook, Amazon.com, Apple, Netflix and Google’s parent Alphabet are each up nearly 37 percent to 60 percent this year, versus the S&P 500‘s 20 percent gain. Chinese e-commerce conglomerate Alibaba has soared 97 percent, search engine Baidu has climbed nearly 47 percent and Hong Kong-listed tech and gaming giant Tencent has leaped more than 110 percent.

The term “FAANG” came about in reference to a handful of high-flying stocks in which much of the market’s gains were concentrated. The surge of the Chinese conglomerates has earned them the nickname “BAT.”

Bitcoin performance (July to December)

Source: CoinDesk

Technology stocks overall are the best performers in the S&P this year with gains of nearly 40 percent.

However, investors are not overexuberant about the gains. The BofAML survey found that allocation to tech stocks in December fell to the long-term average of 24 percent overweight.

Overall levels of cash holdings among the fund managers rose to 4.7 percent, slightly above the 10-year average of 4.5 percent and back into the territory signaling “buy,” BofAML said.

Global money managers also called out short volatility, or betting on calm markets, as a crowded trade. Noted investors such as DoubleLine CEO Jeffery Gundlach have said for months that a “massive amount of money” is short volatility indexes, and the extended period of subdued market performance should soon result in a sharp increase in volatility.

Source: Investment Cnbc

Bitcoin is the 'most crowded' investment in the world, according to widely followed investor survey