It’s a bird, it’s a plane … nope, it’s Twitter!

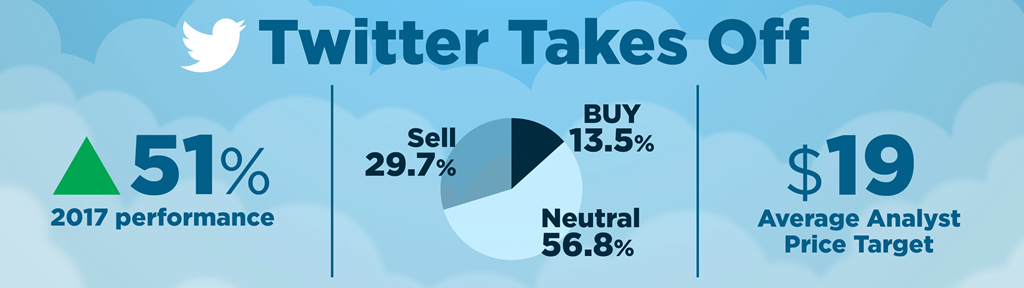

Shares of Twitter have surged more than 50 percent this year, getting a boost this week on the heels of an upgrade from J.P. Morgan. Despite the move, one technician warns the stock may have flown too high, too fast.

“You can see for the last two years the stock has done absolutely nothing and you’re back up into this critical resistance up and around $25,” Rich Ross of Evercore ISI said Monday on the “Trading Nation” segment of CNBC’s “Power Lunch.” “We failed last year at this point and shaved off about 50 percent of value.”

A longer-term chart of Twitter also shows some bearish technical signals that have Ross saying he would avoid buying the stock at this time.

“If you did take out that multiyear downtrend and the neckline of that double bottom base around that big figure around $25, then the stock sets up as a trade and buy,” he explained. “But I’m not buying it here into resistance. I’m going to wait for the break and buy it on a breakout.”

Wall Street analysts tend to be skeptical of the social media giant as well. Of the 36 who cover the stock, only about 14 percent have a buy rating, with the vast majority, 57 percent, putting the stock at a neutral rating, per FactSet.

Furthermore, the average price target among analysts for Twitter stands at around $19, while the stock traded just under $25 on Tuesday, implying that the Street sees more downside.

Kevin Caron, a portfolio manager at Washington Crossing Advisors, believes that the tech sector as a whole could still have more room to run. However, he does warn that the sector could be facing slightly more volatile times going forward.

“Tech is a sentiment play, and we’ve seen strong sentiment lately,” he said on “Power Lunch.” “It’s hard to imagine that extrapolating out forever, so we have to be a little careful here, and that’s why we’re neutral on the group.”

Shares of Twitter were trading at around $24.85 Tuesday morning.

Investors are flocking to Twitter, but the charts show that trouble is ahead