While cryptocurrency trading has the trappings of established financial markets, Coinbase’s attempt to open trading in a new digital currency on Tuesday shows the industry is still experiencing growing pains.

“It’s the wild west,” said Mike Novogratz, a noted hedge fund manager who is launching a cryptocurrency fund through his firm Galaxy Investment Partners. “It still is, but regulation is coming. If I was a regulator I would be running not walking. There’s too much money in this.”

San Francisco-based Coinbase is valued at $1.6 billion as the leading U.S.-based platform for buying and selling major digital currencies and also operates a GDAX exchange for professional investors. As a result, news or rumors the company would open trading in a new coin can move markets.

“You have a very thin market with a lot of investor demand and that’s pushing prices up,” said Brian Kelly, a CNBC contributor and head of BKCM, which runs a digital assets strategy for clients. “Coinbase is viewed as the New York Stock Exchange of cryptocurrencies.”

But the digital currency exchanges are dealing with far newer markets and less developed infrastructure.

Bitcoin cash, an offshoot of the wildly popular bitcoin, climbed Tuesday afternoon and soared further above $3,000 after Coinbase announced around 7 p.m., ET, it was beginning trading in the cryptocurrency. The news surprised many in the market since Coinbase said in August it wouldn’t allow withdrawals of bitcoin cash until January 1, 2018.

“This is the difference between a tech company and a financial services company. A bank or broker would never surprise customers or the market with a change of plans like this,” said DataTrek Research co-founder Nick Colas, a market strategist who began writing about bitcoin several years ago.

“Coinbase was very clear on their old FAQ. January 1st. Only sales. That was a good plan,” Colas said in an email. “And then they changed it on the fly. Why? They should answer that.”

The short notice didn’t allow enough interest from buyers and sellers to build before trading in bitcoin cash launched on GDAX at 7:20 p.m., ET on Tuesday.

Just four minutes later, trading was suspended as a lack of sellers caused high volatility, according to a company representative. Many tweets showed Coinbase charts temporarily indicated bitcoin cash was trading well above $8,000.

Few, if any trades, were cleared at the higher price, the company representative said.

Trading resumed on GDAX around 2 p.m., ET, Wednesday. Bitcoin cash traded about 40 percent higher, near $4,013 as of 5:21 p.m., ET, according to Coinbase. Bitcoin itself traded 8.5 percent lower near $15,983 on Coinbase.

Bitcoin cash split off from the original bitcoin on August 1 after a minority of developers decided to implement an upgrade proposal to improve transactions speeds and costs. Investors in bitcoin at the time of the split should have received equal amounts of bitcoin cash, the funds that Coinbase did not make available until Tuesday.

Coinbase CEO Brian Armstrong also said in a Wednesday blog post that the company was investigating potential violation of a policy prohibiting employees from trading on knowledge of forthcoming Coinbase announcements.

“Bitcoin Cash isn’t a security, so much of the regulation of the equity world simply doesn’t apply,” said Ari Paul, chief investment officer at cryptocurrency investment firm BlockTower Capital.

“I expect more stringent regulation to come to cryptocurrency exchanges and brokers, but market manipulation and insider trading remains rampant in traditional commodity and currency markets – the main difference is just the volatility it produces due to the relatively smaller size of cryptocurrency markets and their lack of liquidity.”

Coinbase said late Wednesday afternoon ET that it was allowing bitcoin cash buys and sells, although the service was paused as of publication. The U.S. Securities and Exchange Commission did not respond to a CNBC request for comment.

ICE, the owner of the New York Stock Exchange, and an investor in Coinbase, didn’t have a comment. Another investor, Andreessen Horowitz, also had no comment because its offices were closed for the holidays.

Brian Patrick Eha, author of How Money Got Free: Bitcoin and the Fight for the Future of Finance, pointed out that Coinbase’s customer support website still said that it would “notify all customers with an update e-mail” about bitcoin cash withdrawals.

“The rollout was clearly botched,” Eha said. “Worse, Coinbase sprung it on users with no advance warning.”

Coinbase has struggled to keep up with surging demand. Its users grew from less than 5 million last fall to more than 13 million at the end of this November, according to publicly available data. On several occasions, customers have been unable to buy or sell due to record high traffic.

Its GDAX exchange also saw a “flash crash” in late June, when digital currency ethereum plunged from above $300 to 10 cents, before recovering.

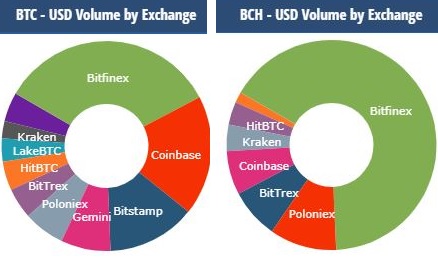

Source: CryptoCompare

Major digital currency exchanges also remain vulnerable to hackers. Morgan Stanley analysts estimated in a Monday report that more than $630 million in bitcoin has been stolen from exchanges by hackers.

“I think consumers should recognize every cryptocurrency exchange on this planet is a startup company, and when you work with a startup, you should do your homework,” said Ryan Gilbert, partner at Propel VC, which focuses on financial technology and has a $250 million fund. Propel is indirectly a minority investor in Coinbase, Gilbert said.

“I think they’re lacking when it comes to the speed of withdrawal of funds and speed of deposit of funds,” Gilbert said. “That’s where these exchanges are lagging the traditional players on Wall Street.”

Many already consider Coinbase one of the more transparent and developed digital currency exchanges. It is one of four to hold a BitLicense issued by the New York State Department of Financial Services for operating in the state.

“Through the virtual currency regulation, DFS is continuing its record of responsibly encouraging innovation while implementing necessary safeguards to protect consumers and markets,” the department said in a statement to CNBC.

But the cryptocurrency exchange is one of the biggest businesses in the industry that’s emerged around digital currencies. Overstock.com’s subsidiary tZero has announced its launching a platform for trading digital coins and the stock of the e-commerce company has soared nearly 300 percent this year. Japanese cryptocurrency exchange bitFlyer has grown so much it expanded to the U.S. at the end of November.

Some are trying other exchange models that don’t require the company to hold funds, making firms less susceptible to hacks. Colorado-based Radar Relay, which bills itself as a “bulletin board” for peer-to-peer token exchange, announced Tuesday it raised $3 million in a seed funding round. Daily trading volume has topped $300,000 in just a few months and the platform, still in beta stage, has tens of thousands of users.

“Sitting at the end of 2017,” Gilbert said of the exchanges, “we’re still at the very, very beginning.”

Source: Tech CNBC

Cryptocurrencies still a 'wild west' after exchange's rocky rollout of trading in new coin