Japan‘s bitcoin craze could help the country’s economic growth, research analysts at Nomura Instinet said.

“We estimate the wealth effect from unrealized gains on Bitcoin trading by Japanese investors since the start of [2017], and estimate a potential boost to consumer spending of ¥23.2 billion to ¥96.0 billion” ($206.7 million to $855.4 million), Japan economics research analysts Yoshiyuki Suimon and Kazuki Miyamoto said in a Friday report.

“Moreover, the fact that the rise in Bitcoin prices was concentrated in 2017 Q4 could result in the wealth effect materializing in 2018 Q1, and if that is the case, we estimate a potential boost to real GDP growth on an annualized quarter-on-quarter basis of up to about 0.3 percentage points,” the report said.

At one point in December, bitcoin briefly soared 1,900 percent for the year. The digital currency was last trading near $15,000, a roughly 1,370 percent increase over the last 12 months, according to Coinbase.

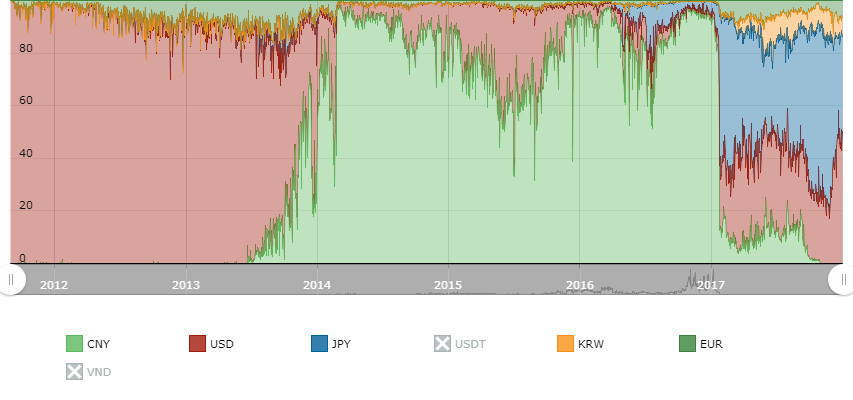

For much of last year, bitcoin trading in Japanese yen accounted for nearly half or more of total trading volume in the digital currency, according to CryptoCompare. U.S. dollar-bitcoin trading volume typically had the second largest share, until rising to first place in the last few weeks.

Bitcoin trading volume by government currency (2012 – 2017)

Source: CryptoCompare

Assuming the Japanese hold about 3.7 million bitcoins and estimating an ¥866,000 ($7,716) gain in price between the second and fourth quarter of the year, “we estimate unrealized gains on Bitcoin held by Japanese people of roughly ¥3.2 trillion ($28.5 billion),” the analysts said.

“Although Japanese investors’ unrealized gains are unlikely to feed straight through to their patterns of consumption, it is common knowledge that personal consumption is bolstered as a result of increases in the value of asset holdings (ie, the wealth effect),” the analysts said.

Digital currency trading in Japan is also a big business. Tokyo-based bitFlyer expanded its operations to the U.S. in late 2017.

The Nomura analysts did point out that Bank of Japan Governor Haruhiko Kuroda said in late December that the bitcoin price surge was the result of speculation.

Last week, the South Korean Financial Services Commission said in a statement, translated by CNBC, that it is prohibiting anonymous digital currency trading accounts and also banning cryptocurrency exchanges from issuing new trading accounts. If an exchange does allow new accounts, the government has the ability to take action to either stop trading or shut the exchange down, the statement said. According to an English language Facebook post by the Commission, the rules would take effect in January.

China cracked down on digital currencies in September and the share of yuan-bitcoin trading has fallen drastically to less than 5 percent after dominating the market for years.

Source: Tech CNBC

Bitcoin could boost Japan's GDP, Nomura analysts say