Goldman Sachs advised clients to buy commodities and cash in the next few months as equities look to shake off a “fat and flat” trend of little growth so far this year.

“We keep our overweight [rating on] commodities, which has been the strongest asset class year to date and still has the strongest return potential near-term, based on our commodities team’s estimates, driven by their bullish view on oil and copper in particular,” wrote Goldman equity strategist Christian Mueller-Glissmann.

“While the growth/inflation mix has turned less favourable, we continue to see bear market and recession risk as low,” he added.

While Goldman is still optimistic on equities over the next 12 months, the strategist said the so-called Goldilocks backdrop that helped stocks grind higher throughout 2017 could fade nearer term.

Burgeoning oil and copper prices should bode well for commodity investors, but inflationary pressures could embolden the Federal Reserve in its quest to hike rates.

The central bank kept its benchmark interest rate unchanged last week, but did note that inflation is beginning to creep up. The Federal Open Market Committee said that “overall inflation and inflation for items other than food and energy have moved close to 2 percent,” a target rate considered a healthy level of inflation.

For their part, Goldman Sachs economists still maintain that the Fed will raise rates three more times this year, well ahead of Wall Street consensus. Mueller-Glissmann upgraded cash for the next three months. “The competition from cash for other asset classes has picked up.”

The dollar index surged 0.4 percent on Tuesday, to 93.16, a 2018 high against a basket of other currencies as a rout of the euro prompted traders to buy the greenback. The dollar has now risen for three consecutive weeks.

While rising interest rates can be a sign of a stronger economy, some worry that rising short-term Treasury payments could become competitive with stocks and add to market jitters.

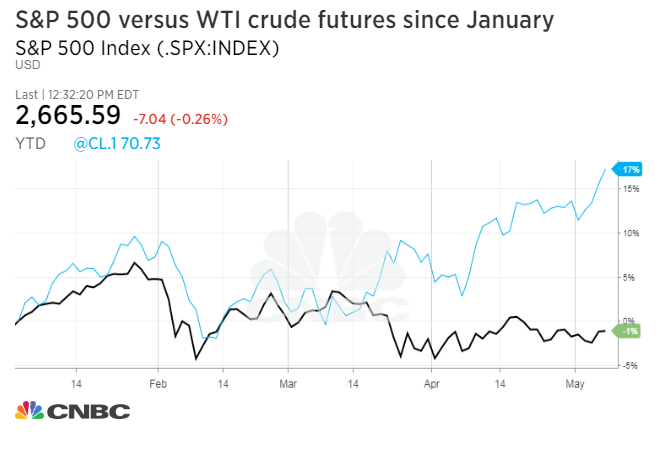

Major stock indexes have underwhelmed in 2018 after a spell of volatility in February and March sent the Dow Jones industrial average and the S&P 500 spiraling into correction territory.

The Goldman team added that political uncertainty around trade and U.S. midterm elections doesn’t help the investing thesis either.

“In addition to a worsening growth/inflation mix investors had to digest a pick-up in policy uncertainty, a lot of which has been concentrated in the U.S: continued risk of a trade war and regulation uncertainty on the U.S. tech sector, which is the largest in the U.S. equity market.”

Stocks fell modestly Tuesday afternoon ahead of President Donald Trump’s decision on the Iran nuclear deal, a landmark diplomatic agreement forged under the Obama administration.

— CNBC’s Patty Martell contributed to this report.

Goldman Sachs bets on oil, cash near term as 'Goldilocks' backdrop fades