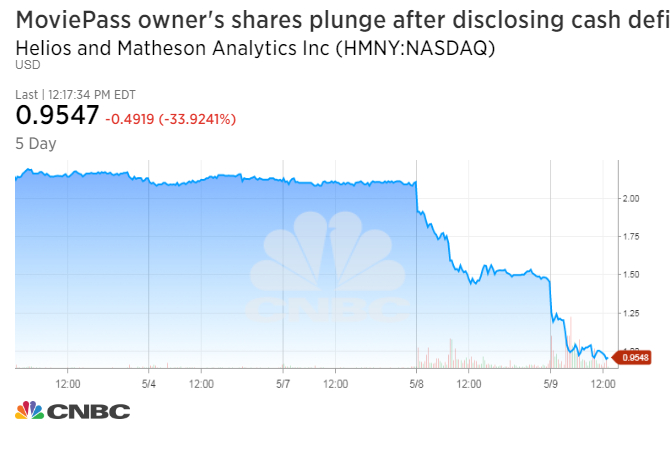

Shares of MoviePass owner Helios and Matheson Analytics plunged more than 30 percent in Wednesday trading, after falling 31 percent a day earlier.

The stock hit a low of 87 cents, down more than 97 percent from HMNY’s 52-week high of $38.86 a share hit in October. The company’s market value has plunged from $281 million then to roughly $50 million at Wednesday’s prices, according to FactSet.

Helios and Matheson Analytics disclosed in an SEC filing Tuesday that it estimated its average cash deficit was about $21.7 million a month for the seven months through April. That’s a total deficit of $151.9 million.

On the other hand, the company said it had about $43.4 million in available cash and deposits with merchant processors, which represent some of the payments received from MoviePass subscription plans.

The product lets users watch one movie in theaters a day for roughly $10 or less a month. Although many criticize the business model as unsustainable, some say MoviePass could be as disruptive to the struggling theater industry as Netflix was to movie rentals.

Since HMNY bought its majority stake in MoviePass in August 2017, the number of subscribers has multiplied at least 100 times to more than 2 million in February, according to company releases.

“They’re burning through $20 million a month and have $40 million on hand, so they can last two more months,” Michael Pachter, managing director, equity research, at Wedbush, said in an email. “I don’t see how they turn it around unless they charge much more or they limit how many movies their customers can see.”

“It’s impossible to run a business where the cost of sales is 2x the revenues,” Pachter said, based on his estimates.

For a few weeks, MoviePass reduced the number of movies new subscribers could see a month to four. But it reintroduced the movie-a-day model last week, and updated its technology to prevent users from sharing accounts.

“We have always known, from when MoviePass took off in August, that it was going to be a high cash burn business model,” Ted Farnsworth, chairman and CEO of Helios and Matheson Analytics, said in a statement.

“We are not changing our guidance on 5 million subscribers by the end of this year – which should make us profitable/cash flow positive according to our business model,” Farnsworth said. “We have access in capital markets to over $300 million.”

Source: Investment Cnbc

MoviePass owner's shares plunge more than 30% for a second-straight day