The Trump administration’s history with trade has been volatile for stocks, usually sending them lower at first, but investors who have bought equities on those dips have been rewarded.

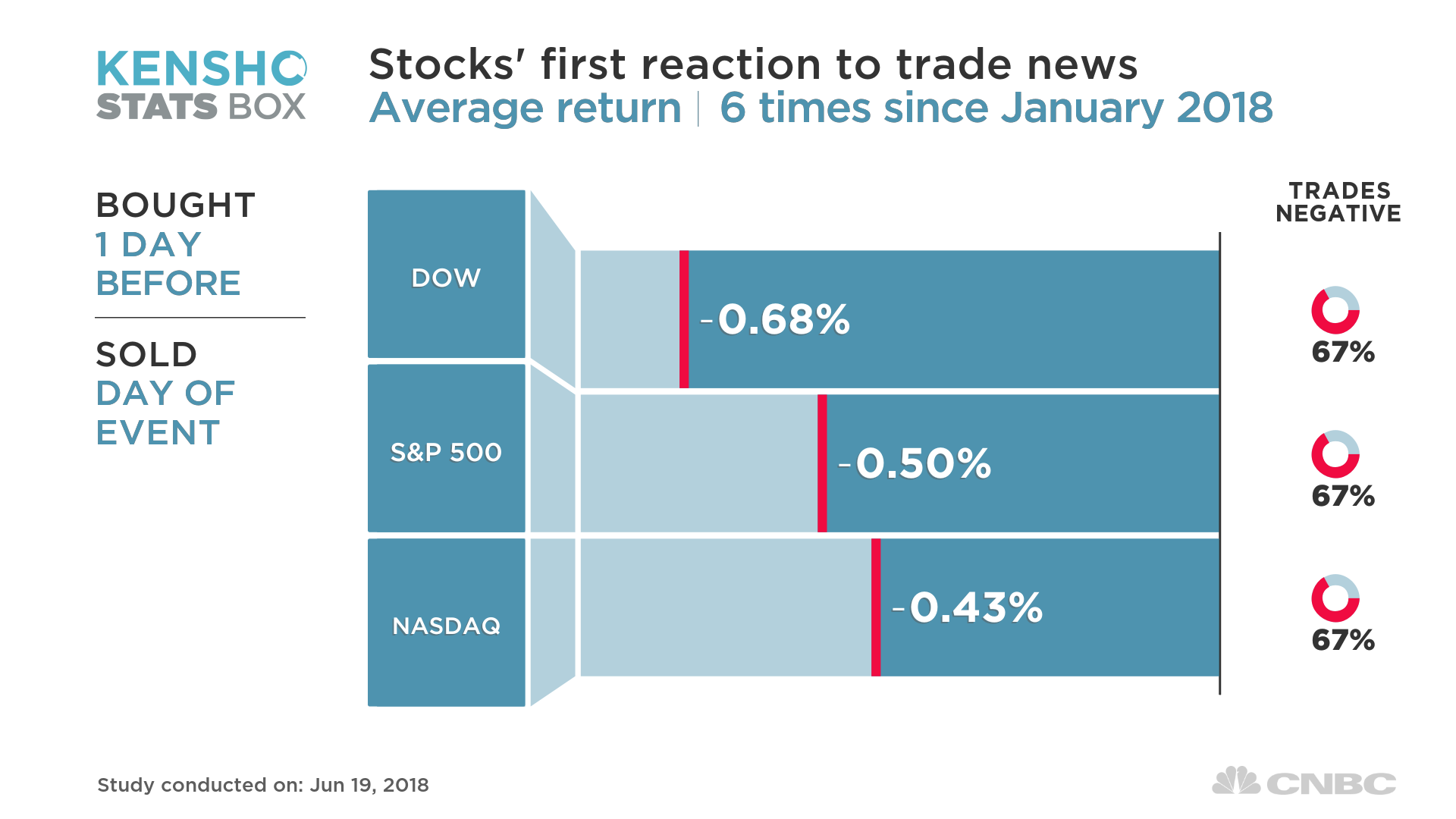

The Dow Jones industrial average, S&P 500 and Nasdaq composite this year dropped on average at least 0.4 percent immediately after an announcement on trade policy from the U.S. or its partners, according to CNBC analysis using Kensho. The analysis takes into account six instances this year in which the Trump administration and the European Union have announced they will impose tariffs or had threatened to impose them on certain goods.

Leading the major indexes lower when trade worries rise are industrials and financials, which fall at least 0.6 percent in these instances, the analysis shows. Materials are also among the biggest laggards.

Large-cap industrials like Boeing and Caterpillar do a lot of business overseas, making them susceptible to rising trade tensions. Financials, meanwhile, are usually pushed down by a decline in long-term rates as investors load up on U.S. sovereign bonds in their search for safety.

Late on Monday, President Donald Trump asked the United States Trade Representative to identify $200 billion worth of Chinese goods for additional tariffs, at a rate of 10 percent. If China “refuses to change its practices” and insists on continuing with the new tariffs it recently declared, then the additional levies would be imposed on Beijing, Trump said.

Soon after, the Chinese Commerce Ministry issued a response, stating that the latest threat of more tariffs violates previous negotiations and consensus reached between the U.S. and China. “The United States has initiated a trade war that violates market laws and is not in accordance with current global development trends,” the ministry said.

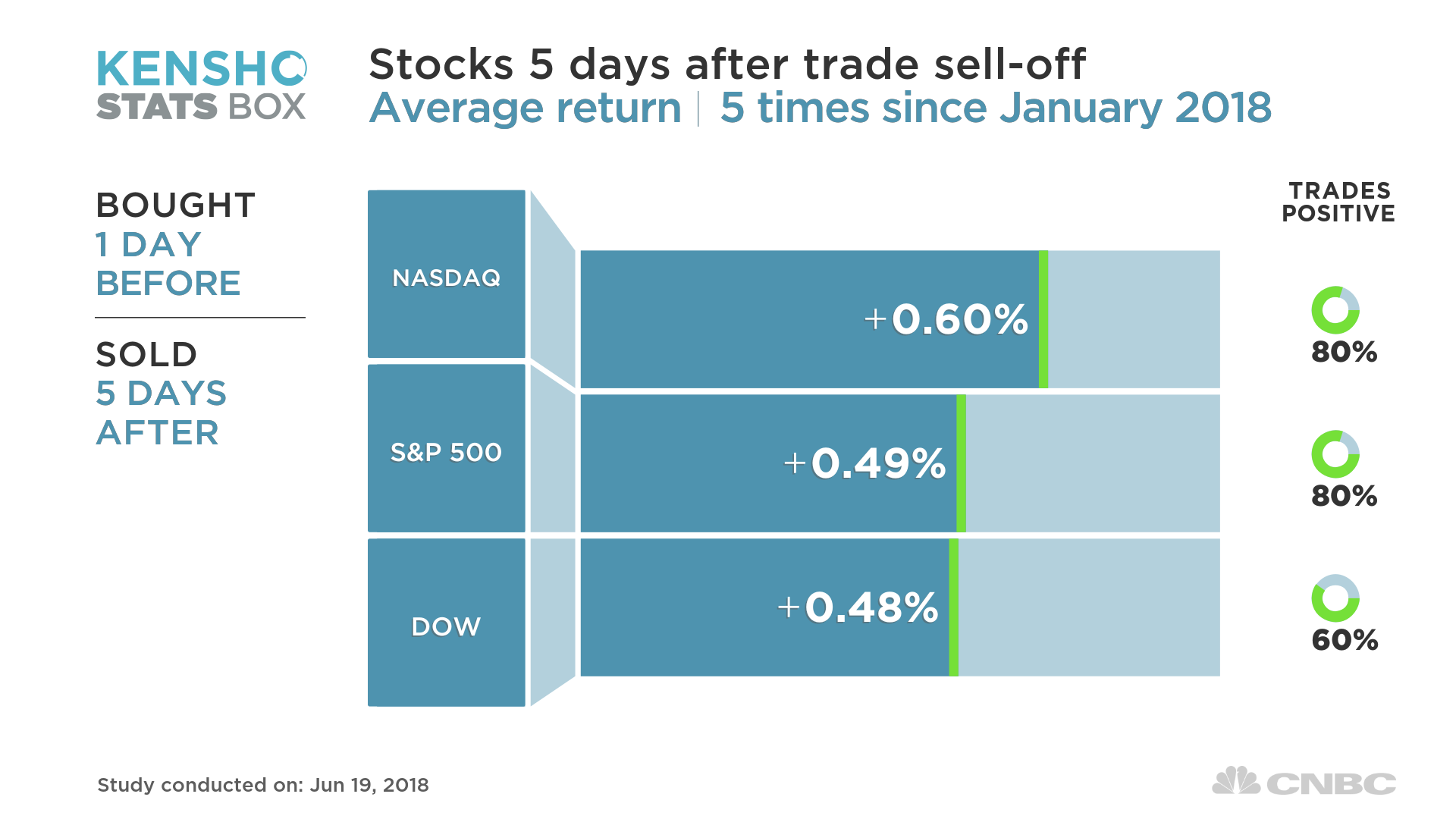

The news rattled Wall Street, sending stocks down sharply. This, however, might be a good time to buy stocks. According to Kensho, the major averages are up at least half a percent just five trading days after the news on U.S. trade.

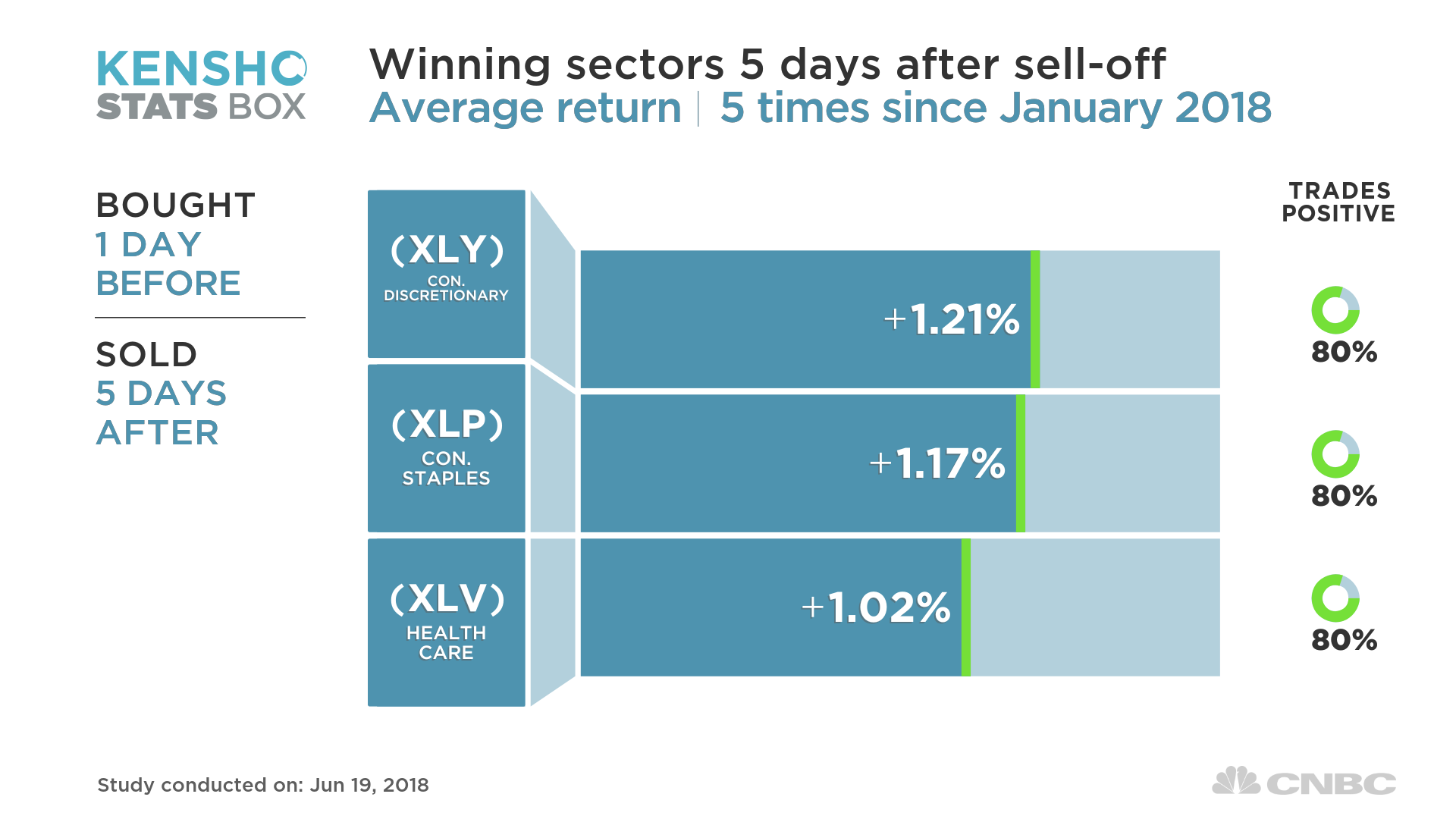

The previous rebounds have largely been led by consumer and health-care stocks, all of which average returns of at least 1 percent.

Industrials, however, still struggle five days after the initial decline, averaging a loss of 0.06 percent.

Source: Investment Cnbc

In the short history of Trump trade conflicts, it has paid to buy the market dip