General Electric shares were lower early Wednesday, a day after news that the last original Dow component was being dropped from the blue-chip index.

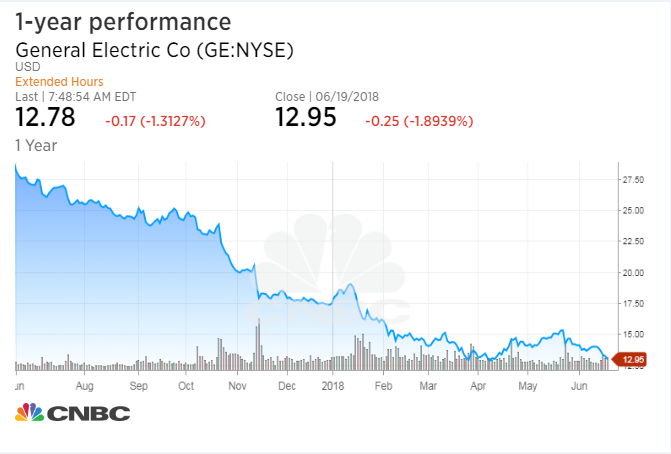

Shares of GE, which has been in the index continuously since November 1907, fell more than 1 percent in premarket trading Wednesday to around $12.81 per share. At one point, it was down 2 percent. The stock closed at $12.95 on Tuesday.

On Tuesday, it will be replaced by Walgreens Boots Alliance on the Dow Jones industrial average.

GE, with a market cap of more than $112 billion, has seen its shares fall more than 55 percent over the past year, on investors’ concern about the value of GE’s businesses declining.

GE Chairman and CEO John Flannery is in the midst of an aggressiveturnaround plan and restructuring.

Flannery replaced GE chief executive Jeff Immelt in the latter half of 2017. Immelt’s departure capped a rocky 16-year run that saw GE stock lose about 38 percent of its value.

Deutsche Bank’s John Inch had warned in January that GE would likely be dropped from the Dow this year and that such a move would hurt its shares.

“We believe headline risk to be the most significant risk factor if GE were to be dropped from the Dow — potentially amplified by GE’s high mix of retail investors (roughly 40% of GE’s common stock is held by retail investors),” the analyst wrote.

Nicholas Heymann, a multi-industry analyst William Blair & Co., told CNBC on Wednesday he believes GE’s stock should be trading between $14 and $21, depending on earnings.

“Asset sales are going to come through,” Heymann said in a “Squawk Box” interview, adding the industrial giant is “obviously” going through a transition phase.

“There’s been serial capital misallocation here for a long time,” since 2004 in the early years of Immelt’s tenure, Heymann said.

When Immelt took over at General Electric in 2001 from GE boss Jack Welch, the stock was already turning over, as the dot-com bubble burst and took the broader stock market lower as well. Immelt navigated GE through the aftermath of the Sept. 11, 2001, terrorist attacks and the 2008 financial crisis.

—CNBC’s Angelica LaVito contributed to this report.

GE shares drop after the blue chip gets booted from the Dow, ending a 110-year run