Since it went public eight years ago, Tesla’s share price has risen nearly 2,000 percent.

And the company is still unprofitable.

CEO Elon Musk has said he expects Tesla to turn a profit in the third and fourth quarters of 2018. There is a bit of skepticism on Wall Street as to whether the company will actually be able to manage that, at least twice in a row.

To be fair, Tesla has had two profitable quarters so far.

But the success of its stock is especially stark considering that its market value is $56.7 billion, surpassing Ford’s market value of $43.2 billion and General Motors‘ value of $55.5 billion. This is despite the fact that Ford and GM sell several times the number of cars Tesla does, and have pretty consistently delivered profits over the last several quarters.

And bullish investors point to a number of other firms that have had trouble turning a profit over the years, some of which have eventually become money makers.

Here is a sample:

Amazon went public in 1997, but it neither had a profitable quarter until the fourth quarter of 2001, nor a profitable year until 2003. It has occasionally posted losses in some quarters since then.

IPO Date: May 15, 1997

IPO Price: $18

Current Closing Price: $1,699.80

Stock price change since IPO: About 114,171 percent

.1530299593707.jpeg)

Yelp went public in early 2012, but did not turn a profit until the second quarter of 2014, and has even had losses in some quarters and years since then.

IPO Date: March 2, 2012

IPO Price: $15

Current Closing Price: $39.18

Stock price change since IPO: About 163 percent

Twitter had its IPO in 2013, but turned a profit for the first time in the fourth quarter of 2017 and still has not had a profitable year.

IPO Date: November 7, 2013

IPO Price: $26

Current Closing Price: $43.67

Stock price change since IPO: About 69 percent

Netflix didn’t make money as a public company until the second quarter of 2003, about a year after its 2002 IPO. Since that first profitable quarter, it has also posted losses from time to time.

IPO Date: May 23, 2002

IPO Price: $15

Current Price: $391.43

Stock price change since IPO: About 36,724 percent

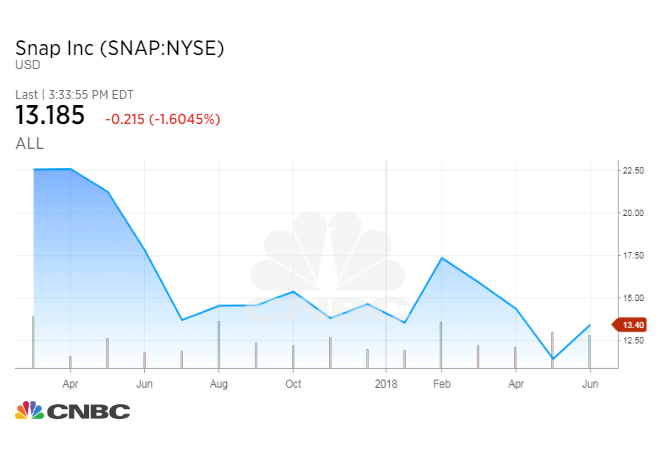

Snap‘s social media app Snapchat might be quite popular with young people, but the company hasn’t turned a profit since its IPO in 2017.

IPO Date: March 2, 2017

IPO Price: $17

Current Closing Price: $13.09

Stock price change since IPO: About -20 percent

To be sure, even legacy automakers have had their fair share of struggles over the years. Both General Motors and Chrysler declared bankruptcy in 2009 and received billions funds from taxpayers through the Troubled Asset Relief Program.

Source: Tech CNBC

Tesla still isn't profitable 8 years after its IPO. But, it hasn't been alone.