Tom Lee, the only major Wall Street strategist to issue bitcoin price targets, told CNBC on Thursday he sees the world’s largest cryptocurrency by the end of the year at more than $20,000 per unit — 20 percent less than his previous estimate.

“Bitcoin has historically traded at 2.5 times its mining costs. It’s not out of the question that it could be over $20,000 by the end of the year at fair value,” the Fundstrat Global Advisors co-founder said on “Squawk Box.”

That’s down from Lee’s previous year-end projection of $25,000.

But he stressed that investors should not quibble over a few thousand dollars because any return approaching $20,000 would be about 200 percent higher than current levels — around $6,600 in early Thursday trading, according to data from CoinDesk.

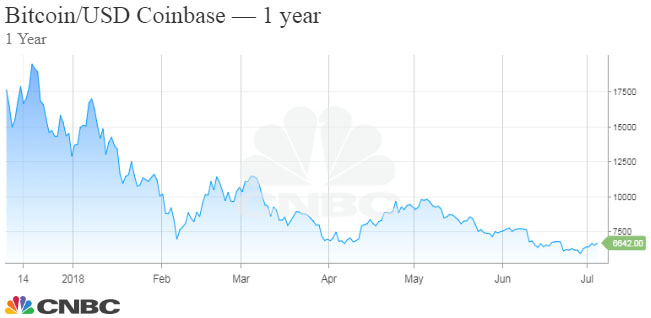

Bitcoin at $6,600 brings prices back to the lows in April, which marked the halt of a slide from nearly $20,000 in late 2017. Since its most recent top around $9,800 in May, bitcoin has lost about 30 percent.

However, Lee remains undeterred. “The reason bitcoin looks really good here is the cost of mining around $7,000 fully loaded. And the difficulty is rising. So by the end of the year, it’s going to be $9,000.”

Cryptocurrency miners use high powered computers that use a lot of electricity to complete a series of complex calculations to create a bitcoin. The bitcoin protocol calls for a finite number of bitcoins of 21 million, of which about 80 percent have already been made.

Lee, chief equity strategist J.P. Morgan from 2007 to 2014, said bitcoin and blockchain, the technology underlying it, is a “multidecade story” that’s in the “early stages” of transformation.

“I did wireless [research] in the 1990s. I saw 20 years of mobile and internet convergence. To me, this is not that different” in terms of how an industry has change over time, he said.

Source: Tech CNBC

Wall Street's Tom Lee cuts his year-end bitcoin price target by about 20%