As Netflix and Amazon search for new users abroad, they are increasingly looking to India as a big market.

Once crippled by poor internet infrastructure and low household income, the world’s second-largest internet market has exhibited tremendous potential in the recent years. It’s proving, however, to be a tough nut to crack for the American streaming leaders.

Netflix, which aired “Lust Stories,” an anthology of four short films by high-profile Indian directors that breaks the taboo around women’s sexuality, in the country and elsewhere last month, is this week releasing its first original Hindi series for the country. Called “Sacred Games,” it is based on a novel by Indian author Vikram Chandra.

Shortly afterwards, Amazon is scheduled to premiere “Comicstaan,” a series featuring a group of prominent comics from India who are tasked with finding new talent in the country. “Comicstaan” is the fourth original show Amazon has made for India, with seven more already in the works, Vijay Subramaniam, director and head of content at Amazon Prime Video in India, told CNBC in an interview.

Posters of the new shows have started to flood bus stops, shopping malls and metro stations in several cities across the country. That aggressive play from the companies, both of which entered India in 2016, is becoming increasingly necessary: Amazon Prime Video and Netflix have long trailed local services in the nation, and that gap has only widened in recent months.

Leading the pack is Hotstar. Owned by Star India, which is controlled by Twenty-First Century Fox, Hotstar had about 70 percent of the on-demand local streaming services market earlier this year, according to estimates by research firm Jana. The three-and-a-half-year-old service has 150 million monthly active users, CEO Ajit Mohan told CNBC in an interview. Netflix, by contrast, has fewer than one million subscribers in the country, according to industry estimates.

Once considered a luxury, an increasingly growing number of Indians are giving online streaming services a try. Companies have taken notice: More than 35 streaming services have launched or expanded their businesses in India in the last three and a half years, with many more planning to enter Bollywood soon.

Many of those services are owned by local television networks and production houses. Balaji Telefilms, known for producing some of the most watched family TV shows in India, has amassed over 2.5 million paying customers on ALTBalaji, a streaming service it launched last year, Nachiket Pantvaidya, group COO of Balaji Telefilms, told CNBC.

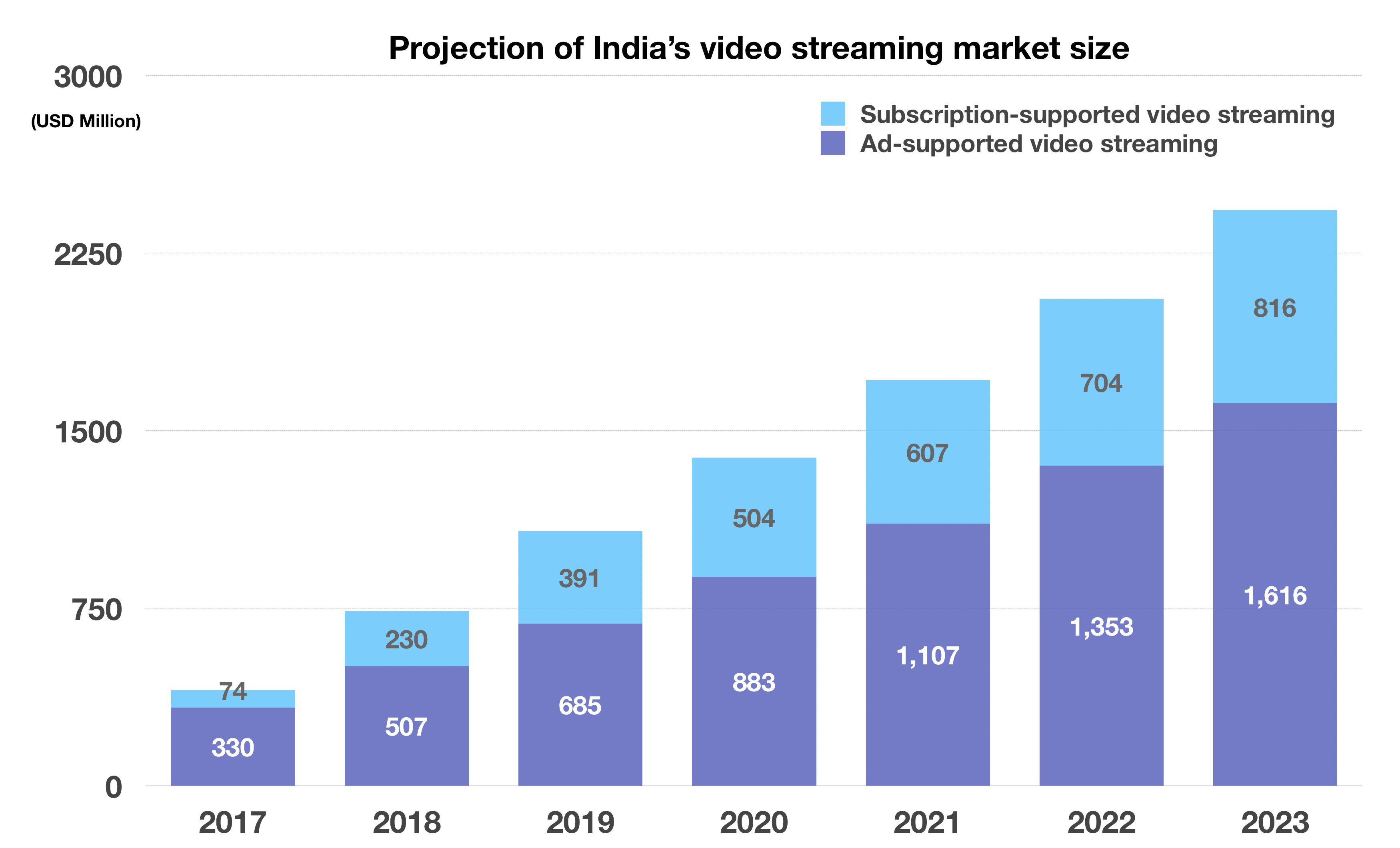

India’s online video market, valued at over $700 million, is expected to grow to $2.4 billion in value by 2023, according to research firm Media Partners Asia.

Much of the credit for the boom in streaming goes to the stark drop in India’s mobile data prices. Reliance Jio, a telecom operator owned by India’s richest man, Mukesh Ambani, kickstarted a telecommunications price war in the nation in the second half of 2016, when it began offering a bulk of data at no charge to customers for an extended period of time.

The months that followed its launch brought tens of millions of new users to the internet, and changed the way many consumed data. Thrifty Indians, once extremely conscious about each megabyte they burned on the web, are now reportedly clocking 1.5 million terabytes of data each month.

Another barrier that has hindered the adoption of internet video services is pricing. Jehil Thakkar, an analyst with Deloitte consulting group, said Indians, unlike Americans, have had fewer incentives to flock away from cable TV.

In the U.S., a monthly cable TV subscription could cost more than $100, making offerings by Netflix, Amazon and others quite appealing, said Thakkar. But in India, that price point has remained under $4 for the last two decades, he said.

To lure customers, many services in India are aggressively priced, relying largely on advertising for revenue, said Frank Dsouza, an analyst with PricewaterhouseCoopers consulting group. Hotstar, unlike Netflix and Amazon, bandies out nearly 80 percent of its catalog at no charge to customers.

For its premium offering, it charges about 199 rupees (roughly $3) per month. In comparison, the cheapest monthly plan offered by Netflix in India costs Rs 500 ($7.30). Amazon, for its part, has been very aggressive with the pricing of Prime membership in India. The service, which costs $119 a year in the U.S., costs Rs 129 ($1.90) a month or Rs 999 ($14.50) for a year in India. It includes access to Prime Video, Prime Music and faster delivery for packages.

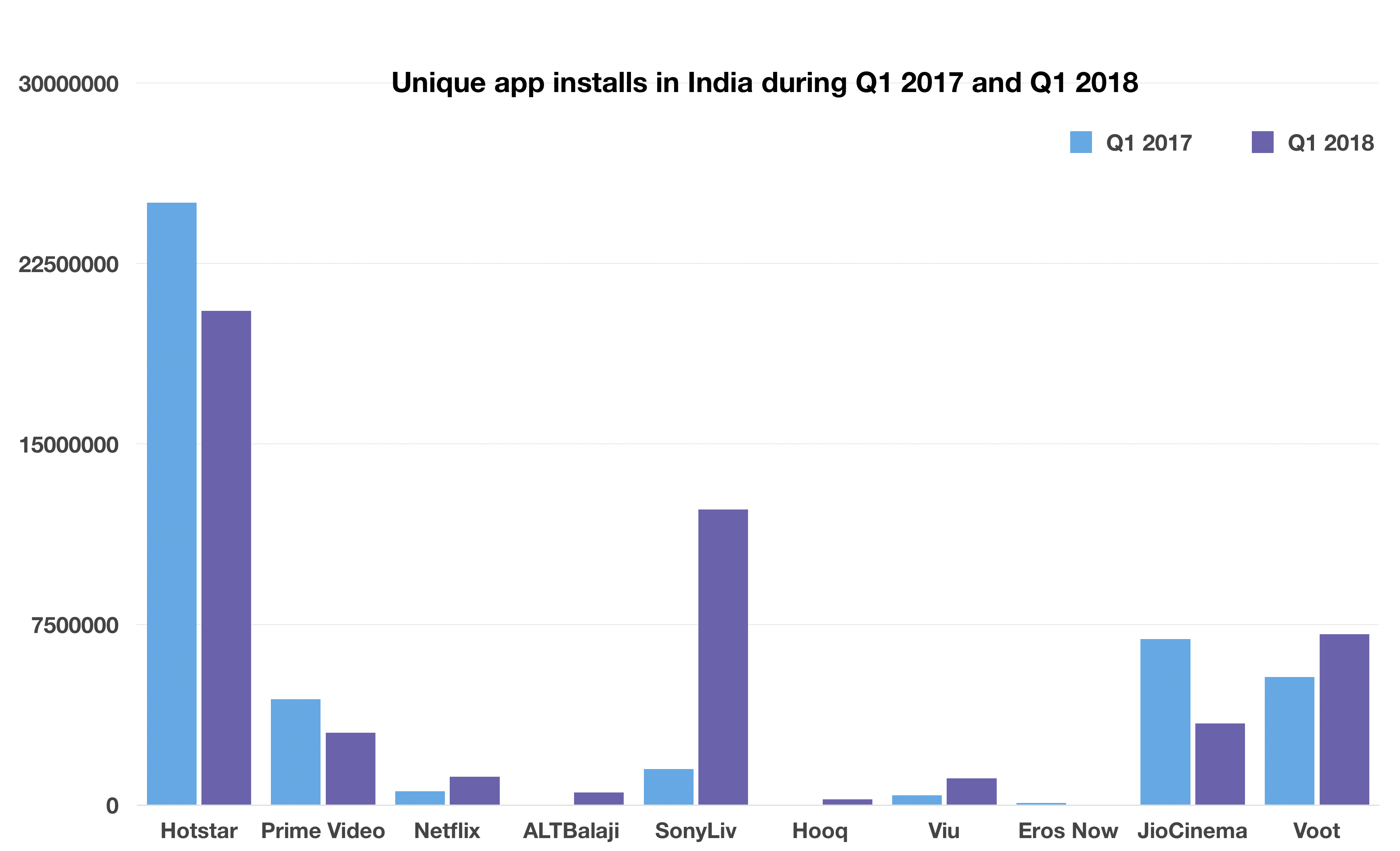

Unique app installs across Google Play and App Store in India. Data: SensorTower

Unique app installs across Google Play and App Store in India. Data: SensorTower

Hotstar’s Mohan said that many companies don’t realize that the price Indians pay for data access, however affordable that may have become, is still very material to them. “Unlike many of our competitors, we are not happy with building a small subscriber base. We’re not happy with offering a streaming service that appeals to a very small part of Mumbai, Delhi, and Bangalore,” he said.

Netflix declined to comment on what it thinks of Mohan’s views, its Indian pricing model or its plans for winning more market share in the country.

At an event in New Delhi earlier this year, Netflix CEO Reed Hastings wondered out loud if the land of Bollywood — which releases more than 2,000 movies in a year and sells more tickets than Hollywood, but generates only a fraction of its revenue — could be the place that gets his platform its next 100 million users.

“The Indian entertainment business will be much larger over the next 20 years because of [investment] in pay services like Netflix and others,” he said.

“Our strategy is to build up the local content, of course, we have got the global content as well, and really try to up-level the industry,” Hastings added, ruling out the possibility of his company lowering its price in the country. Netflix, in many ways, operates like Apple in India, which too, has a very small presence in the nation.

Analysts say sporting events and local content are proving crucial in bringing new users to video platforms and then keeping them online, two areas where international giants are struggling.

Hotstar owns streaming rights to the vast majority of cricket tournaments played in India and by the Indian cricket team. Its strong bet on cricket, the biggest sporting spectacle in the nation, was on display in late April, when 10.3 million viewers, a global record, watched the service to simultaneously view the final game of this year’s IPL tournament.

Last year, Facebook, Amazon, Twitter, and Yahoo had expressed interest in acquiring the digital streaming rights for IPL cricket tournament in India. Facebook was willing to pay north of $600 million for IPL’s digital rights, a bid it lost to Star India.

How India’s streaming market is projected to grow over the years. Numbers are in U.S. million dollars. Data: Media Partners Asia.

How India’s streaming market is projected to grow over the years. Numbers are in U.S. million dollars. Data: Media Partners Asia.

SonyLiv, which is exclusively streaming the FIFA World Cup in India, is observing a similar growth in its viewership. Each game is generating an average of 1 million concurrent views on the platform, Uday Sodhi, executive vice president and head of digital business at Sony Pictures Networks India, told CNBC. To put things in global perspective, Fox Sports said on Tuesday that the game between Mexico and Brazil had an average-minute online audience of 538,000, a new record for the network’s streaming service.

For their part, both Amazon and Netflix have also attempted to cash in on the popularity of cricket in India. The former released a fictional show with cricket as its central plot last year, while the latter is working on one. Amazon’s Subramaniam declined to comment on whether the company planned to invest in sports streaming.

Indians are showing a similar appetite for regional and original content. Alphabet’s YouTube, which had 225 million monthly active users in India late last year, witnessed a surge in demand for content in South Indian languages, according to Satya Raghavan who heads entertainment at the platform.

Following the launch of Reliance Jio, Hotstar saw new users searching the platform for vernacular content, Sidharth Jain, the former creative producer of Hotstar and a current consultant for several internet video services, told CNBC. Hotstar, which exclusively offers several shows from HBO, Showtime, ABC, and Fox in the country, also provides a host of TV shows in regional languages that it has borrowed from more than 55 channels operated by Star India.

The company has shifted its focus to aggressively scale regional catalog, Jain said. The vast majority of movies and shows on Hotstar are in Indian regional languages, according to data the company shared with CNBC.

According to analysts, international companies aiming to make a big impact in India should look beyond their standard playbook, and think more local — sooner than later. That is, the battle for users in the country’s nascent video streaming market is projected to get a lot tougher.

Last week, India’s conglomerate Times Internet acquired MX Player, a video app that works swiftly on dated and entry-level Android handsets, for $140 million. In a statement, Times Internet said the company intends to turn MX Player, used by 175 million users each month, into a streaming service.

Local production house Shemaroo, Chinese giant Alibaba, and Facebook are said to plan entries into the local streaming market soon, too. Eros Now, a service with more than 100 million users worldwide, is also gearing up to make big investments in the nation.

Source: cnbc china

Netflix and Amazon are struggling to win over the world's second-largest internet market