Semiconductor stocks headed lower Wednesday after the White House released a new list of tariffs on $200 billion of Chinese goods on Tuesday evening, as President Donald Trump continued to broaden the trade war with Beijing.

Nvidia, Advanced Micro Devices and Broadcom were among those falling more than 1 percent in premarket trading. Each company logs substantial annual revenue from China connected to its chip manufacturing business.

The new list appears to target China’s important manufacturing export industries. It includes electronics, textiles, metal products and auto parts. Under those industries, specific products such as refrigerators, bags, cotton and Chinese steel and aluminum products are on the list.

The new list appears to target China’s important manufacturing export industries. It includes electronics, textiles, metal products and auto parts. Under those industries, specific products such as refrigerators, bags, cotton and Chinese steel and aluminum products are on the list.

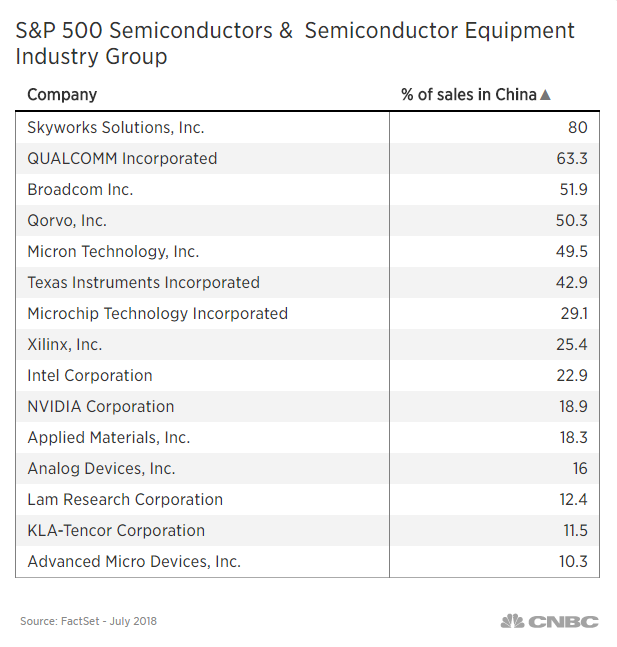

Semiconductors may be the sector most affected by rising trade tensions between the U.S. and China. A Goldman Sachs list of the top 20 companies with the highest revenue exposure to China is dominated by technology chip suppliers that send products to manufacturers in China.

Trump’s new tariffs will not go into effect immediately but will undergo a two-month review process, with hearings Aug. 20-23.The list of comes after warnings by Trump that he may implement tariffs on at least $500 billion in Chinese goods should Beijing retaliate against the $34 billion in U.S. tariffs that kicked in Friday. Despite the president’s threats, China implemented retaliatory tariffs on the U.S. shortly after. China has again accused the U.S. of bullying and warned it would hit back after the Trump administration raised the stakes in their trade dispute.

– CNBC’s Tae Kim and Chloe Aiello contributed to this report.

Source: Investment Cnbc

Nvidia, AMD lead chip stocks lower on fears about the escalating trade war with China