TradingAnalysis.com founder Todd Gordon said that the market is potentially on the verge of a major move out of a consolidation phase, and there’s one sector that he sees breaking out.

Of the 11 sectors of the S&P 500, Gordon believes consumer discretionary is set to rally along with the broader market. The chart-minded trader suggested that this group of stocks could be a less volatile way to ride the market higher. Here’s why:

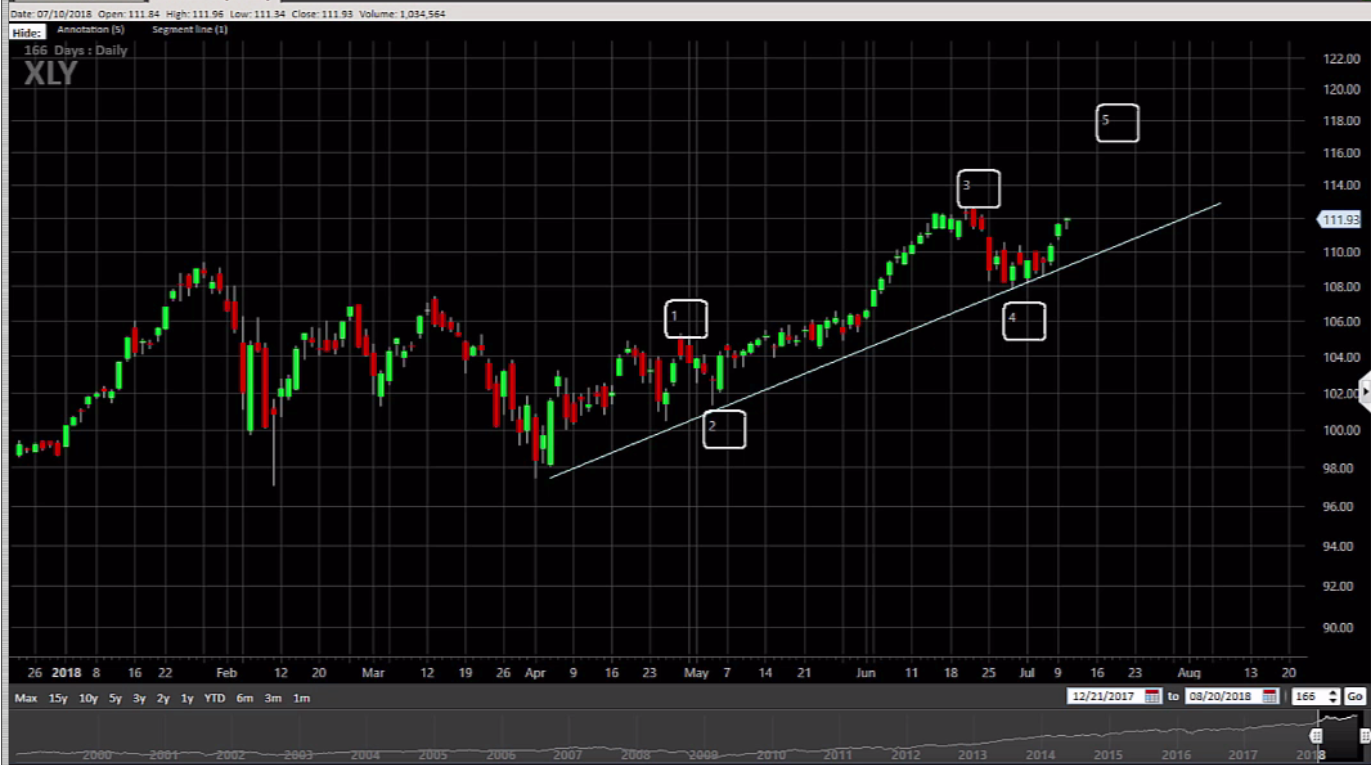

- On a chart of the consumer discretionary-tracking ETF (XLY), Gordon points out that XLY needs to complete the fifth and final wave of the Elliot Wave theory. The classic theory, in this case, would mean that XLY would need to make one final rally higher.

- Gordon then draws a line connecting XLY’s recent lows and duplicates the line to make a parallel channel. The trader sees XLY rallying up to the ceiling of the channel to around $117.

- As a result, Gordon wants to buy the August monthly 112-strike call and sell the August monthly 117-strike call for a total cost of $1.77, or $177 per options spread.

- If XLY closes above $117 on Aug. 17 expiration, then Gordon could make a maximum reward of $323. If XLY closes below $112, however, he would lose the $177 he paid for the trade.

The trade: Gordon is suggesting buying the August monthly 112/117 call spread for about $1.77, or $177 per options spread.

Bottom line: Gordon sees XLY rising above $117 on August expiration.

Hide out in this soaring sector amid uncertainty in the broad market, says trader