WITH his flowing locks and hip clothes Adam Neumann, co-founder and chief executive of WeWork, looks less like a property baron than the frontman of a rock group. He speaks expansively on the subjects of character, destiny and God. His four-year-old daughter wanders through his office during an interview with The Economist. Yet Mr Neumann, a veteran of the Israeli navy, also has a reputation for being an intense and demanding businessman. Both sides to his character come together in WeWork. Mr Neumann thinks of his property startup as a profit-making version of Israel’s famed communal farms—a sort of “capitalist kibbutz”.

Shaking up the market for commercial offices globally is the firm’s mission. WeWork’s “co-working” offices, in more than 250 locations and over 70 cities worldwide, are a blend of small private spaces and large public areas designed to encourage a sense of community among its users. The firm rents huge chunks of space from landlords, kits them out and charges clients a membership fee starting at a few hundred dollars a month. Customers rent anything from one desk to whole buildings and range from tiny startups to giants such as General Motors and Samsung.

-

Why Japan is going to accept more foreign workers

-

Arab states are losing the race for technological development

-

Why art exhibitions are returning to domestic settings

-

Transcript: Interview with General Mark Hicks

-

Trans-inclusive feminist voices are being ignored

-

A British traveller’s travelogue

In the eight years since its founding WeWork has become the largest private-sector occupier of offices in central London, and the second-largest in Manhattan. Its expansion is being fuelled by SoftBank’s near-$100bn Vision Fund, which last year put several billion dollars into the firm, valuing it at $20bn. This is more than most big property companies, even though it is not yet profitable. SoftBank is expected shortly to invest another $3bn into the company in a deal that could lift its valuation to $35bn.

Big questions nonetheless swirl. Sceptics wonder about the model’s viability in an unsentimental, margin-driven property industry that is prone to painful ups and downs. As a result, they scoff at its valuation. WeWork’s top brass talk of its becoming a $100bn firm; others regard a tag of $20bn as already extremely stretched.

Suite smell of success

WeWork does deserve credit for reimagining the conventional corporate office. It has spread design innovations from tech companies such as Google. A large common area with sofas and work desks, fruit-infused water and open lines of sight welcomes visitors to every location. Each is manned by a concierge who gets to know “members” and curates events ranging from yoga classes to investor talks. The halls and stairways are deliberately made narrow as a way of encouraging people to interact. In lounges music is played loud enough to prevent eavesdropping. The firm uses a mixture of anthropological research, sensors and data analytics to hone and customise office designs.

At its location near Grand Central Station in midtown New York, a member working at an advertising startup says his old ad agency was so full of politics and corporate silos that he rarely socialised with colleagues. In his new co-working space he often enjoys beers or plays video games with people from other firms. Down the hall, a boss of an Icelandic yogurt firm says running instant focus groups on new flavours in the lounge speeds product development.

Research suggests that employees are happier in co-working environments like those run by WeWork. But the firm’s real genius is that it is also far cheaper for their employers. Property experts estimate that firms typically spend anywhere between $16,000 and $25,000 per employee on rent, security, technology and related office expenses. Mr Neumann insists they can get all of that from WeWork starting at $8,000 per worker. Efficient use of space is one reason. Ron Zappile of Colliers, a property-services firm, reckons that typical corporate offices use some 185 square feet (17 square metres) per employee. WeWork members get by on 50 square feet per head.

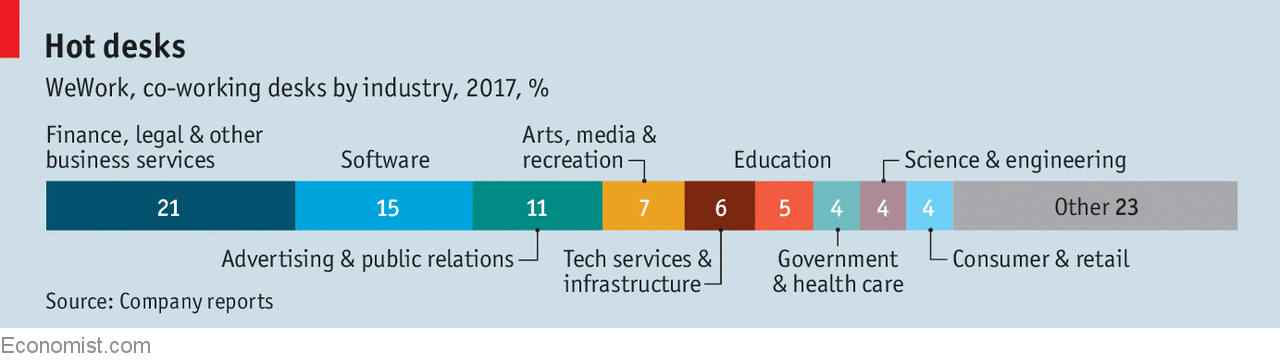

WeWork has more than 250,000 members from a range of industries (see chart) and expects to double revenues this year for the ninth straight year. Last year it made $886m in revenue, 93% of which came from memberships. Artie Minson, its chief financial officer, reckons the firm would need about 1.3m members to reach $10bn in revenues. “On our current course and speed, it’s very achievable,” he says. The firm says it is going after only a slice of the $2.5trn that firms spend worldwide on office-related services.

WeWork’s net losses also roughly doubled, however, from $430m in 2016 to $884m last year. As with many fast-moving startups, it explains its lack of profitability by pointing to big investments. It will open 15 new offices a month worldwide for the foreseeable future. Its bonds issued in April were rated as junk.

What worries observers is its similarity to Regus (now known as IWG), a pioneer of the serviced-office market. IWG expanded wildly during the dotcom boom, taking on piles of debt. Its American division was driven to bankruptcy when the tech bubble burst, and the firm was left with lots of rent to pay and too few tenants to cover outgoings. Mark Dixon, IWG’s long-time boss, says that the chief lesson he learned is that “you have to have a matched book or you will die. It’s not a question of whether but when.” WeWork is on the hook for about $1.9bn worth of leases (typically 15 years in duration, with no more than 7% falling due each year) but its members are tied in only for short periods. A crash could mean lots of empty desks.

WeWork has devised ways to tackle this mismatch. Its leases are held in special-purpose entities specific to one property, so the parent is somewhat insulated from blow-ups. The firm is increasingly using revenue-sharing leases. This gives away some upside to landlords in good times, but it means the firm bears less risk during a downturn. Buying buildings with outside money is another hedge. WeWork recently bought the former Manhattan flagship of Lord & Taylor, a troubled retailer, and is likely to buy more buildings using external capital. It has some $2bn in cash, with more soon to come from SoftBank. Unlike the old Regus, it has relatively little debt even after its $700m offering in April.

Yet the most important source of stability may well be a shift in its customers, from startups to big firms. A few years ago, WeWork’s business was comprised almost entirely of small fry. In the year to September the enterprise segment (firms with over 1,000 staff) grew by around 370%. As of June, big firms accounted for about a quarter of its membership and revenues. More than 1,000 companies now take anything from one to 12,000 desks. In June, Facebook asked WeWork for an entire building for several thousand workers.

The average enterprise lease is close to two years and many new ones are three to five years long. Whereas big firms, used to conventional office leases of 10-20 years, see WeWork’s contracts as flexible, the firm itself sees them as commitments that will help it weather a downturn.

As for the firm’s dizzying valuation, WeWork has devised a measure of profitability that it calls “community-adjusted EBITDA”, which strips out the costs associated with expansion but retains the costs of running existing locations. Despite the hippy-dippy name, analysts regard it as a reasonable measure, akin to the distinction made between “same-store” sales and new-store sales in analysing retailers. In 2016 WeWork’s established locations had community-adjusted EBITDA margins of 22%, which rose to 27% last year thanks to higher occupancy and improved economies of scale. Mr Minson expects it to reach 30% by year-end.

The cost of expansion is also coming down. One measure WeWork uses is the net capital expenditure involved in opening new space. This has declined from $10,888 per desk in 2015 to $5,631 per desk in 2017, and is expected to reach roughly $4,000 per desk this year. This downward trend can be explained by growing economies of scale and vertical integration. Visit its forthcoming office space at 750 Lexington Avenue in Manhattan and you will find a surprisingly high-technology building site, featuring 3D-laser scanning of raw space and real-time online tracking of global construction activity. “We can systematically say how many desks we’ll open in a city in the future,” says Jennifer Berrent, the firm’s chief operating officer. The firm can go from lease-signing to tenancy in four months; old-fashioned landlords take six months to a year.

Mr Neumann thinks this in-house expertise will ignite new sources of revenue. He reckons that most growth will come from new products such as Powered by We, a service that brings WeWork’s design and operational capabilities to a customer’s site, where it revamps existing offices. So far it has attracted 30 enterprises.

WeWork also wants to advise firms on improving corporate culture. A forthcoming product, described in a case study prepared by Harvard Business School, envisages WeWork helping firms transform by applying its methods (which it calls its “Culture OS”). Mr Neumann observes that firms are often much better at taking care of their customers than they are at looking after their employees. In addition, WeWork offers a range of services for members, such as third-party health insurance for startups, which make up a small but growing part of revenues. It has acquired America’s Flatiron School, and offers its computer-coding classes to members. It recently launched WeWork Labs, whose services for startups include mentorship from seasoned entrepreneurs, matchmaking with big firms and other benefits.

The firm’s ambitions do not stop at the office. Mr Neumann is currently bidding against Elon Musk, the boss of Tesla and SpaceX, for the right to develop a large tract of public land near San Francisco’s Golden Gate Bridge. In addition to co-working space, the complex would house WeGrow, a network of schools for young children that WeWork has designed, and WeLive, a “co-living” style of housing it is working on. The first such school, on the third floor of the firm’s New York headquarters, will start classes this autumn. Two residences are already open, one near Washington, DC, and the other on Wall Street.

Some investors reckon that such initiatives are a distraction from its core business. The startup’s stratospheric valuation is partly a matter of faith. Yet established corporates’ growing interest is also a sign that the firm can endure. In the WeWork building west of Times Square in New York, the penthouse floor is occupied by employees from Nasdaq—just two blocks from the stock exchange’s own spacious offices. Eric Folkemer, a manager, says that it wanted to attract talent from Silicon Valley firms, but that recruits were put off by its old-fashioned facilities. “It’s a lot easier to get them to work for us in this building.”

Source: economist

Big corporates’ quest to be hip is helping WeWork