Wall Street could see a pullback of 3 to 5 percent next month, strategist Katie Stockton told CNBC on Monday.

“[It] depends on where support is at the time at which we’re looking for that pullback,” the chief technical strategist at BTIG said.

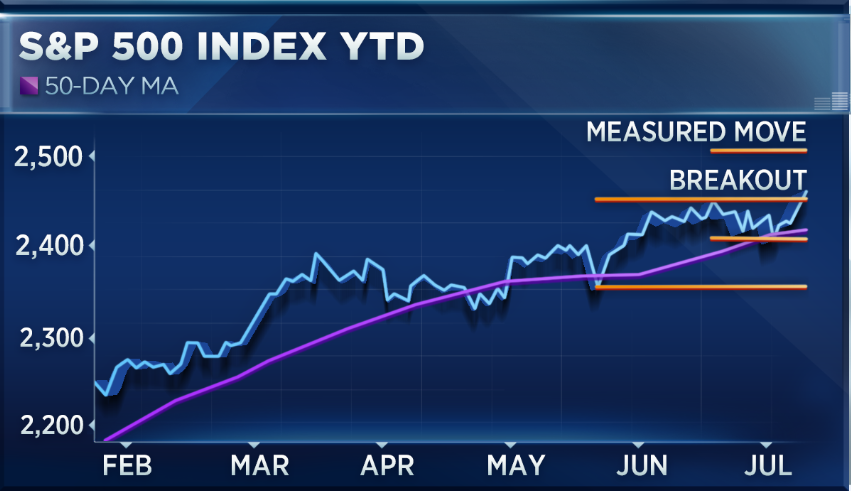

“Right now, support for the S&P 500 is around 2,400. That’s the previous breakout point,” she said on “Squawk Box.”“I look at the market from a bottom up perspective as well. If I start to see a lot of breakdowns … that’s when I get nervous.”

Last July, Stockton predicted the S&P 500 would make a move to 2,400. The index was trading around 2,135 at the time. In May, the S&P closed above 2,400 for the first time ever.

U.S. stocks rose to record levels on Friday. The Dow Jones industrial average and S&P were coming off their 25th record closes of 2017, finishing 21,637 and 2,459 respectively. The Nasdaq was riding a six-session winning streak, and ahead of Monday’s session was less than 10 points away from its previous record close of 6,321.

After her predicted pullback, Stockton sees the S&P reaching 2,640 in the intermediate term, which she defines as weeks to months.

Also on “Squawk Box” Monday, Wall Street veteran Jeff Saut said the bull market “probably has years left to run.” The chief investment strategist at Raymond James also believes investors are “woefully” under allocated in stocks.

Watch: Two Dow Theory buy signals indicate bull market has room to run: Raymond James’ Jeff Saut

Get ready for a big August pullback, says analyst who called last summer's rally