Taking right out a good HELOC getting debt consolidating is going to be a beneficial option to balance cash. You do not anticipate to retire, however your financial situation and you may money may differ should you. Your own societal, medical, and physical means may to improve since you many years. Finding a method to gradually reduce loans is also prepare yourself your getting life’s unpredictability. Providing a great HELOC is one way to start consolidating present or lingering expense.

When you’re unable to create some debts, dont panic. Alternatively, have a chat with one of our knowledgeable mortgage consultants. We are able to take you step-by-step through the methods in which a great HELOC or any other financial method one to taps on the household equity may replace your condition.

The advantages and you may downsides regarding combining obligations that have a HELOC

Practical HELOCs run-on a 30-seasons model. Your own draw period usually can last for the first a decade. Shortly after you are in your payment several months, try to generate monthly premiums. This type of money wade into both credit line principal and you may appeal. That said, specific homeowners is always to err on the side regarding warning whenever exploring HELOCs if to have debt consolidating or other monetary projects. While you is officially HELOC getting one thing, measure the advantages and disadvantages before you finalize any intends to rating good HELOC getting debt consolidation.

Investing in an excellent HELOC is high-risk proper. Meticulously check out the possibilities you will be making, and set aspirational requires for your self. You need to be in a position to real time a loans-totally free lives. Trying to consolidate your financial situation while you’re still operating will help you remain casual if moments get-tough afterwards.

Exactly what if you discover merging obligations?

Obtaining an excellent HELOC to have debt consolidating differs to possess people due to the fact for every man or woman’s monetary demands are unique. You have got concerns in your concerns regarding dealing with and resolving your specific financial obligation in the long term. Such questions consist of:

Do you require household guarantee to repay expense in other ways?

This new quick answer is: Surely. You can search with the taking a property collateral mortgage. In the place of operating just like the a great rotating credit line, so it mortgage is actually put in the form of a lump sum. At exactly the same time, in the place of good HELOC’s varying rate, household guarantee funds usually feature a fixed interest.

You can even talk about the great benefits of a funds-out re-finance or All in one Home loan. In lieu of getting an effective HELOC for debt consolidation, you could potentially safer down rates with a cash-aside alternative. You can save yourself thousands of dollars for the focus when you pay away from a fantastic bills. Getting an all in one Financial, you might make use of your home collateral and you may handle the mortgage balance and you can appeal whilst preserving lots and lots of dollars from inside the appeal over the life of the borrowed funds.

Does DTI include an excellent HELOC?

If you are using your property equity for a HELOC, your home value usually lose. Additionally improve your DTI, to make challenging to apply loans Deer Park for most money or lines of credit. Because of this, it is essential to make sure you cannot are obligated to pay over just what you reside value.

Do merging debt damage their borrowing?

Having fun with a good HELOC to possess debt consolidation reduction is harm the credit if you aren’t careful. Although not, it generally does not need certainly to cause long-title discomfort. Prepare yourself getting a preliminary-title credit rating drop. Once you generate regular progress combining the money you owe, you can start seeing improvement. You will also initiate carrying out more powerful much time-identity cash.

Tips dictate some slack-actually interest rate point?

Separate the brand new settlement costs by the what kind of cash it can save you for each and every times. The outcome have a tendency to imply just how long it will require one break-even on the deal. For those who have questions, telephone call (866) 891-7332. All of us could possibly offer understanding of whether the time is great on the best way to combine your debts.

How to use a beneficial HELOC to deal with debts

Ahead of playing with an effective HELOC to possess debt consolidating, you have to know how exactly to submit an application for you to. Loan providers might require individuals to follow along with other procedures regarding process. not, certain strategies are usually a similar round the loan providers.

1. Check your credit score. Lenders usually opinion the get to determine if or not you qualify for a beneficial HELOC. Evaluating your existing condition can help you improve your rating.

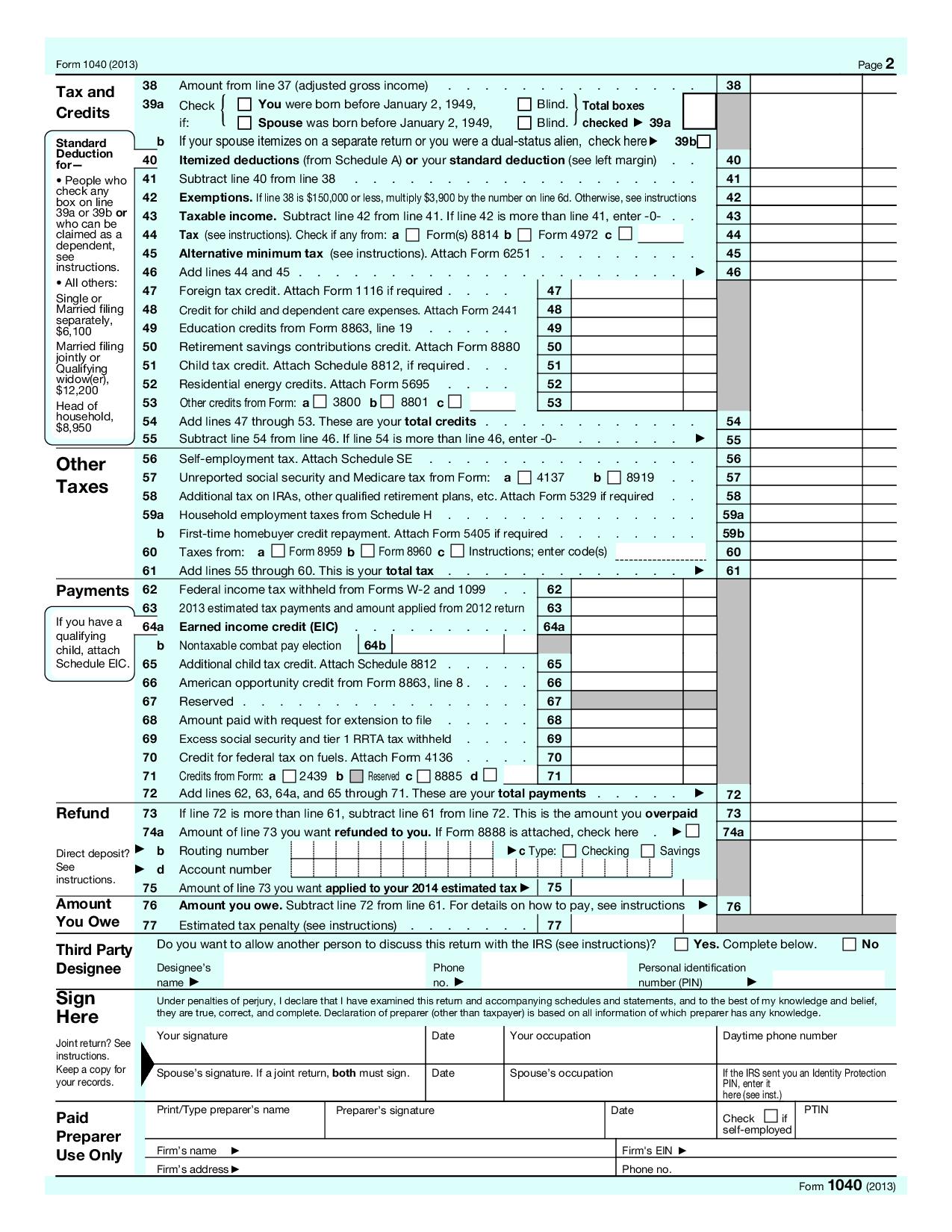

dos. Gather financial and you will crucial ideas. Keep employment history, Social Safety Matter, earnings pointers, and home loan balance inside an accessible lay. The financial can get request a lot more documentation.

3. Be certain that your earnings. When you complete your own HELOC application, financing pro commonly be certain that your revenue. You can constantly offer spend stubs or a W-dos Function.

4. Loose time waiting for a last decision. The loan underwriter will need to comment the debt-to-money and you can loan-so you can worthy of percentages just before granting their HELOC to own debt consolidating.

5. Sign off on your personal line of credit. Opinion the last HELOC terms and conditions before signing documentation. This will take to three working days.

Making sure your terms meet your financial demands is crucial. Homeowners is struggle with training, medical, or other debts any kind of time age. Merging these bills really helps to overcome one weight.

Or even need a good HELOC but really, you can strive to boost qualifications having coming money otherwise contours off borrowing. If you are alarmed that your particular financial obligation-to-earnings (DTI) ratio is actually high to help you qualify for a great HELOC, be connected. We are available for ten-second to just one-time consultation services whenever you are to your-the-wall regarding the taking a HELOC to have debt consolidation. The financial advantages often mention your very best borrowing from the bank choices and you will methods you can attempt assist decrease your DTI proportion.