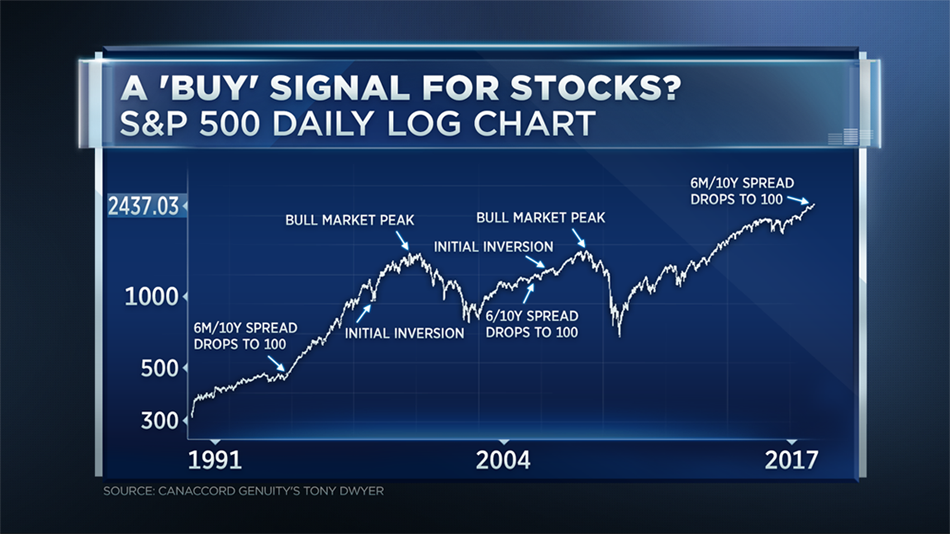

Canaccord Genuity’s Tony Dwyer is using just one chart to show the bears that stocks are moving higher.

“There’s this narrative out there that the yield curve flattening is telling you that the economy is closer to recession and the stock market is in trouble. History shows the opposite is true,” the firm’s chief market strategist said Wednesday on CNBC’s “Trading Nation.”

Dwyer explains in his latest note that when the U.S. Treasury yield curve as measured by the six month/10-year spread sees a drop of 100 basis points, there has “historically been at least two years until a bull market peak driven by recession.”

He argues that this historical trend should be enough to persuade investors to buy any correction, rather than try to trade ahead of it.

Dwyer said the stock market a “terrific buy.” He has a 2,470 year-end price target on the S&P 500, just 1 percent away from current levels. His 2018 year-end price target of 2,720 is an 11 percent jump.

His comments come just two days after Gluskin Sheff chief economist and strategist David Rosenberg told “Trading Nation” that the booming stock market is in “denial.”

“While I respect David quite a bit, I’m very hesitant to say that the bond market is ‘telling me something,'” said Dwyer, who points out that when yields reached 2.62 percent after the election, investors were worried the “economy was running too hot.” That scenario never materialized, and yields have fallen since then.

Even though Dwyer notes the intermediate-term is looking solid, he predicts that some choppy market action could be just weeks away.

“You can correct very easily. We frankly think we’re going to get one very near term. But for a significant and sustainable drop, you really have to have a recession,” he said. “We are so not close to a recession.”

Top strategist sees screaming 'buy' signal for stocks, here's the chart