A NEW phrase, “range anxiety”—the fear that an electric vehicle (EV) will run out of power before it reaches a charging-point—entered the Oxford English Dictionary in 2013. At the time a Nissan LEAF, the world’s best-selling EV, could travel only 120km between charges. A car with a full tank of fuel will travel 650-800km between refills. A motorist relying on batteries has to find a public charger, a rare sight in 2013, or plug in at home to cover the same distance. Range anxiety has not gone away as EVs have advanced. But the problem now feels much more soluble.

Many governments are pushing hard to replace the internal combustion engine (ICE) with cleaner EVs—this summer both Britain and France said that by 2040 new cars completely reliant on petrol or diesel will be illegal. By 2050, half the cars on the road globally, a billion in total, will be battery-powered, reckons Morgan Stanley, a bank. Falling battery costs mean that the total cost of EV ownership will soon hit parity with ICE models.

-

Why Stephen King’s novels still resonate

-

Are Americans sacrificing food and clothing to pay their taxes?

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why “affordable housing” in Africa is rarely affordable

-

What effect is Donald Trump really having on American tourism?

Surveys show, however, that car buyers’ worries about charging—where you can do it, and how long it will take—remain a big impediment to going electric (after high prices). Unless buyers can be reassured about the availability and speed of charging, the EV revolution may progress at the pace of a milk float, not a Tesla in fast-accelerating “ludicrous” mode.

Better EV batteries with greater capacity are helping. A range of 190km or more is now the norm. Nissan’s latest LEAF, unveiled on September 6th, will travel nearly 400km between charges. Tesla’s Model S, a luxury EV launched in 2012, has a range of 500km, as does its new Model 3, a cheaper car for the mass market.

As ownership of EVs spreads, another reassuring fact is becoming clear: the amount of daily driving that people actually do, combined with an ability to charge at home, mean public charging facilities are rarely needed. Four out of five Europeans drive less than 100km a day. The average daily distance a car covers in Britain, for example, is less than 40km. Americans cover around 70km a day.

So far, most EVs have been bought by better-off motorists, who usually have off-street parking with a socket to plug into. Over 90% of charging is currently done at home, carmakers say. Charging times at home are hardly a difficulty—a standard residential electricity supply and a 3.5KW charger will fill a battery in a smaller car in about eight hours, as its owner sleeps. A special 7KW home charger can recharge a Tesla’s larger batteries in eight hours. A car with a smaller battery takes just four.

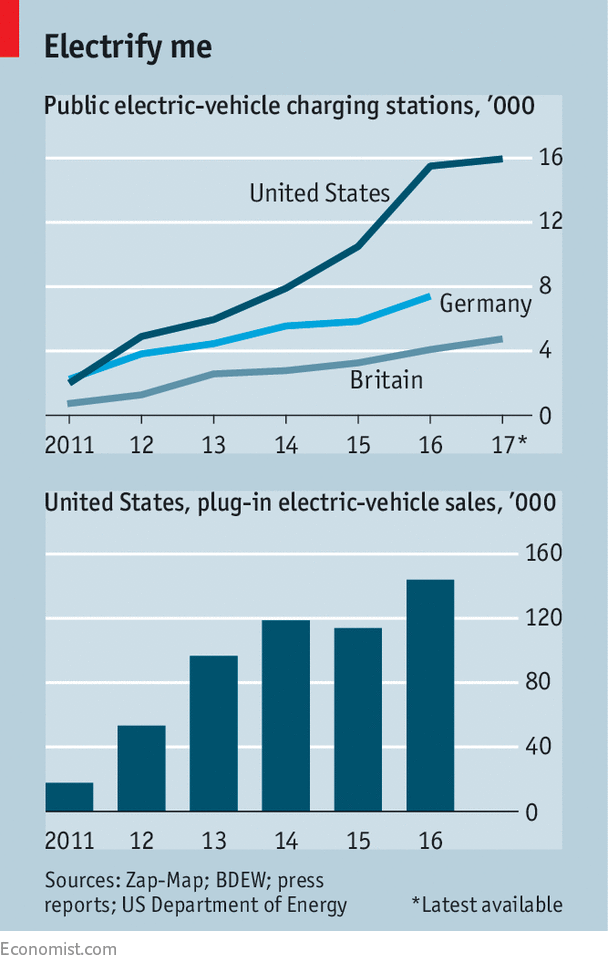

Yet mass adoption of EVs will mean appealing to the millions of households without garages. Nor can people on long road trips rely on better batteries alone. So far the rate of increase in the number of public charging-points in rich countries has just about kept pace with the growth of EVs, says Sean O’Flynn of Alix Partners, a consulting firm. In America the number of charging-stations grew by more than a quarter, to almost 16,000, in 2016 (see chart). But in most places the system needs to expand to provide enough chargers of the right capacities in the right locations.

Carmakers, governments and commercial charging firms are all investing. Carmakers can differentiate their vehicles by providing souped-up charging. Tesla plans to expand its global network of 145KW “supercharger” stations, to 10,000. These public facilities can replenish the firm’s larger batteries to 80%—charged in 40 minutes (for technical reasons, fast chargers cannot top up batteries completely). Several other carmakers are also rolling out their own fast-charging networks, which need expensive kit but bring charging speeds down to the time it takes to use a conventional fuel pump. Nissan now has a global network of 4,000 fast chargers. Last year Daimler, BMW, Volkswagen and Ford also said they would together install a total of 400 public charging-points in Europe delivering 350KW, which will charge a small car to three-quarters full in four minutes and a big vehicle in 12 minutes.

City and national governments are working on slower roadside charging for drivers who cannot plug in at home. Officials in London recently announced plans for 1,500 new charging-points by 2020. Local authorities there are experimenting with providing low-cost kerbside charging by enabling streetlights to double up as charging-points. France, Germany, the Netherlands and Norway are among the countries that have launched initiatives to improve access to public charging. (The EU is also mulling regulations that will require all new dwellings to have access to an EV charging-point.) China’s government, which is set on remaining the largest market for electric cars, has far bigger plans. This year alone it is installing 800,000 public charging-points, including 100,000 semipublic ones at workplaces and for taxis and commercial vehicles.

Companies that do nothing but provide charging services have their own plans to invest large sums as more EVs hit the road. Pat Romano of Chargepoint, based in California, which runs more charging stations worldwide than any other firm, sees workplace charging as another way of filling the charging gap. He notes that for a few thousand dollars spent on the equipment, plus a cost for electricity that is about the same as the price of a cup of coffee a day, employers can offer workers free charging in the office car park. Commercial firms such as Chargepoint may well come to dominate charging away from the home, if only because they are more focused on it than either carmakers or governments.

Better business models and technology should further increase the availability of charging. Chargie, an app that allows owners of home chargers to rent them to the public much like an Airbnb flat, launched recently in Britain. Wireless inductive charging from road to car is already technically feasible, if expensive; that would make sense at taxi ranks when vehicles sit idle, for example. Qualcomm, a chipmaker, has demonstrated technology for recharging a moving vehicle off any road surface, although this way of providing limitless range is still some way off.

So there seems little likelihood that a dearth of infrastructure will hold back the spread of EVs. Some pundits imagine car parks of the future bristling with charging-points as plugging in becomes normal and filling with liquid fuel is regarded as an aberration. Range anxiety may then be remembered only by ageing motorists, along with other quaint old phrases such as “fill it up and check the oil”.

Source: economist

An infrastructure for charging electric vehicles takes shape