Central banks may one day need to issue their own cryptocurrencies, the Bank for International Settlements, or BIS, said in its latest quarterly review.

“Whether or not a central bank should provide a digital alternative to cash is most pressing in countries, such as Sweden, where cash usage is rapidly declining,” the Sunday report said. “But all central banks may eventually have to decide whether issuing retail or wholesale [central bank cryptocurrencies] makes sense in their own context.”

The report’s argument in favor of digital currencies comes from two needs: anonymity for consumers and efficiency for institutions.

Cryptocurrencies like bitcoin don’t need a third party to validate transactions, which are essentially instantaneous and irrevocable due to the currencies’ blockchain technology.

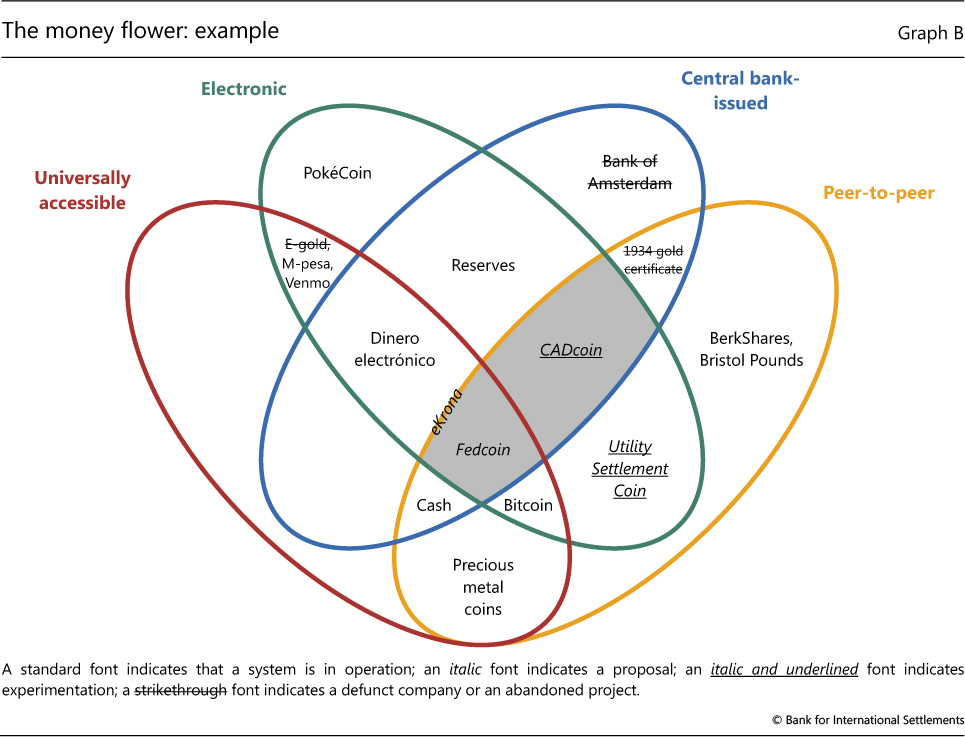

Forms of money from the past, present and possible future

Source: Bank for International Settlements

The report comes as regulators remain divided on whether to officially recognize digital currencies like bitcoin as currencies or commodities, if the institutions consider such a designation valid at all.

Russia, Singapore and some other central banks have announced experiments with digital currencies, while some researchers have proposed central bank tokens such as Fedcoin, the report noted. The bank was also quick to point out that the Federal Reserve has not endorsed Fedcoin and no central bank has officially launched a retail or wholesale-use digital currency.

However, bitcoin’s exponential surge from a few cents seven years ago to around $4,000 has caught the attention of Wall Street and now, the Bank for International Settlements’ 14-page report chose to look at digital coins through four properties of money: issuer, form, accessibility and transfer mechanism.

The report then defined a central bank cryptocurrency as “an electronic form of central bank money that can be exchanged in a decentralised manner known as peer-to-peer, meaning that transactions occur directly between the payer and the payee without the need for a central intermediary.”

Bitcoin jumped 10 percent Monday to above $4,000, its highest since Wednesday and up more than 300 percent for the year, according to CoinDesk. The digital currency hit a record high of $5,013.91 on Sept. 2 before plunging 41 percent to the lows of the month after Chinese authorities announced a ban on new token sales and major Chinese bitcoin exchanges said they would close by the end of September.

In late July, Bank of America Merrill Lynch’s commodity and derivatives strategist Francisco Blanch said in a sweeping report that bitcoin still faces many challenges in becoming a globally accepted currency. The “crucial hurdle” is whether major financial institutions will accept the digital currency as collateral, Blanch said then.

To be sure, extreme caution is warranted for central banks wading into cryptocurrencies. Bitcoin and ethereum, the most prominent digital currencies have been very volatile and sometimes hit by major hacks.

“Some of the risks are currently hard to assess,” the report said. “For instance, at present very little can be said about the cyber-resilience of [central bank cryptocurrencies], something not touched upon in this short feature.”

Source: Tech CNBC

Fedcoin? Central banks may need 'digital alternative to cash,' global financial watchdog says